Market disconnect for a Canadian junior

“Our company is undervalued” is a common phrase heard around investor conferences.

Executives are their own best cheerleaders and they constantly seek innovative ways to create value with their companies. Sometimes the assertion that a company is not being valued in a fashion similar to its peers is more compelling than others, however, and taking a look at EnerCom’sCanadian E&P database, one name – Razor Energy Corporation (Ticker: RZE) – stands out.

The ten-month old company has current production of 4.5 MBOEPD and a market cap of $25 million, and an enterprise value of $45 million, making it one of the smallest Canadian companies in EnerCom’s coverage universe. But no matter how you look at the valuation, and the company’s share price of $1.55, the company comes up significantly undervalued compared to its peers.

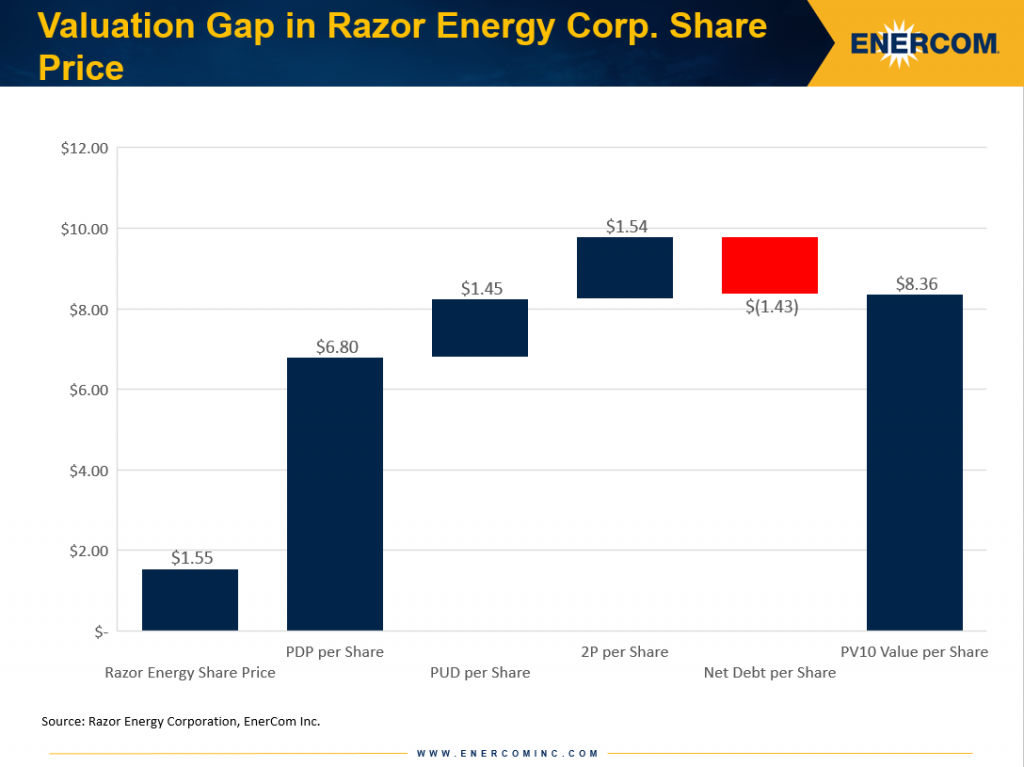

Public companies typically trade at a multiple greater than the PV-10 value of their total proved reserves. Razor, which is backed by Alberta’s $100 billion AIMCO pension fund, shares are currently trading 4.4x below the Proved Developed Producing (PDP) assets, which equate to $106.7 million or $6.80 per share. Stepping that analysis out further to encompass upside from PUD locations and 2P reserves less the company’s $22.4 million in net debt, the valuation gap grows even wider.

On a PV-10 basis, Razor Energy’s shares have an implied value of $8.36 per share, or 5.4x greater than where they trade today. This valuation target makes no assumptions of changes in Razor’s operations or greater market trends. Simply by applying a PV-10 value to the company’s current production and reserves a major disconnect is apparent.

Deals in the area support an even higher implied valuation

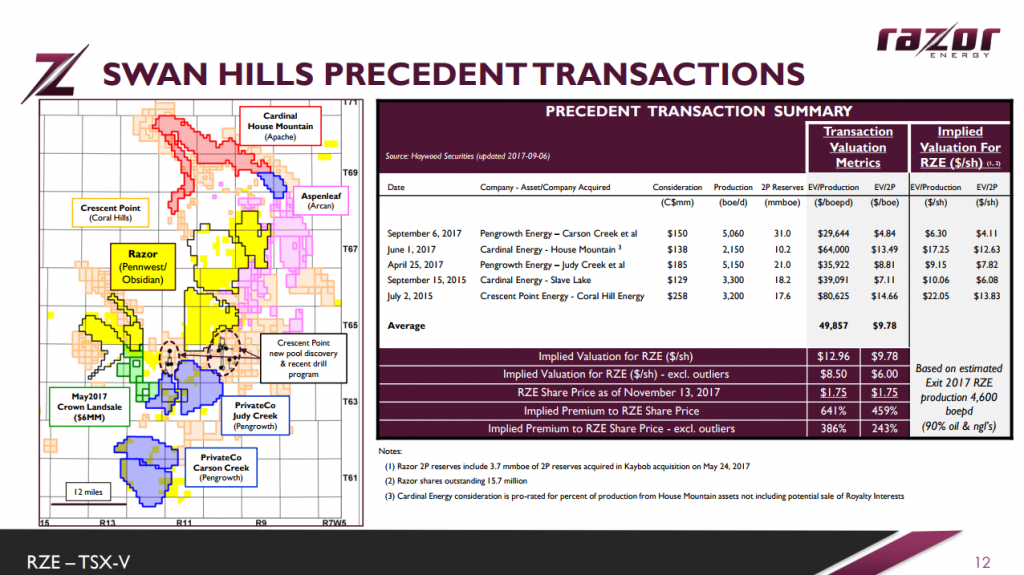

The majority of the company’s current production comes from Swan Hills region of Alberta, Canada, which has seen a number of transactions over the last several years. The most recent of those deals, which was announced in September 2017, was Pengrowth Energy’s purchase of ExxonMobil Canada Energy’s average 89% working interest in properties in the Carson Creek area. That deal went for $29,644 per flowing BOE or $4.84 per BOE of 2P reserves.

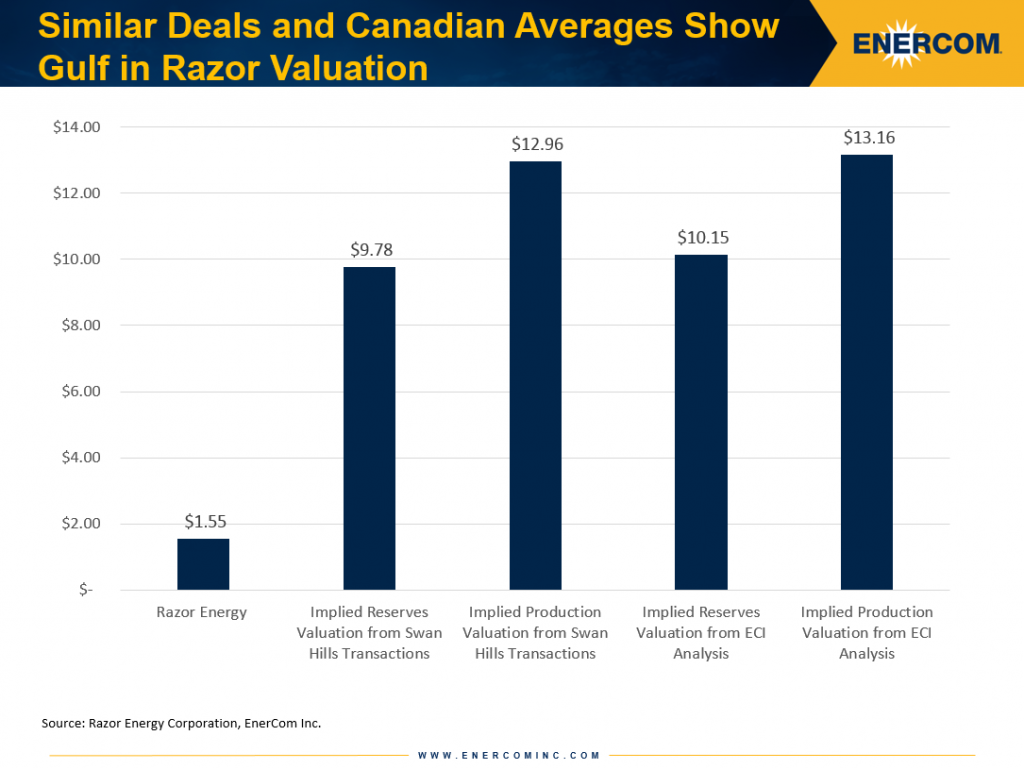

Of the five deals that took place in the region since July 2015, the average deal metrics is $49,857 per flowing BOE and $9.78 per BOE of 2P reserves. Applying those metrics to Razor’s assets, the company’s implied valuation is $12.96 per share on a flowing BOE basis and $9.78 per share per BOE of 2P reserves.

As of December 11, 2017, Razor was trading at a $6,168 per flowing BOE and $1.70 per BOE of 2P reserves, 88% and 83% below average metrics in the area, respectively.

Looking at Razor Energy’s Canadian peers in the EnerCom database, the valuation disconnect is even wider. By applying a multiple of the average dollar-per-BOE realized by Canadian companies to Razor’s production, the company’s implied share price is $13.16 while applying a similar analysis based on average dollar-per-BOE of 2P reserves implies a value of $10.15 per share. The company’s current stock price of $1.80 per share is 5.6x and 7.3x below the implied valuation from applying the average multiple achieved by Canadian companies on their 2P reserves and flowing production, respectively.

Razor energy consolidates interest in Kaybob

The Canadian junior continues to consolidate its interest in the Kaybob area, announcing it purchased certain non-operated working interest positions on December 18, 2017 to consolidate its existing Kaybob Triassic Units 1 and 2 from a private company. Razor paid $4.6 million from cash on hand to increase it’s working interest in both units which are characterized by low-decline, light oil focused production and abundant infrastructure that directly complements Razor’s existing asset portfolio, according to the company.

The acquisition increases Razor’s operated working interest position in:

- Kaybob Triassic Unit #1 from 52.86% to 52.95% and;

- Kaybob Triassic Unit #2 from 43.31% to 73.25%.

On a pro forma basis including this acquisition, using field production estimates, Razor expects December 2017 production to exceed 4.7 MBOEPD, up from 4.6 MBOEPD in previous guidance, of which 85% is light oil and natural gas liquids. Current production on the asset is 250 BOEPD with a 15% annual decline rate.

At $18,400 per flowing BOE, the deal was also done at a significant discount compared to other deals in the area. This may be expected with a non-op purchase, but as the operator on the acreage, Razor is essentially turning discounted non-op interest into greater operated interest.

Razor Energy’s assets

Razor Energy is a light oil-weighted company with 394 gross (228 net) sections of land in its Swan Hills/Kaybob core region. The company reported 4.5 MBOEPD of production in November (88% light oil and NGLs) which the company has achieved through a program of reactivations in the area.

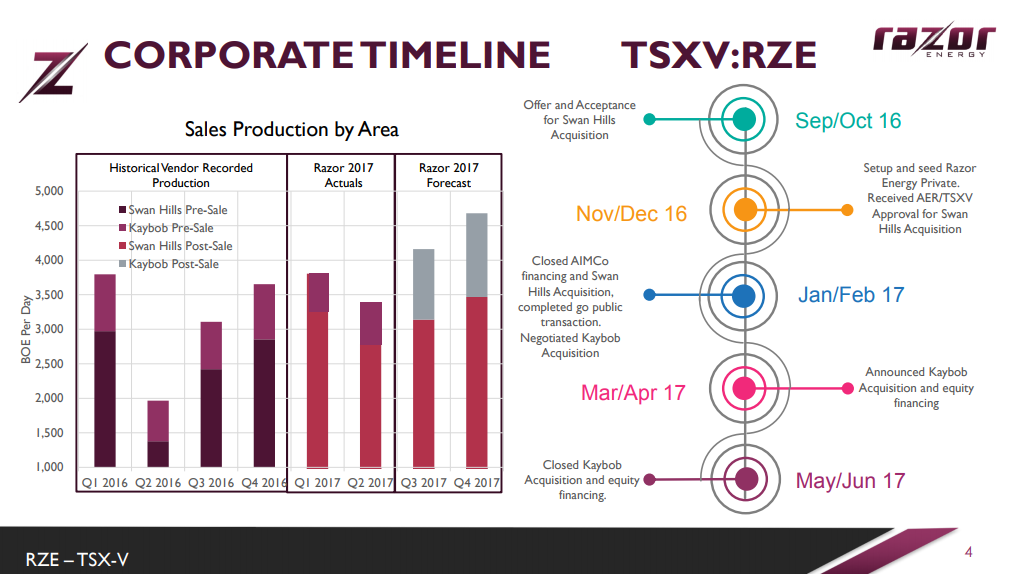

RZE has moved quickly to build its position in the region with the initial offer and acceptance of its Swan Hills acquisition taking place in Q3 2016, less than a year prior to its most recent deal for the acquisition of its Kaybob assets. The company has more than doubled the production on the assets from lows recorded in Q2 2016 before Razor bought the assets, and RZE expects Q4 2017 production to average around 4.6 MBOEPD.

In a $55 WTI price environment, Razer expects its Kaybob directional wells to pay out in 1.2 years while its horizontal Swan Hills wells are expected to pay out in 2 years with the same price assumption.

For 2018, the company plans to pursue horizontal sidetrack re-entries to existing vertical wells in the Swan Hills area Razor President and CEO Doug Bailey at EnerCom’s The Oil & Gas Conference in August 2017.

“These don’t need to be stimulated by frac,” explained Bailey. “So what we have created here, on a cost basis, is a shallow light oil play in zones that we know produce hydrocarbons. This is not exploration, this is development.” At the time of the conference, Bailey said Razor has identified 30 existing vertical wells that would make viable sidetrack drilling locations and continues to look for more.

In 2018 management intends to be more aggressive in the Kaybob area, with a mix of deviated drilling, optimization of existing EOR schemes, and well reactivations, Bailey told Oil & Gas 360. “With abundant infrastructure and land, and further unit consolidation as demonstrated with the acquisition announced on December 18th, the full-cycle economic environment is in place at current oil prices for significant production gains.”

Swan Hills, although secondary in terms of development spending, remains a core production piece exhibiting low declines and decreasing cost structures, Bailey added.