60%-75% stake in Driftwood Holdings up for grabs, successful sale would raise $25-$31 billion

Tellurian is looking to modify its business model, bringing in external investors and customers, according to the company’s latest presentation.

Tellurian is a Texas-based LNG export developer, currently working to bring the 27.6 MTPA Driftwood LNG project online. In addition to the facility itself, Tellurian is also constructing the Driftwood pipeline, which will supply gas to the terminal, and is acquiring production capacity.

The desire for the cheapest possible natural gas recently led the company to acquire acreage in the Haynesville, securing 1.3 Tcf of natural gas resource. According to the company, this gives it a source of gas at prices below Henry Hub, allowing it to lower prices further. Further acquisitions are being evaluated, focusing on the Haynesville and Eagle Ford. According to the presentation, the goal of this effort is 1.5 Bcf/d of production starting in 2022, with total resources of 15 Tcf.

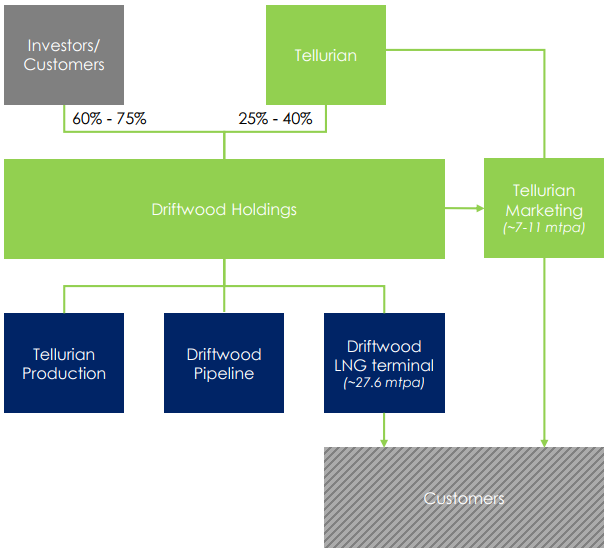

A new 27.6 MTPA LNG facility is not cheap, though, and Tellurian is looking to a new method to raise money. Tellurian has combined the LNG terminal, pipeline and its upstream holdings into a single subsidiary, Driftwood Holdings. It plans to offer equity interest in the holding company, thereby raising money.

Equity will cost $1,500 per tonne, and Tellurian plans to offer up to 60%-75%. Investors will receive volumes of LNG equal to their equity in the project at the Driftwood terminal – at cost.

Tellurian elaborated on this point, noting that variable and operating costs, including maintenance, are expected to be about $3/MMBtu.

Tellurian will retain a 25%-40% share in Driftwood Holdings, therefore it will retain 7 to 11 MTPA of production for marketing. Tellurian will continue to manage and operate the project.

In May, the company had announced plans to raise capital by selling 10,000,000 shares of its common stock, but the next day it pulled the offering. At the time, CEO Meg Gentle commented, “Due to the current market environment and in the interest of achieving the best value for our stockholders, we have decided to withdraw our recently announced public offering of common stock.”