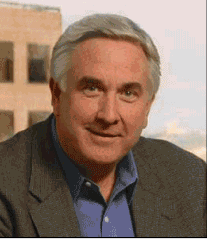

After 30 years at the helm, Scott Sheffield announces he will retire as CEO of Pioneer Natural Resources

Scoot Sheffield, one of the most transformative CEOs in the oil and gas business, announced plans to retire from Pioneer Natural Resources (ticker: PXD) after more than 30 years of leading the company and its predecessor, Parker & Parsley. Sheffield will retire from his position as CEO at the end of this year, and remain the company’s executive chairman of the board until the end of 2017, according to a press release from Pioneer. He will remain a director after 2017.

Pioneer’s board of directors announced its approval of a plan under which Tim Dove, the company’s current president and COO, will take over as CEO following Sheffield’s retirement.

Sheffield is credited with turning Pioneer into the first big “pure play” company working only in shale fields. In 2005, he made the decision to sell off international assets, focusing instead on the Permian Basin and Eagle Ford, and in 2011, shifted the company’s focus solely to hydraulic fracturing. Both bets paid off handsomely for the company, and under Sheffield’s leadership, Pioneers predecessor grew from a $32 million market cap into a company worth $28 billion.

“The announcement comes somewhat as a surprise given the nascent oil price recovery and relatively early stage of horizontal development in the Permian,” a note from Gordon Douthat at Wells Fargo said Thursday, “but Mr. Sheffield will continue to have a significant stake in the success of the company remaining CEO through year end and beyond as Executive Chairman of the Board in addition to his ownership of PXD stock.”

Sheffield said the board had been asking him every couple of years how long he wanted to stay, so the company could plan for the transition, reports The Dallas Morning News. This seemed like the right time, he said.

When asked about the most important moments running Pioneer, he said one moment that stood out was the realization that the companies in the Barnett Shale near Fort Worth were making money from fields that had long been considered impossible to work economically.

Pioneer’s geologists took a look at years of data the company had accumulated drilling the Permian and investigated whether fracing would work there. They told Sheffield the company was sitting on 10 billion barrels of resources.

“That was when we all woke up and said we have a home run underneath our acreage,” he said.

Leaving Pioneer in a strong position

Like every other E&P, Pioneer was hit by the downturn in oil prices. The company reported a $266 million loss in 2015 on $3.1 billion in income. Despite this, its debt-to-market cap remains just 14%, much lower than the 75% median in EnerCom’s E&P Weekly.

“We are really back on top of the world,” Sheffield said about the position in which he is leaving the company.

Oil needs to return to at least $60 per barrel to spur full production in the Permian, Sheffield said Thursday. If that happens, he said PXD is in better shape than many of its peers to take advantage because of its low debt.

“We can apply our first dollars to applying new rigs,” he said.

Dove hopes to become Pioneer’s Jimmy Johnson

Sheffield’s successor has big shoes to fill, and he seems to know it.

Tim Dove said he would work to ensure the company continue to be an industry leader, and he compared his following Sheffield as the new leader of Pioneer to the Dallas Cowboys replacing respected coach Tom Landry who had led the football team to 20 winning seasons.

“The Cowboys found Jimmy Johnson,” Dove said of the new coach who led the Cowboys through a golden age which included consecutive Super Bowl victories. “Maybe I can do what Jimmy did.”

Dove, a 1979 graduate of the Massachusetts Institute of Technology, joined Parker & Parsley as a vice president in 1994. He quickly moved up the ranks there and at Pioneer, where he served as executive vice president of business development and chief financial officer before being promoted to chief operating officer in 2004.

“When I hired him, I put him through the wringer,” Sheffield told The Wall Street Journal. “I knew by the time I made him president and chief operating officer in 2004 that he was going to my replacement,” he said.