Exit puts deepwater FLNG plans in jeopardy

One of the largest LNG projects in Africa was put in peril today, as the largest backer of the Fortuna project pulled out.

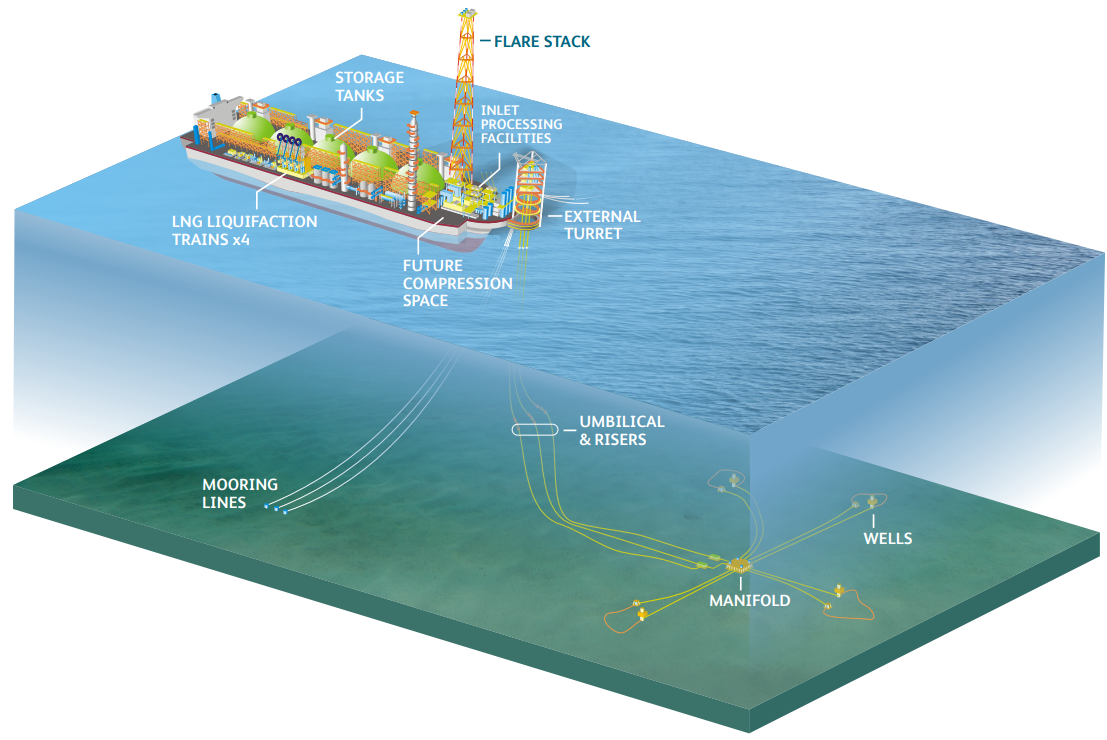

Targeting deepwater LNG in Equatorial Guinea, Fortuna is expected to be the first deepwater LNG in West Africa. With water depths from 3,000 to 6,000 feet, current plans call for a floating LNG plant (FLNG), which would be one of the first in the world.

Deepwater projects are typically very expensive, and FLNG plants particularly so, so Fortuna’s estimated CapEx of $2 billion is low. Ophir Energy (ticker: OPHR) has been the largest partner in the project, which also included Golar LNG (ticker: GLNG) and Schlumberger (ticker: SLB).

Originally, Ophir planned to make FID in mid-2016, with first gas in 2019. However, the project has been plagued by delays, and first gas was pushed back to 2022. Ophir has had difficulty securing the $1.2 billion in loans needed to fund the project, which has further delayed operations. The government of Equatorial Guinea has expressed its frustration at the delays, and the country’s energy minister said Ophir would be forced out of the project unless loan details were presented to the government by December.

Fortuna was dealt another major blow today, as Schlumberger exited the project. Schlumberger held roughly one third of the project so this exit is a major setback. Golar LNG had a pessimistic tone in its presentation today, stating that financing is “increasingly unlikely in the short-term.” An equity raise is not expected to be attractive to the market, so debt funding is required.

Ophir stated it has already held informal discussions with other potential partners for Fortuna, which will now begin in earnest.

If this project is cancelled, it will further contribute to a projected shortage in LNG around 2022. While there is an overabundance of supply at the moment, demand is growing rapidly, and will soon exceed supply.