OPEC sees lower market share despite decision to maintain production

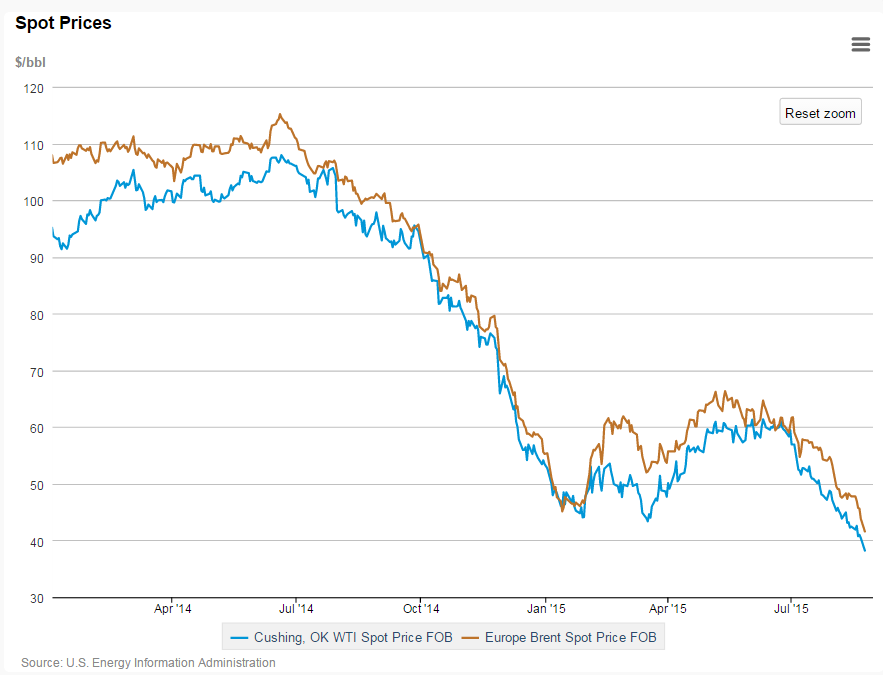

In November 2014, OPEC, led by its largest producer Saudi Arabia, decided to cast off its traditional role as swing producer in the global oil market. The decision sent oil prices plummeting from over $115 per barrel for Brent crude in June, down to $42.69 per barrel, the closing price on August 24, 2015.

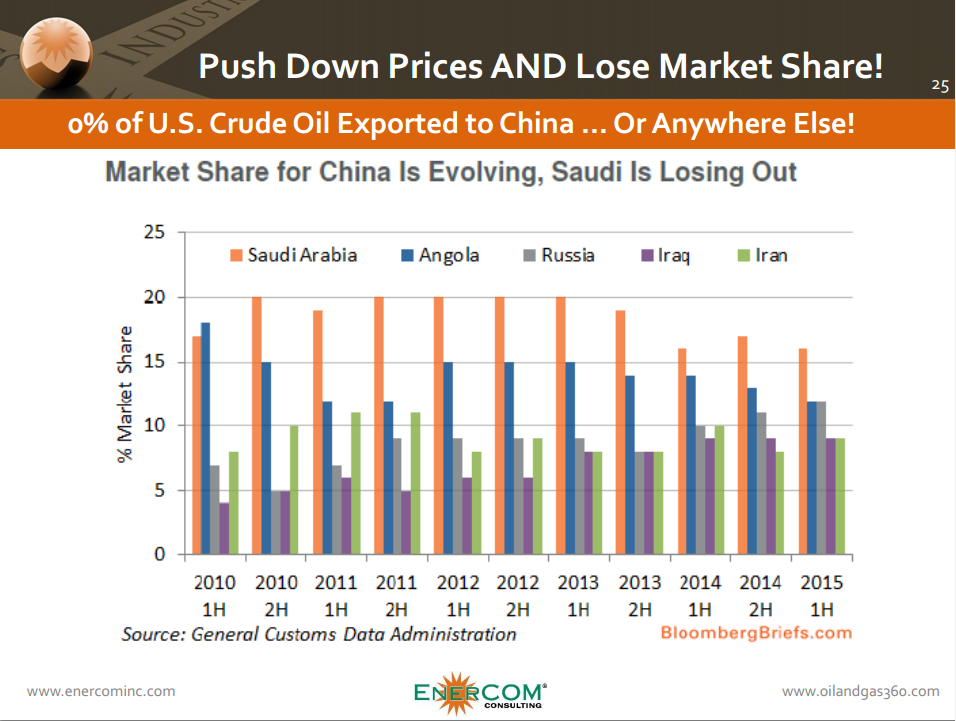

The decision was made to defend market share, especially in Asia, with OPEC cutting prices to Asian markets repeatedly to maintain their customer base. “The U.S. used to be the market the Saudis were most concerned about preserving market share in, but that’s no long the case,” said Bill O’Grady, chief market strategist at Confluence Investment Management. “China is where they see growth coming from in the decades ahead.”

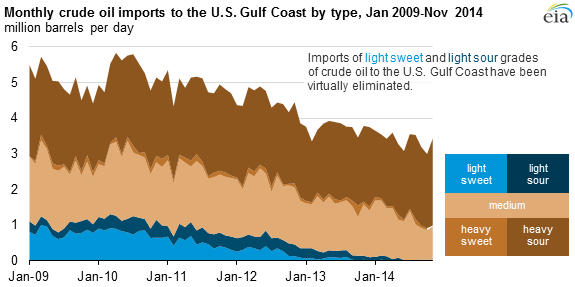

Supporting O’Grady’s point, total U.S. imports of crude oil in the first six months of 2015 are down 63% since the first six months of 2008. Crude oil imports from OPEC to the U.S. in 2014 averaged 2.9 MMBOPD, down 46.2% from their all-time high in 2008 of 5.4 MMBOPD, according to the Energy Information Administration (EIA). In February 2015, the EIA reported that imports of light sweet crude to the Gulf Coast had been virtually eliminated due to shale production.

If a market is going to shrink due to technological disintermediation, like fracing shale zones using horizontal drilling techniques, the importance for OPEC to protect its market share in a country like China becomes clear; once the U.S. reached supply/demand equilibrium, it could potentially begin exporting crude oil to China and the rest of Asia, cutting OPEC out of the largest energy demand center in the world.

A Tactical Decision that Backfired

Despite the hope that maintaining production at record-high levels might protect market share, OPEC has actually seen declines in its share of the market along with less revenue from lower oil prices. The organization’s June numbers indicated that in the previous 12 months, its share of the market had fallen to 32.6% from 33.5%, while the lower price of oil had brought its exports under $1 trillion for the first time since 2010.

Saudi Arabia put themselves in a precarious position: likely to post a deficit of nearly 20% of GDP for 2015

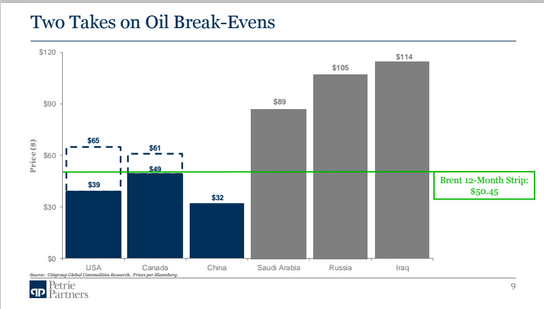

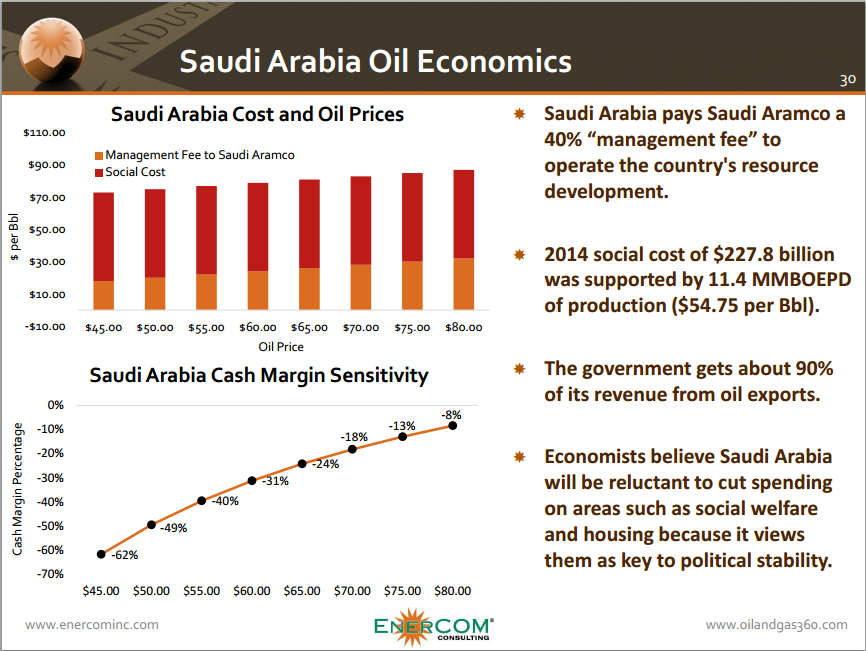

A report from the International Monetary Fund released August 17, projects that Saudi Arabia will likely post a fiscal deficit of 19.5% of GDP in 2015, compared to a deficit of 3% of GDP in 2014. The IMF anticipates that the deficit will decline after this year, but it will remain high over the medium-term.

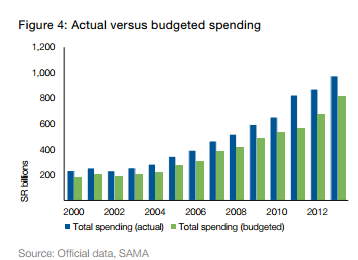

Sources familiar with Saudi’s financial planning have indicated that Saudi Arabia is looking to cut 382 billion riyals ($102 billion), approximately 10%, in government spending this year in order to soften the blow from lower oil prices, reports Bloomberg. Many of the Saudi’s social programs are funded through oil revenue, making continued low prices politically unpalatable, and forcing the government to look for ways to continue supporting government-run programs.

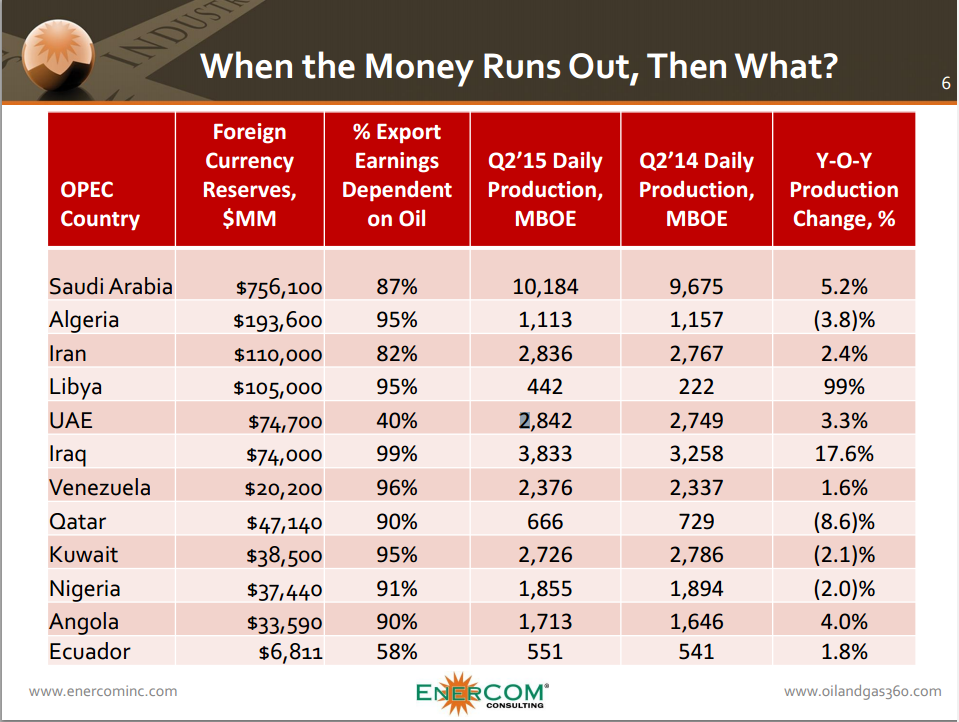

Saudi Arabia has raised at least 35 billion riyals from local bond markets this year, issuing securities with a maturity over 12 months for the first time since 2007, but it has not been enough to stem the tide. With approximately 87% of the country’s revenue coming from oil, low oil prices will force the Kingdom to continue burning through its sovereign wealth fund. For comparison, just 1.6% of U.S. GDP comes from crude oil production.

Khalid Alsweilem, a former official at the Saudi central bank and now at Harvard University, said the fiscal deficit must be covered almost dollar-for-dollar by drawing down reserves. “We are much more vulnerable,” said Alsweilem, commenting on the fact that Kuwait, Qatar and Abu Dhabi all have three times greater reserves per capita than Saudi Arabia. “That is why we are the fourth rated sovereign in the Gulf at AA-. We cannot afford to lose our cushion over the next two years.”

Saudi’s financial reserves peaked at $737 billion in August of 2014. They sat at $672 billion in May 2015, but with Brent below $45 per barrel, the Kingdom will need to spend at least $12 billion per month from its sovereign fund in order to support social spending.

Will OPEC countries sell assets to raise capital to continue their social programs?

Saudi Arabia is not alone in feeling the pressure caused by lower oil prices. Other OPEC countries are also quickly spending their reserves, and are looking to start selling other assets as well, reports Bloomberg.

In Angola, reserves dropped last year by $5.5 billion, the biggest annual decline since records started 20 years ago. For Nigeria, foreign reserves fell by $2.9 billion in February, the biggest monthly drop since comparable data started in 2010. Algeria, one of the world’s top natural gas exporters, saw its funds fall by $11.6 billion in January, the largest monthly drop in a quarter of a century.

“This is the first time in 20 years that OPEC nations will be sucking liquidity out of the market rather than adding to it through investments,” David Spegel, head of emerging markets sovereign credit research at BNP Paribas SA in London, told Bloomberg. With much of their economies based around oil and gas revenues, OPEC countries will now need to sell more than $200 billion of assets in order to bridge the gap created by low oil prices.

Oil producers recycled a large portion of their petrodollar profits by buying U.S. sovereign debt, as well as the sovereign debt of other countries. As they draw down their own sovereign reserves, Middle East countries are likely to start selling off “low-yielding European assets,” said George Saravelos, strategist at Deutsche Bank AG.

Rabah Arezki, head of the commodities research team at the IMF in Washington, said that unless OPEC countries cut spending, they will “have no choice but to draw on their financial assets when available” as oil prices remain below the break-even required to meet their social spending.

While the total amount of assets purchased in petrodollars may not be large enough to cause a storm in the ocean of global investments, the IMF and others do believe that petrodollar assets are significant enough to influence market sentiment.

The change in commodity-related foreign reserve flows will have “an impact around the margins” in global markets, said Albert Edwards, global strategist at Societe Generale SA. But Saudi Arabia’s finance minister, Ibrahim Abdulaziz Al-Assaf, believes the country’s reserves should last for “quite some time.”

Petrie’s take: Saudi won’t sell assets

Tom Petrie, chairman of Petrie Partners, said selling assets is not the most likely way Saudi Arabia will fund its social programs. “Conceivably, they have some stocks, but this is not the kind of environment you want to go into trying to raise big money from the stock market,” he said during an interview with Oil & Gas 360®. “I think they’re more likely to issue debt and cut back on their social programs.” The programs they will most likely target first will be the ones that do not put money into the hands of the populate, like infrastructure, Petrie said.

Saudi market therapy

Petrie believes that Saudi Arabia will likely continue its course for the next six months, or 12 months as the outer limit. The Saudi-led decision to maintain OPEC production has caused several other member countries to call for the group to lower production in order to raise prices back up. This represents an opportunity for OPEC to resume its traditional role as swing producer without Saudi Arabia being saddled with all the cuts, says Petrie.

“The Saudis don’t want to go to OPEC and suggest they (the Saudis) go back to being the swing producer. That’s a sucker’s game. If they get a series of requests from other OPEC members, which they have, then they can say ‘if we’re all in this together, and we all observe it, we can come up with some kind of program. If you think we’re going to do it alone, that’s not going to fly,’” explains Petrie. “I think they wanted to have this market therapy for all of OPEC. Now they can say that they can bring prices up, but all the members have to observe their cuts.”

Iran will present its own set of problems as it comes back to the market, says Petrie, but it can work. “If the Saudis try and make the case that Iran can sell what it has been selling historically, then Iran will not go along with that, so it will be a tough negotiation.” Despite the challenges presented by the removal of sanctions on Iran, the country may be able to negotiate some of its production back to the market, but not as much as it hopes, or as quickly, Petrie said.

Meanwhile, The Saudi benchmark Tadawul index sank 16% this month, entering a bear market, according to an official, and Saudi’s royal family remains quite about its next move. King Salman, who came to power in January, is in Morocco on holiday. The last public appearance of his son, Deputy Crown Prince Mohammed, chairman of the Council for Economic and Development Affairs, was on August 10. Finance Minister Al-Assaf is out of town and his ministry declined comment when asked about the latest economic development, reports Bloomberg.

The current challenges are “an excellent wake-up call for our top planners to reconsider the risk of” their dependence on oil, said Bashr Bakheet, managing director of Osool & Bakheet Investment Company. What step the Saudis will take next remains the topic of intense speculation, but it remains clear that even OPEC’s largest producer can only weather the storm it created for so long.

As Jeb Armstrong, Vice President of Energy Research at the Marwood Group, said at the EnerCom’s The Oil & Gas Conference 20, “One takeaway I came away with is I think the Saudis are truly in trouble,”