“If you are Saudi Arabia…you would go to full capacity”

Goldman Sachs and Citi Group predict that Saudi Arabia will likely start to push production to its daily maximum of 11 MMBOPD in the second half of 2015, reports Bloomberg.

“If you are Saudi Arabia and you’re looking at the new oil order we live in, you would go to full capacity,” Jeff Currie, head of commodities research at Goldman Sachs in New York, said. “The world has come around to the realization that the U.S. shale barrel is the swing barrel.”

This new reality means that Saudi’s spare capacity is no longer of much interest to OPEC’s largest producer. Lower prices, “turns oil in the ground in Saudi from an appreciating resource into a depreciating resource,” said Citigroup’s head of energy strategy, Seth Kleinman. “If it’s depreciating, you produce it all as fast as you can.”

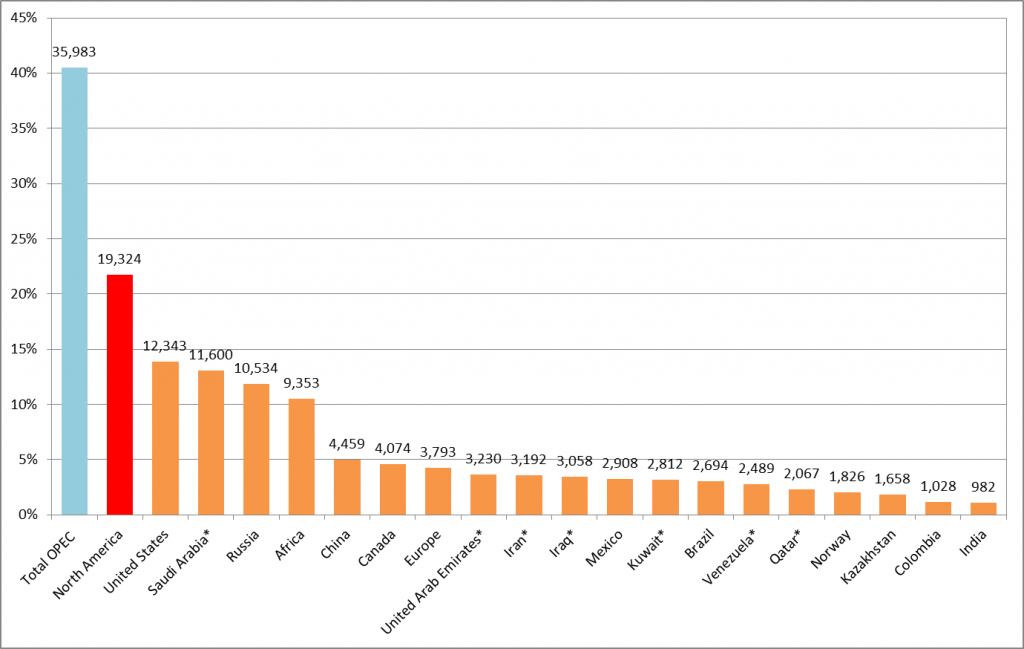

In St. Petersburg on Thursday, Saudi Arabian Oil Minister Ali al-Naimi said the country has about one and a half million and two million barrels per day of spare capacity, and is ready to raise production if demand calls for such action. Estimates vary on how much more capacity Saudi Arabia has, however, with the International Energy Agency (EIA) estimating full capacity at 12.3 MMBOPD, and Citi’s Kleinman pegging full production around 11 MMBOPD.

Saudi Arabia was the main proponent of OPEC’s decision to maintain production in order to defend market share last November, a decision that sent oil prices tumbling. OPEC’s share of global markets declined despite the group’s decision to keep producing, but Saudi plans to continue pumping, even as prices remain below its own fiscal breakeven price of $103 per barrel.