SandRidge Energy (ticker: SD) is an oil and natural gas company headquartered in Oklahoma City, Oklahoma, with its principal focus on exploration and production in the Mid-Continent, Permian Basin, Gulf of Mexico, West Texas Overthrust and Gulf Coast.

SandRidge reported net income of $14.9 million in Q4’13, according to its quarterly earnings release on February 28, 2014. Operating cash flow totaled $218 million and adjusted EBITDA reached $166 million for the same time period. Adjusted net income for fiscal 2013 ended at $103.9 million, compared to $124.3 million for fiscal 2012. SandRidge’s adjusted operating cash flow ended at $812 million for 2013 and adjusted EBITDA was $609 million.

Mid-Continent Focus

SandRidge previously explained plans for the Mid-Continent in its Q3’13 earnings call and has ramped up operations despite declining interest from large operators like Shell (ticker: RDS.B) and Chesapeake (ticker: CHK). SandRidge drilled 94 horizontal wells in Q4’13 following the drilling of 91 horizontals in Q3’13. The company placed 80 wells online in Q4’13 with an average production rate of 326 BOEPD. SD plans on drilling 460 horizontals as part of its 2014 program. Overall Mid-Continent assets contributed 51.7 MBOEPD for Q4’13.

A portion of the new activity will be directed at acreage in Kansas. SD has identified its 117,000 net acres in Sumner County as a key driver moving forward, and five wells drilled in the region produced an average 30-day IP rate of 601 BOEPD (90% higher than the 2013 type curve). The company plans on drilling 45 Sumner wells in 2014. A total of 52 Kansas wells were drilled in H2’13, with another 133 drilled in Oklahoma for the same time period.

The inconsistency of the Mississippian Lime play in the Mid-Continent results in varying success, according to a reservoir study by Core Laboratories (ticker: CLB). However, the shallowness of the reserves is an added bonus. SD brought online its 80 horizontal wells in Q4’13 for an average price of $2.9 million apiece and operated at a cost of $6.91 per BOE – its lowest mark to date.

Analyst Day: A Fresh Perspective

The company hosted its seventh annual analyst day on March 4, 2014. The key takeaway of the program was the company’s assertion that it had commercialized more acres in its core operating regions, was increasing the company’s net asset valuation, and the capital program was fully funded from “growing cash flows,” cash on the balance sheet and undrawn reserve-based borrowings.

Click here for a full webcast of SandRidge Energy’s 2014 Analyst Day.

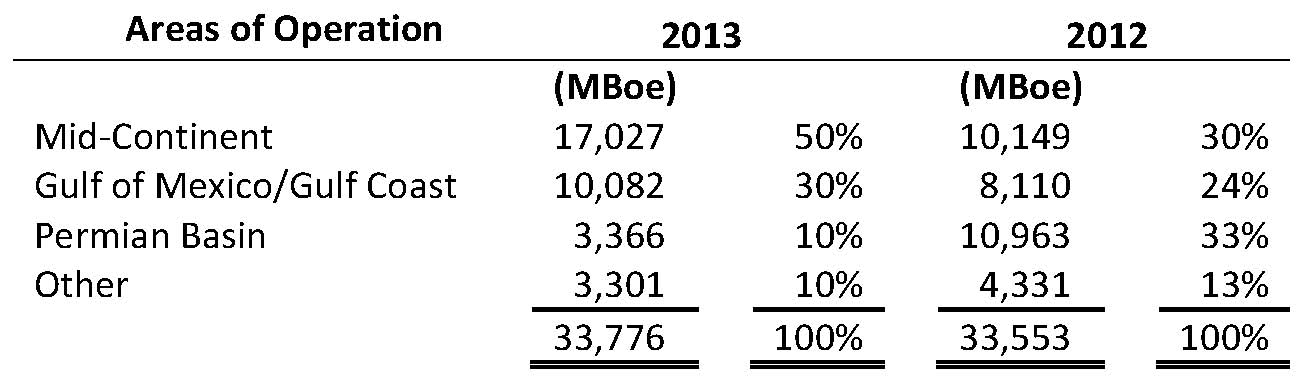

2013 in Review

Overall for 2013, SD increased its Mississippian Lime well type curve by 10%. The increase boosted estimated ultimate recovery (EUR) rates in the Mississippian to 118 MBOE, which pushed its overall EUR rates to 380 MBOE (3% higher than before). Its active drilling operations added 119 MMBOE of proved reserves (107 MMBOE from Mississippian horizontal drilling) with reserve replacement of 520%, and pro forma adjusted EBITDA grew 67% year-over-year to end at $609 million.

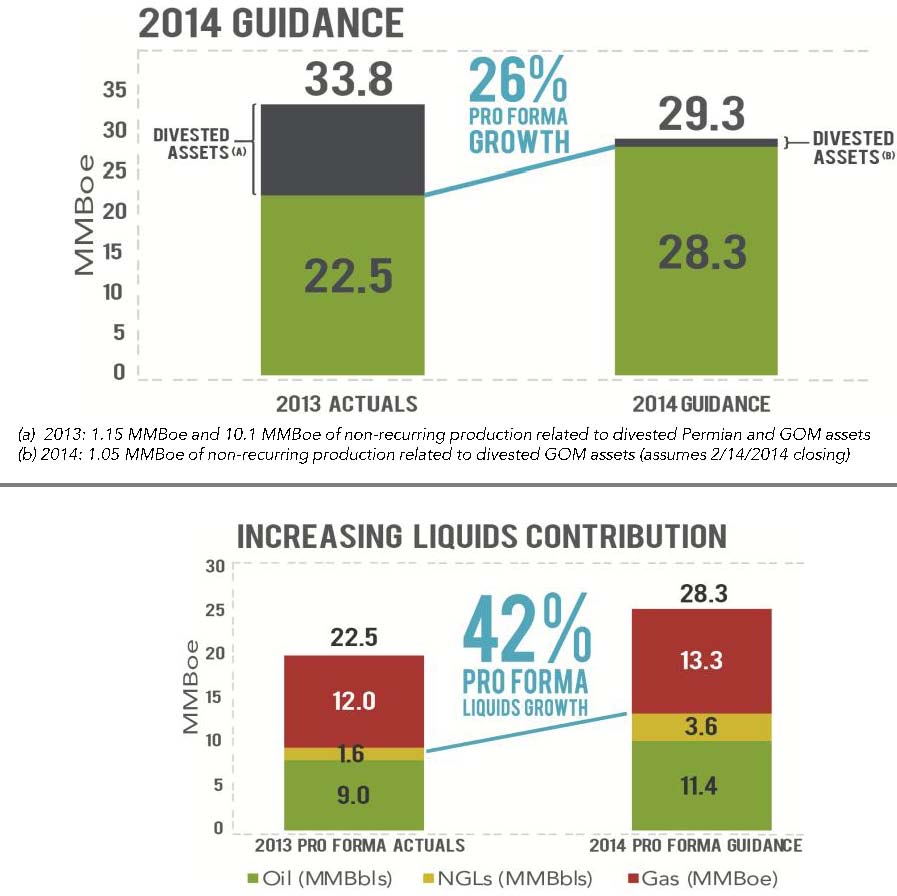

In addition, the company closed the sale of its Gulf of Mexico business for proceeds of $750 million, subject to customary adjustments. The divested assets produced 23 MBOEPD during Q4’13. Assets in the Permian Basin were also sold off for $500 million, effectively completing SD’s transition to a majority Mid-Continent operator.

Financial Situation Moving Forward

By the end of February 2014, SD held roughly $2.1 billion of available liquidity and $1.35 billion in cash following the Gulf of Mexico asset sale. Pro forma net debt for year-end 2013 was $1.6 billion, and the company is planning on hedging 95% and 65% of its 2014 liquids and natural gas volumes, respectively. The company said the hedging program provides cash flow and stability for future growth, according to its 2014 Analyst Day presentation. No amount has been drawn on its $775 million senior credit facility.

The company plans on spending $1.475 billion in 2014, which is similar to 2013’s budget. Plans in addition to drilling the 460 Mid-Continent horizontal wells include drilling 180 obligated vertical wells in the Permian Basin, an area that produced 6.2 MBOEPD for SD in Q4’13.

In a conference call following the release, James Bennett, President and Chief Executive Officer of SandRidge, said: “We think in this $1.5 billion zip code is a very comfortable place for us. It’s efficient for our operating teams and allows (our) team to keep costs under control and keep things running smoothly. Also, it affords us a reasonable growth rate, growth in terms of production and growth in terms of reserves and value.”

The company outlined a three year capital expenditures plan at its Analyst Day, with the number expected to increase to $1.55 billion for both 2015 and 2016.

The aggressive drilling program is expected to pay off, and 2014 guidance rates place production at 29.3 MMBOE with 28.3 MMBOE coming from Mid-Continent operations. SandRidge is forecasting a 26% increase in Mid-Continent production due to increased drillbit activity. Overall, 2014 production is expected to drop by 15% compared to its 2013 total of 33.8 MMBOE, but OAG notes SD divested approximately 11.2 MMBOE (roughly 33% of production) in the past fiscal year.

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. A member of EnerCom, Inc. has a long-only position in Core Laboratories and Shell.