Company size increases by ~50%

SandRidge Energy (ticker: SD) announced the acquisition of Bonanza Creek Energy (ticker: BCEI) today, in the largest U.S. deal since August.

SandRidge will acquire Bonanza Creek in a cash and stock transaction, increasing the size of the company by half in a single stroke.

The pro-forma company will combine SandRidge’s 38.8 MBOEPD and Bonanza Creek’s 15.8 MBOEPD, thereby growing SandRidge production by 41%. Bonanza Creek is more heavily oil-weighted, so oil production will increase by 80%.

Both active in Niobrara

Both companies are active in the Niobrara, but in separate locations. SandRidge has operations in North Park, a high basin in north central Colorado, not in the northeast plains. The company holds 123,000 acres in the play, and is producing about 1.4 MBOPD from the area currently. Bonanza Creek is also active in the Niobrara, in the traditional DJ basin. With 67,000 net acres, Bonanza Creek is producing 12.5 MBOEPD in the field.

Despite the difference in location, Sandridge CEO James Bennett reports “The geological and operational characteristics of Bonanza’s Niobrara and Codell locations are analogous to our existing Colorado North Park assets.”

In addition, SandRidge will acquire the midstream and marketing infrastructure that services Bonanza Creek’s Niobrara acreage. This infrastructure consists of 100 MMcf/d of gathering capacity, with six compressor stations and 12 miles of water transport pipeline.

Cash, stock transaction with 17.4% premium

SandRidge will pay Bonanza Creek shareholders a total of $36 per share, comprised of $19.20 in cash and $16.80 in SandRidge stock. Based on yesterday’s closing prices, this represents a premium of 17.4%. following the transaction, Bonanza Creek shareholders will own about one third of the company, and one of the directors of Bonanza Creek will join the board of SandRidge.

SandRidge will fund the acquisition using debt, and expects to have a 1.0 net debt/EBITDA. The company has $38 million in debt and $98 million in cash currently, for a net debt of 0. This transaction involves two companies of roughly equal size, as SandRidge and Bonanza Creek each have market caps of around $675 million. The transaction is expected to close in Q1 2018.

Based on yesterday’s prices, this deal has a value of $746 million. This purchase price equates to $47,215 per flowing BOE and $8.19 per BOE of reserves. If production is valued at the standard $35,000 per BOEPD, SandRidge paid roughly $2,500 per acre, far lower than the $30,000 and higher that companies have paid for acreage in the Permian this year.

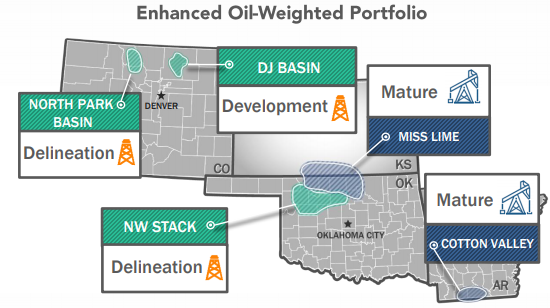

Bennett commented “this acquisition greatly enhances our existing portfolio by adding a deep inventory of drill-ready locations in the DJ Basin of Colorado and is highly complementary to our existing North Park, Northwest STACK and Mississippian assets… Overall, we believe this will drive strong risk-adjusted returns in both areas. Likewise, SandRidge will benefit from the greatly increased scale and substantial cost and operational synergies as a result of the transaction. Lastly, the acquisition will be accretive to cash flow per share and will enhance our ability over time to increase cash flow generation of the business.”

Q&A from joint analyst call

Q: Bonanza Creek has a midstream component too, I’m just curious how you value that and then really how we should value that as part of this deal too?

SD: Yeah, sure that RMI system they have is a real competitive advantage in this basin. There have been some midstream constraints and bottlenecks here and that system really allows them to move the molecules through their own network and get them to the best outlet. I wouldn’t say that we’ve got to – we’re going to peg a value for this publicly. Certainly, it’s strategic, it gives us a lot of operating flexibility. And at the right time, it could be value for us, but we’re not really ready to peg a value to it, if that’s okay.

Q: How should we think about the potential growth trajectory of the combined entity, and really maybe how you’ll think about capital allocation in 2018?

SD: We haven’t set 2018 budget yet. We talked about it a little bit on our call a couple of weeks ago, it’s going to largely depend on the commodity price outlook and what kind of returns we can achieve. But as we sit right now, I would anticipate like we said that two rigs running in the Northwest STACK and the delineation agreement. We have one rig in the North Park Basin delineating that play. So, I would anticipate that rig to continue. And then one rig in the DJ Basin really drilling development wells there.

So, call it two rigs in Niobrara and two rigs in the Northwest STACK roughly, and we haven’t set the CapEx program. We’ll be rolling that out in the first quarter, but that’s a good program to pencil in for now. And in terms of outspend, pro forma the transaction will be one times levered and plenty of liquidity. And I’ve always said, we’ll protect the balance sheet and maintain, any outspend will be a modest outspend and I would expect that to continue in 2018.