Sanchez Energy Corporation’s (ticker: SN) development of its Catarina assets in the Eagle Ford (EF) are exceeding company expectations, SN management said in a news release on December 10, 2014. The Catarina, acquired from Royal Dutch Shell (ticker: RDS.B) in May 2014 for a price of $639 million, instantly doubled Sanchez’s asset base and production volumes. Announced production is currently 45 MBOEPD, which exceeds the company’s previous estimates of 40 to 44 MBOEPD for Q4’14. The current volume is a company record and 16% higher than average Q3’14 production of 38.6 MBOEPD.

Catarina Update

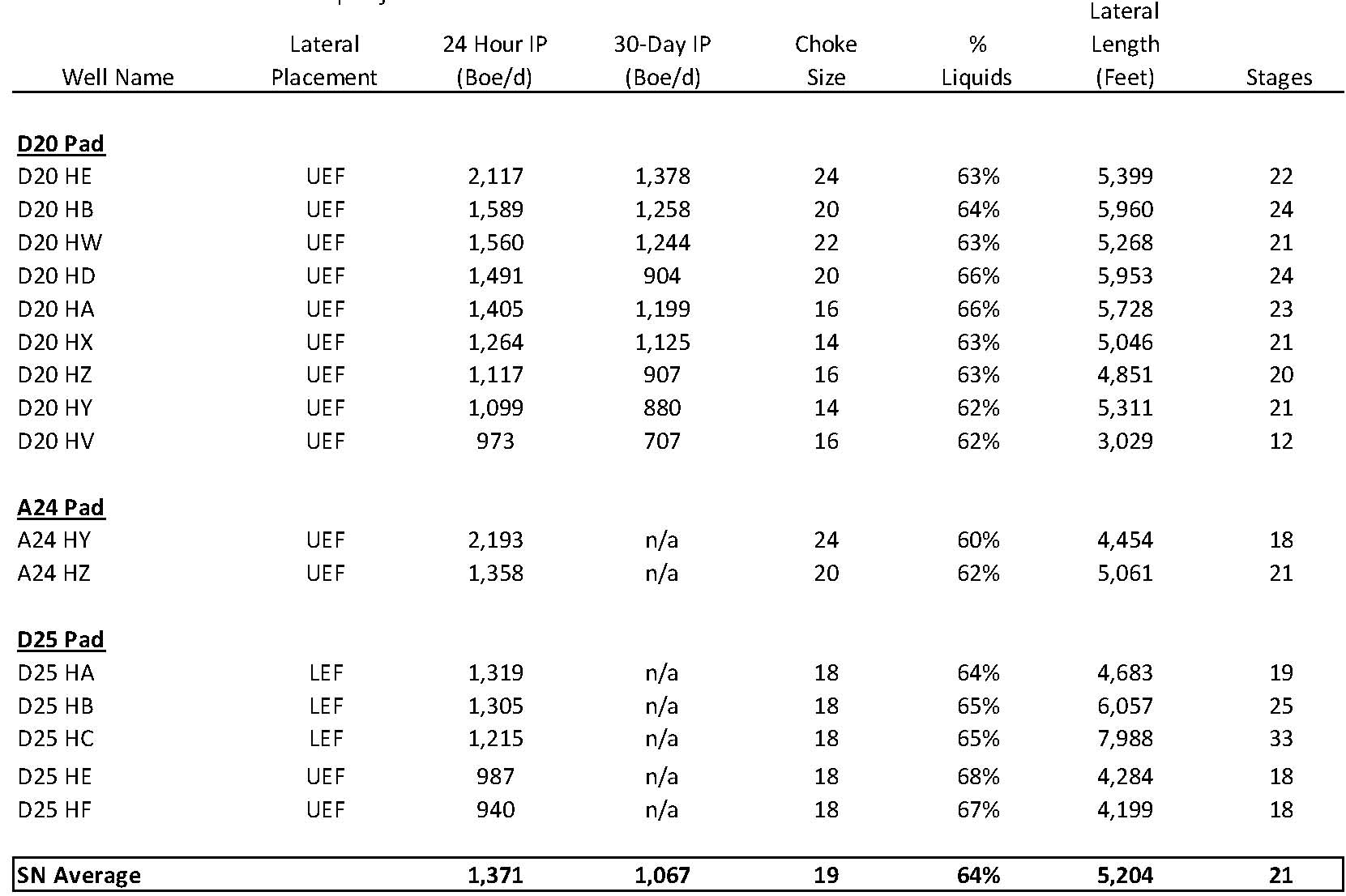

The majority of Shell’s development in the Catarina were focused on the Upper EF formation, and nine wells previously completed by RDS averaged 24-hour and 30-day rates of 1,402 BOEPD and 1,200 BOEPD, respectively, according to SN’s Q3’14 report. Nine more Upper EF wells completed by SN averaged 30-day production rates of 1,067 BOEPD, while three Lower EF wells produced an average rate of 1,280 BOEPD (65% liquids) apiece. The Lower wells are tracking along SN’s type curves of 600 to 700 MBOE.

Catarina requires 50 wells to be drilled annually, and Sanchez anticipates meeting those requirements by employing 2.0 to 2.5 net rigs. An appraisal well drilled in the northwestern part of the Catarina has proved to be prospective for both Upper and Lower EF formations, and the company believes both can be simultaneously developed throughout the region.

Eight more Catarina wells are expected to be placed online by year-end. A full list of completed wells can be seen below.

Sanchez also announced the completion of a well in the Tuscaloosa Marine Shale (TMS), with a lateral length of 5,600 feet. The TMS well yielded a peak 24-hour rate of 1,143 BOEPD and a 30-day rate of 920 BOEPD (91% liquids). SN is undertaking the region as part of a joint venture with privately held Sanchez Resources. Another lateral drilled to 6,450 feet is targeting the upper TMS and is forecasted to begin production within December. The TMS wells are shallower than traditional wells in the region due to the “rubble zone,” which SN believes allows for shallower decline rates. A total of 110,000 net acres are held in the play.

Balance Sheet

Sanchez announced total liquidity of $1,180 in its update – $530 million in cash and a total of $650 million on its available borrowing base following its increased commitment last month. SN has elected to use $300 million of the borrowing base, and has a total of $1.5 billion under its first lien revolving credit facility.

Net debt to pro forma EBITDA (trailing twelve months), according to Sanchez, is 1.8x. Upon purchasing the Catarina asset, management said its goal was to keep its net debt to EBITDA multiple below 2.0x. Its current level is well below its restrictive covenant of maintaining a 4.0x net debt to EBITDA multiple. The revolver and senior notes will not begin to mature until 2019 and 2021, respectively.

As previously mentioned by management, Sanchez intends to fully fund its 2015 capital program of $850 to $900 million through cash on hand and from operations. There will be nothing drawn on the company’s credit facility.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.