Sanchez Energy Corporation (ticker: SN), a rapidly expanding E&P targeting the Eagle Ford Shale, announced an increase of $287.5 million to its borrowing base in a press release on November 20, 2014. Per the terms of the commitment, SN has an available borrowing base of $650 million (up from its initial base of $362.5 million) with an elected commitment of $300 million. The company has $1.5 billion under its first lien revolving credit facility.

“We have significantly expanded our available borrowing base under our revolving credit facility as a result of strong reserve growth through the drill-bit and acquisition activity as well as through converting proved undeveloped and probable reserves into proved developed reserves,” said Michael Long, Chief Financial Officer of Sanchez Energy, in a statement.

The company had approximately $900 million in liquidity ($600 million cash and cash equivalents with $300 million elected commitment) at the time of its Q3’14 earnings release for the period ended September 30, 2014. The available liquidity was already enough to finance preliminary capital expenditure estimates for 2015, which are expected to be between $850 and $900 million.

Fully Funded for 2015

“We have decided to maintain our elected $300 million commitment amount, knowing we have immediate ability to access the much higher approved borrowing base,” Long said. “We have strong financial flexibility and have the option to further enhance our liquidity if needed by electing the full $650 million borrowing base, increasing our liquidity to over $1.2 billion.”

The company expects its 2015 program to be fully funded through cash on hand and cash from operations, assuming average oil and gas prices of $80 per barrel and $3.75 per MMBtu.

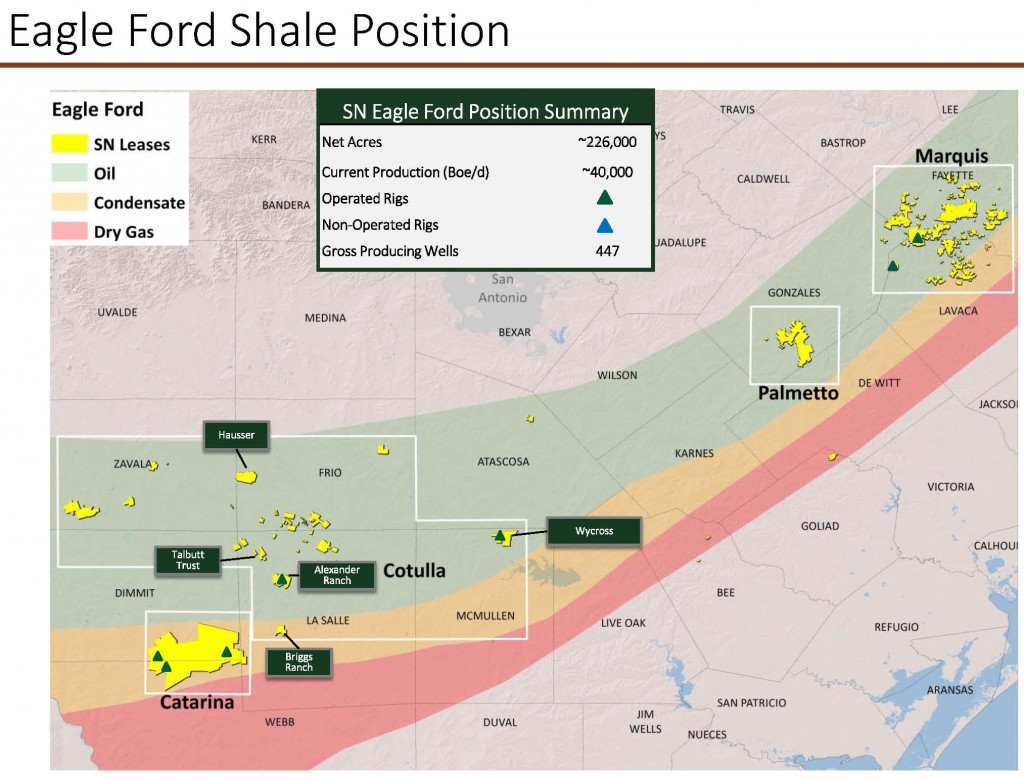

Eagle Ford Presence

Sanchez nearly doubled its production in Q3’14 on a quarter-over-quarter basis, boosted by completing the $639 million acquisition of the Catarina asset. Guidance in 2015 places production at 50 MBOEPD – roughly 17% higher than volume achieved in Q3’14. Global Hunter Securities called SN a “go-to buyer” in the Eagle Ford in a research note following the announcement, and doesn’t expect the company to stand pat in the upcoming year. “We think the excess liquidity could be put to work in the A&D market… should the current commodity weakness extend into 2015, we think there will be no shortage of acquisition opportunities in the Eagle Ford and elsewhere.”

Capital One Securities has a $31 price target for Sanchez and maintained its “Overweight” rating in response to the announcement. “At our current price deck, we are modeling a ~$275MM outspend next year and a ~$325MM outspend in 2016 (on a higher budget), so we project that the revolver can fund SN’s deficit spend over that time frame w/ a sizable cushion, even w/o stepping up the $300MM elected commitment,” said the note. “Despite the projected outspend over the next 2 yrs, we forecast that SN’s leverage ratio will not materially change going forward, as net debt/annualized EBITDA rises from 1.9x currently to 2.2x by YE15 and 2.0x by YE16.”

When Sanchez first acquired Catarina, management said it is focused on maintaining a 2.0x debt to EBITDA ratio, which would be in line with Capital One’s projected outspend.

In a conference call following its Q3’14 results, Tony Sanchez III, President and Chief Executive Officer of Sanchez Energy, said the company has “substantial” acreage either locked in long-term leases or held by production. “That allows us to treat the majority of capital spending as discretionary,” he said. “We could cut capital spending further while maintaining even a 45 to 50 MBOEPD rate, and still cut some more [compared to] what we recently cut.”

If an additional reduction in capital does in fact happen, the low end of its anticipated volume rate would still represent year over year growth.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.