Move boosts liquidity

Samson Oil & Gas (ticker: SSN) announced an agreement to sell the company’s interest in the North Stockyard field for $15 million. The buyer of the acreage is Angelus Private Equity Group, who has placed a $1 million deposit on the property. Closing is expected to occur on August 31, 2016. The sale will allow Samson to increase its’ liquidity.

Samson will use the cash from the sale to pay down its’ existing revolving credit facility. The debt level under the credit facility will be reduced by $11.5 million from the proceeds of the sale.

According to a press release from Samson, the sale of North Stockyard will achieve a number of goals including:

- A reduction of debt level.

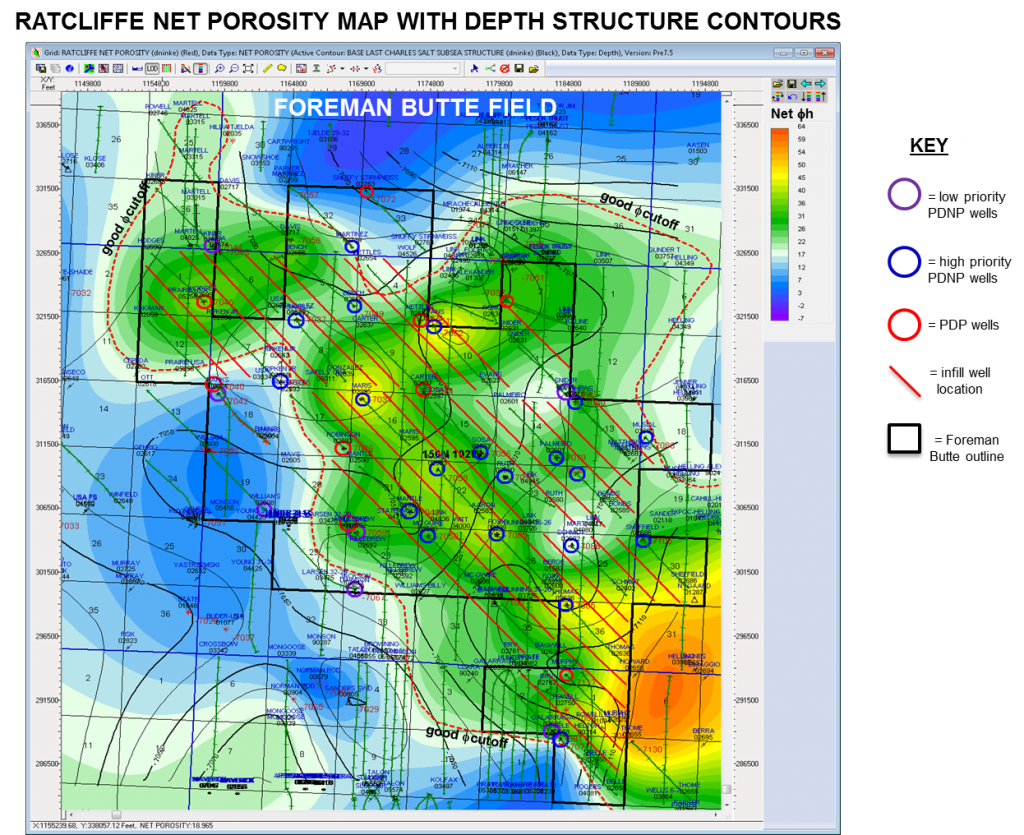

- Providing cash liquidity that can be invested in Samson’s Foreman Butte project which, as illustrated by the company’s recent reserve report has considerable growth potential, with more than $50 million of proved developed non-producing and proved undeveloped reserves.

- Maintaining compliance with debt covenants.

- Maintaining the excellent working relationship with the company’s lender.

The Foreman Butte acreage is located in North Dakota and Montana and was acquired by Samson in early April. The Foreman Butte acreage includes the potential for further growth opportunities for Samson through the continued production of the currently producing wells, the workover and stimulation targets of the PDNP wells and, as the oil price continues to improve, the development of numerous PUD locations.