Chinese Fund Buys 9.9% Stake in $27 Billion Russian LNG Project

Since the implementation of U.S. sanctions against Russia for its actions in Crimea, one of the major challenges facing the Russian oil and gas industry is gaining access to long-term project financing. Under the current sanctions regime, loans to Russia can be no longer than 30 days if they come from the U.S., and 90 days if the loans are from European lenders. Cutting off access to longer-term loans has made financing capital-intensive projects like liquefied natural gas (LNG) much more difficult.

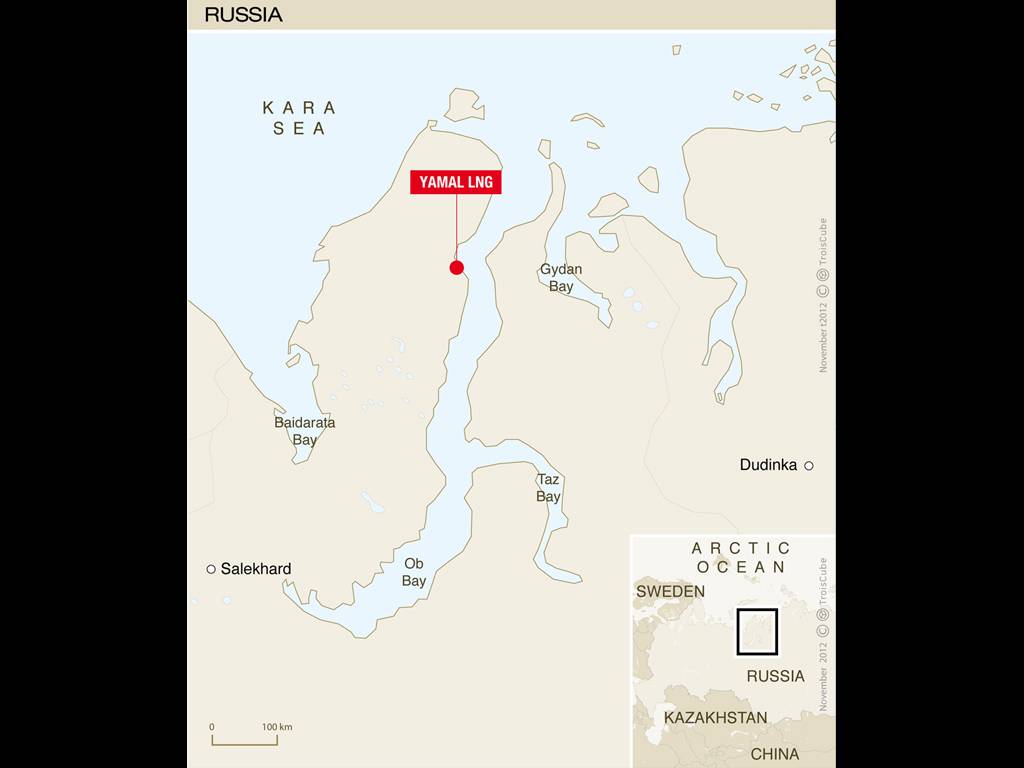

Earlier this month, Russia’s largest independent gas company, Novatek (ticker: MCX: NVTK), announced that China’s state-run Silk Road Fund (SRF) agreed to purchase a 9.9% stake in Novatek’s Yamal LNG project, pumping much needed capital into the project. The price SRF paid for its stake in the Russian LNG project was not disclosed.

Yamal LNG is expected to have an annual capacity of 16.5 million tons per annum with natural gas sourced from the South-Tambeyskoye field, which has 926 billion cubic meters of natural gas, according to Novatek. Following the closing of the deal with SRF, the projects partners will include Novatek (50.1%), Total (ticker: TOT; 20% stake), China National Petroleum Corp (20%) and SRF (9.9%).

President of SRF, Wang Yanzhi stated “We consider Yamal LNG to be one of the most prospective and competitive LNG projects in the world. Such observation supports our interest in becoming its shareholder. We hope our entrance into the project will facilitate an expedited closing of the Project’s general external financing, as well as contribute to further development of the Chinese-Russian cooperation in the energy sector.”

Silk Road Fund is a $40 billion medium to long term investment fund established in Beijing in December 2014. It makes outbound investment through both equity and debt financing. The fund focuses on infrastructure, energy, industrialization and financial cooperation.

The Russian government has already lent $1.4 billion from its National Wealth Fund to the project, with a remaining tranche of about $1 billion expected in the near future. The project’s partners are hoping to receive an additional $3-$4 billion from Russian banks and up to $5 billion from export credit agencies in Asia and Europe, Total CEO Patrick Pouyanne said during an interview. Pouyanne called SRF’s involvement in the project “a clear commitment by China.”

Total owns an 18.9% interest in Novatek, which it increased from 18% six months ago. The French company has the option to purchase up to a 19.4% stake in the Russian gas producer.

The Asian pivot

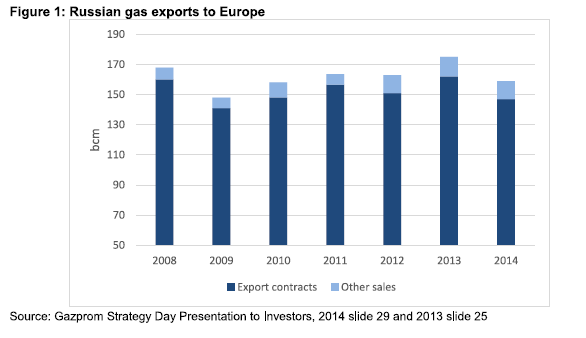

Increasingly tense relations between Russia and the West have been a major catalyst for the Russian oil and gas industry to start looking to Asian markets to sell its gas. Europe, historically Russia’s largest buyer, has been trying to reduce its reliance on Russia as political relations continue to sour, leaving Russia with excess capacity to sell.

For China, Russia is a logical partner for its energy diversification strategy, write James Henderson and Tatiana Mitrova, authors of an Oxford Institute for Energy Studies report titled “The Political and Commercial Dynamics of Russia’s Gas Export Strategy.”

“China has developed a ‘compass’ of supply sources over the past decade to satisfy its security of supply concerns” for natural gas, they write. Currently, China imports gas from Turkmenistan to its west, from Myanmar to its south and is increasing the number of LNG regasification plants on its eastern seaboard to satisfy the heavy energy demands in the east. Long-term, China would like to produce around 50% of its own natural gas needs, with the remaining 50% imported by pipeline and LNG in equal parts, said Henderson and Mitrova.

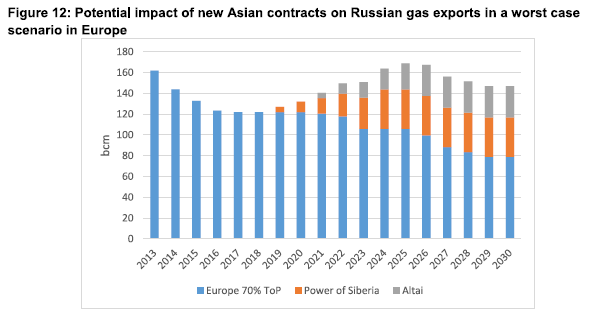

In November of last year, Russia and China announced plans for over 2 trillion cubic feet of natural gas to be supplied from Russia to China via pipelines. Initially, China promised $25 billion in project financing, but this was rejected by Gazprom (ticker: OGZPY), likely due to unfavorable terms on the loan. The project appears to be moving ahead, with China building its portion of the Power of Siberia pipeline in eastern China.

In addition to its proposed pipeline gas, Russia will have approximately 26.5 million tons per annum (mtpa) of LNG capacity, with plans for over 50 mtpa of more capacity, though none of it is likely to come online before the end of the decade.

Russia’s export capacity and its position relative to China make it a logical choice for China’s northern “compass point” of supply security, but its relatively weak bargaining position has left it in a tough position. China may not need as much gas as Russia would like to sell it, said Henderson and Mitrova, leaving with few options when considering loans for financing future oil and gas development, or trying to develop resources that better fit its own needs.

Russia has been pushing for the development of the Power of Siberia-2 (previously called the Altai), which will run from already developed fields in Russia into western China, but it seems unlikely that China will need this second line for the next 15 years. The countries have agreed to bring both pipelines online eventually, but “the Chinese gas market may well not be ready for both pipeline supply routes on the currently proposed timetable,” said the two researchers.

Look for Oil & Gas 360’s exclusive interview with James Henderson and Tatian Mitrova next week.

“It is possible that one could start around the end of this decade and ramp up to full capacity by 2025, but the second would not appear to fit comfortably (into China’s needs) before 2030 at the earliest.” Adding to that, demand for non-Yamal LNG is very low, they note.

Contact between Russia and China over gas supplies actually started in the early 1990’s, Henderson and Mitrova note, but the lack of demand and uncertainty over who actually controlled East Siberian gas reserves put off concrete negotiations until 2004. It would take another 10 years before the two would come to an agreement, with much of the arguments being centered on price, with the disparity in the twos’ positions reaching as much as $3/MMBtu. It was not until sanctions left Russia in a weakened bargaining position that it gave concessions on price and pipeline route.

Lower than expected demand in China for Russia’s natural gas, in addition to the fall in oil prices (and thus gas prices, which Gazprom links to oil prices through long-term contracts) has left the company with little room to negotiate with China. While Russia does offer a logical partner for China’s energy sector, the details of how this might happen remain under debate, “and this fact alone could undermine the so-called ‘pivot to Asia,’” write Henderson and Mitrova.

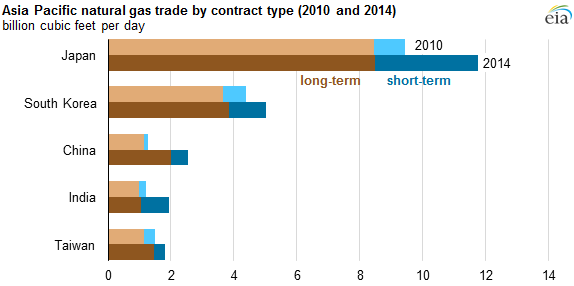

Natural gas prices in Asia increasingly linked to spot markets

A note from the Energy Information Administration (EIA) today noted that the Asian market is developing regional trading hubs so that natural gas prices better reflect natural gas market dynamics. Asia Pacific spot LNG trade almost tripled between 2010 and 2014, the agency notes, and represents 21% of all global LNG trade and 7% of total global natural gas trade in 2014.

China launched the Shanghai Oil and Gas Exchange on July 1, 2015, which will trade both pipeline gas and LNG. China’s diversified natural gas market, with expanding pipeline infrastructure and gas-on-gas competition, may offer a more liquid Asian natural gas price index, but high levels of government regulation make it less attractive as a regional benchmark, said the EIA.