President Putin says the economic downturn will reverse, even as the ruble continues to slide

During his annual press conference, which lasted three hours this year, President Putin offered reassurances that Russia’s economic downturn would be remedied, even as the exchange rate on the ruble continued to drop.

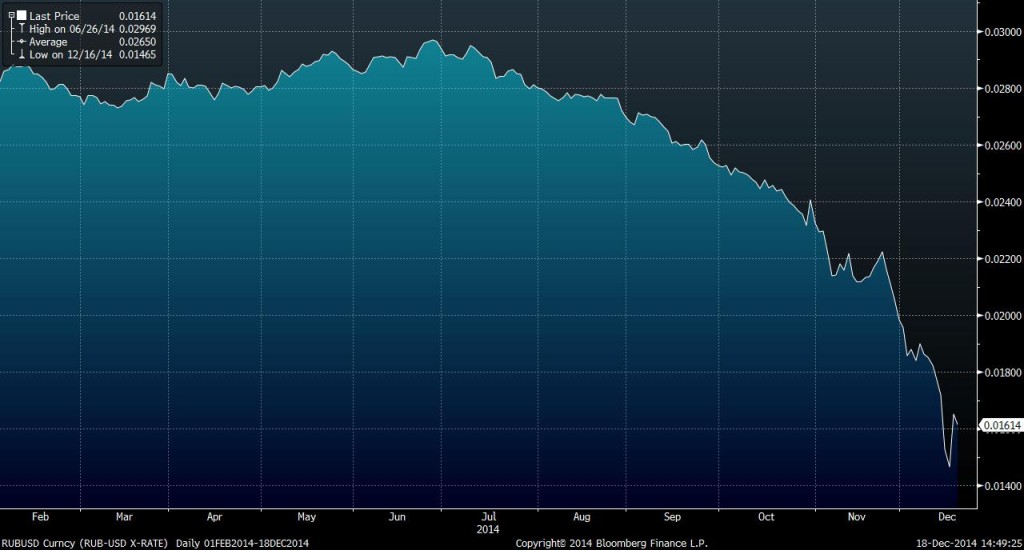

The ruble has fallen about 45% against the dollar this year, with particularly steep falls on Monday and Tuesday, as the currency slipped from 56 rubles against the dollar Monday, to 79 rubles against the dollar at points on Tuesday, a change of 29%. The exchange had improved by the end of Wednesday, with the ruble trading at 61.6 against the dollar at close, according to Bloomberg.

Ruble’s declining value against the dollar starting in Feb. 2014.

Despite the tremendous weakening of the ruble, Putin remained confident that the situation would improve, in time. “If the situation develops unfavorably, we will have to amend our plans. Beyond doubt, we will have to cut some (spending). But a positive turn and emergence from the current situation are inevitable,” Putin said during the press conference. The President of the Russian Federation said he thought, even in the worst-case scenario, Russia’s economy would start to trend upward in no more than two years, reports Reuters.

Even though Putin appears confident that an upturn is inevitable, the ruble continued its downward trend. On Thursday at 7:49 p.m. Moscow time, the ruble was about 3% weaker against the dollar at 62.13 after opening more than 1% higher. Traders say Putin offered few concrete measures at his end-of-year news conference to pull Russia out of the crisis, lending to feelings of uneasiness about Russia’s economic future, reports The Moscow Times.

Diversifying, but to what?

One of the main contributing factors to the ruble’s plunge has been the steady decline in oil and gas prices, which made up 18.7% of Russia’s GDP in 2012, according to the World Bank. Between oil losing around 45% of its value in the last six months, and sanctions against Russia for its actions in Crimea, the Russian economy has not had a leg to stand on.

In order to combat the increasing economic instability, Putin said that Russia must diversify its economy to reduce its dependence on oil, but gave no detail on how he planned to do so, reports Reuters.

Russian Economy Minister Alexei Ulyukayev said this week that were it not for sanctions, falling oil prices and if “we had not done some foolish things,” a comment which he did not elaborate on, the Russian economy could have shown annual growth of between 2.5% and 3%, reports The Moscow Times.

The Central Bank of Russia has tried to keep the currency falling further, but to little avail. The bank’s international reserves fell by $1.6 billion in the week of December 5 to12 to reach $414.6 billion, reports ITAR-Tass. According to the Central Bank’s data, the regulator has spent about $75.0 billion in the first 11 months of this year to defend the ruble, or about 5% of GDP.

Therefore, the volume of the Central Bank’s foreign currency funds spent on supporting the ruble exchange rate, excluding December, can be compared to twice the amount of Russia’s debt on external bonds ($39.3 billion) and 1.5 times the amount of the country’s sovereign foreign debt ($53.7 billion).

In an attempt to bolster government funds, lawmakers in the Moscow region (Russia’s third-largest source of tax revenue, after the cities of Moscow and St. Petersburg) approved longer hours for alcohol sales, reports The Moscow Times.

Alcohol can now be sold in the region surrounding Russia’s capitol from 8a.m. to 11 p.m. Sales were previously only allowed from 10 a.m. to 9 p.m. under a law passed in 2012 to combat alcoholism.

“This will bring an additional 1.5 billion rubles ($25 million) to the regional budget,” said Alexander Sharov, head of the committee on agricultural policy and consumer markets at the region’s Duma.

Purchasing frenzy as the ruble continues to devalue

As the ruble continues to lose value, Russians are purchasing as many consumer goods as they can in order to have tangible objects that will hold value better than the currency itself.

IKEA’s flagship Russia store, north of Moscow, announced that it would be raising prices Thursday, prompting massive crowds to pile into the store Wednesday in order to purchase products at lower prices, reports The Moscow Times. The furniture retailer said it had temporarily stopped selling kitchen appliances because it could not meet the increased demand.

Electronics retailer Media also reported records, with sales doubling the last two weeks compared with the same period last year.

Many car dealers are out of stock and are not ordering more vehicles, while others outright refuse to take new orders until the ruble stabilizes. Major car producers like Jaguar, Land Rover and BMW have reportedly either put a freeze on car shipments to the country or asked for a prompt down payment from dealers.

Other major brands, such as Apple, decided to shut down their online retail in Russia until the country’s currency stops fluctuating so wildly.

Property value is another emerging trend to combat the ruble’s decline. Real estate company NDV reported customers purchasing whole floors of apartment buildings, not just single flats, in December.

Even as President Putin assures Russia, and the rest of the globe, that the country’s economy will improve over the next two years, the market remains unconvinced. The ruble’s value continues to fall against the dollar with oil prices staying in the $60 range and Russian consumers trying to invest in as many actual goods as they can get in their hands. Putin’s predictions about a light at the end of the tunnel will remain to be seen, but in the meantime his very own citizens hedging bets against the ruble’s recovery.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.