Vital Pipeline Startup will Result in Increased Margins

Range Resources (ticker: RRC) is well-established as a low cost producer (its three-year finding and development costs rank fifth among 87 peers in EnerCom’s E&P Weekly Benchmarking Report), but that doesn’t mean there isn’t room for improvement.

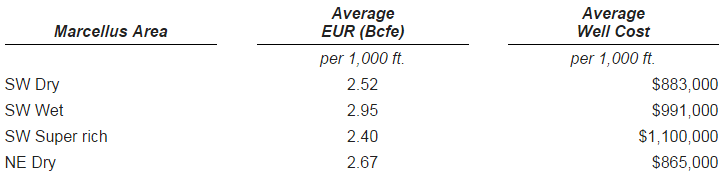

In the last four years, Range has exploited its Appalachia acreage (now in the neighborhood of 1.6 million acres of stacked pay potential) to line of sight production growth of 20%. It has also lowered its drilling costs per lateral foot by 60% and boosted its well estimated ultimate recovery (EUR) to among the best in the play. The company expects its Claysville Sportsman’s Unit 11H well, the 59 MMcf/d record setter of 2014, to return an estimated 15 Bcf, or roughly 2.8 Bcf per 1,000 feet of lateral. Two new wells from the same pad are currently on the drilling schedule, with the second currently being completed. Peers in the region are generating about 2.2 to 2.6 Bcf per 1,000 lateral feet, according to a note from SunTrust Robinson Humphrey.

“Despite drilling 38% longer laterals, our drilling costs per well have actually declined by 10%,” said Ray Walker, Chief Operating Officer of Range Resources, in a conference call. Walker explained that the first well on the Sportsman’s pad is “in the top tier of Utica wells to date… and the second well is better.”

Management believes further improvement can be made, with wells producing EURs of 17 Bcf at costs of about $16 million, as Utica drilling costs are expected to fall by 20% to 30%.

RRC management expects the 20% line of sight growth to be achieved in 2015 despite a capital pullback of 42%, with its 2015 budget allotted at $870 million. Management explains its budgets are typically front-loaded, meaning there will be less capital expended in Q4’15. Another beneficiary is the reduced drilling time, as 7.5 frac stages were completed in Q3’15 – up from 5.2 stages per day in Q3’14. Anywhere from 50 to 60 wells will be waiting on completion by year-end and will be primed to contribute to Range’s expanded takeaway options.

Mariner East I is Ready to Go

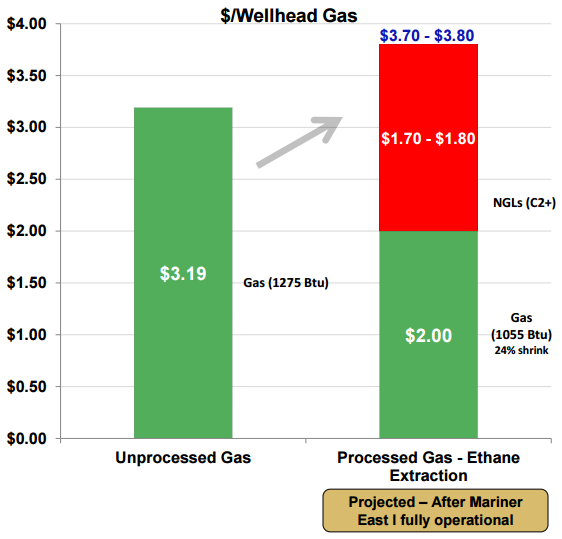

Permitting delays pushed back the commissioning of the Mariner East I pipeline, but the project is finally approaching the finish line. RRC management expects full operations to commence by year-end, with ethane startups possible within a month. RRC has contracts to ship 20,000 barrels of ethane per day to the Marcus Hook refinery in Pennsylvania as part of a 15-year sales agreement.

Permitting delays pushed back the commissioning of the Mariner East I pipeline, but the project is finally approaching the finish line. RRC management expects full operations to commence by year-end, with ethane startups possible within a month. RRC has contracts to ship 20,000 barrels of ethane per day to the Marcus Hook refinery in Pennsylvania as part of a 15-year sales agreement.

An additional 20,000 barrels of propane per day will be sent to the same location and will have the benefit of market optionality, depending on the best price option. Range anticipates the propane transport market, regarding international buyers, will increase by 50% in 2016 – significantly opening up the demand window. RRC holds access to 800,000 barrels of propane storage (80% of capacity) to manage its inventory on a less restricted basis and provide upside in an expanded export market.

The natural gas liquids optionality provides uplift to margins that are becoming slimmer in the gas-heavy region of the Marcellus/Utica. “We think the worst is behind us with the realized NGL prices, especially with propane,” said Chad Stephens, Senior Vice President.

Range expects to realize a $90 million uplift in annual net cash flow if combining the net effects from its new pipeline contracts.