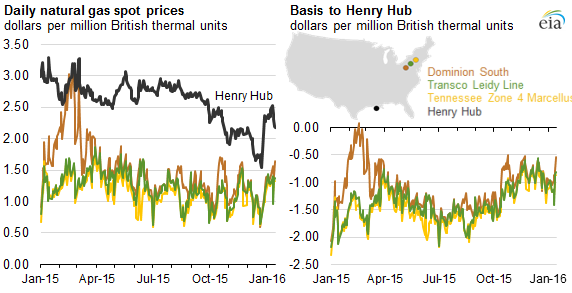

The spread between natural gas prices at Henry Hub and in the North East are narrowing as infrastructure increases, according to information from the Energy Information Administration. Henry Hub in Louisiana acts as the main trading point for natural gas in the U.S., but natural gas from the Utica shale plays in Pennsylvania, West Virginia, and Ohio constantly trade lower than the national benchmark.

Natural gas produced from the Utica shale plays is usually consumed in other areas of the country. With limited infrastructure, natural gas supply can quickly build in the region causing prices within the Marcellus region to be discounted, particularly in Pennsylvania, according to the EIA.

Conversely, the price of natural gas in the North East can skyrocket when demand outpaces the capacity of infrastructure to bring in more supply. During the winter when demand for heating in cities like New York and Boston rises, natural gas spot prices can spike dramatically.

While the price of natural gas in the North East is still trading well below Henry Hub price, the gap has narrowed in recent months. The price at Transcontinental Pipeline’s (Transco) Leidy Hub in central Pennsylvania averaged $0.93 per MMBtu below Henry Hub price from December 1, 2015, to January 15, 2016. In July 2015, the differential was 44% larger, average $1.65 per MMBtu.

Increased infrastructure narrowing the spread

As more infrastructure is built out in the North East, natural gas spreads continue to narrow. The effects of the infrastructure buildout were muted in November and the beginning of December due to warm weather, said the EIA, but natural gas production increased in December and January as demand increased and producers had more access to takeaway capacity.

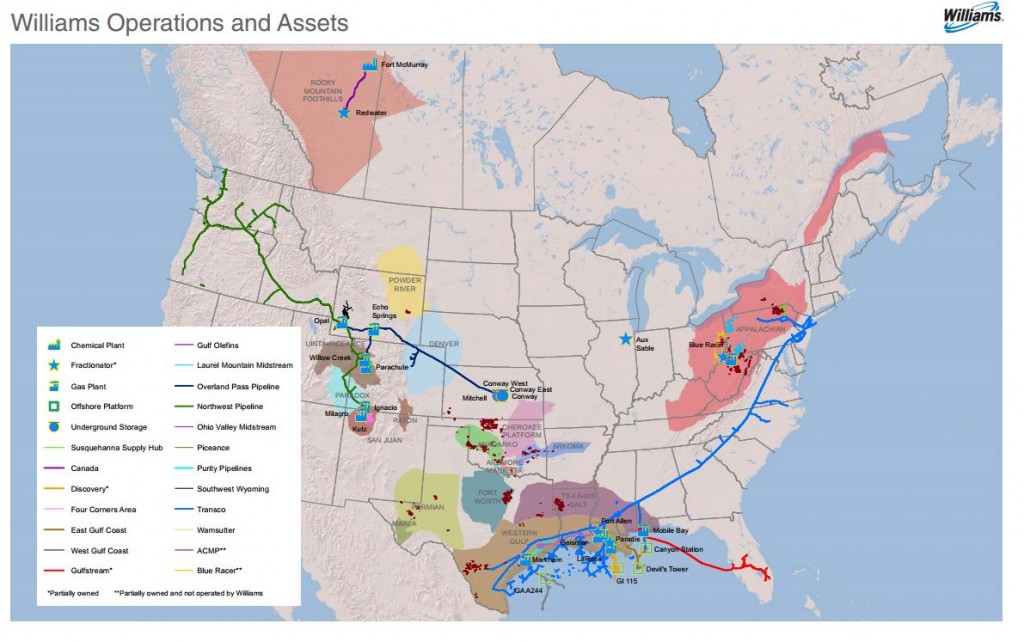

Williams Partners’ (ticker: WPZ, Williams.com) Transco Pipeline project is part of the recent infrastructure buildout going on in the North East. Transco is designed to deliver 10.9 Bcf/d of natural gas 10,200 miles from South Texas to New York City. $1.3 billion of Williams Partners’ $2.1 billion 2016 capital plan is targeted at the Transco expansion, underlining the importance of the project.

One large Marcellus/Utica producer, Range Resources (ticker: RRC; RangeResources.com), has added value to its Marcellus natural gas operations by developing and aggressively marketing natural gas liquids (NGLs), particularly ethane and propane, to a niche customer base.

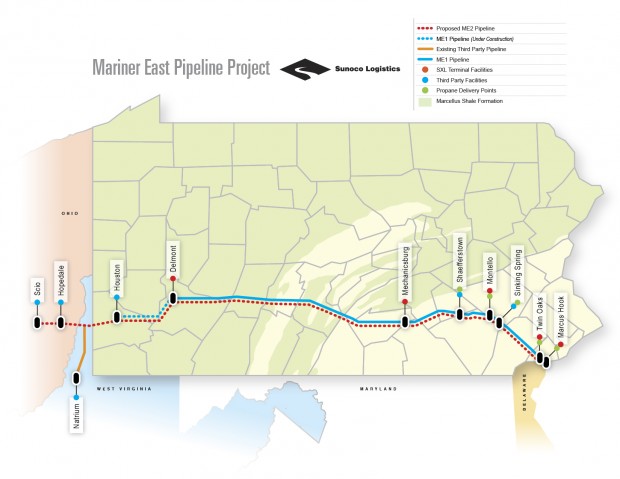

Oil & Gas 360® reported last week on the scheduled February 2016 opening of the Mariner East 1 pipeline, from which Range expects to see a significant revenue uplift. According to the Range website, it has three ethane projects which utilize Mariner West, ATEX, and Mariner East 1. Range is contracted to ship 20,000 barrels of ethane via pipeline to the Marcus Hook Industrial Complex outside of Philadelphia. Another 20,000 barrels of propane will be shipped via pipeline to Marcus Hook, where it can be sold in either the international market, or the local market. The company has access to propane storage at Marcus Hook, which allows faster loading of ocean-going vessels.

Altogether, these agreements provide Range with the ability to sell ethane in Canada, Europe, and at Mont Belvieu, as well as future petrochemical facilities in the Appalachian Basin.