RRC Takes Next Step in Divestiture Plan

Less than one month after selling its Nora assets in Virginia for $876 million, Range Resources (ticker: RRC) has another attractive piece of acreage on the block.

The Fort Worth-based E&P is marketing its leasehold in the STACK (Sooner Trend Anadarko Basin Canadian and Kingfisher Counties) trend of Oklahoma, according to a recent company presentation titled “STACK Opportunity.” RRC’s position consists of 28,493 acres that are entirely held by production (76% operated) and is delivering net production of 6.6 MMcfe/d (83.5% gas). Rates of return on the oil and condensate windows of the Meramec formation were exceeding 100% based on current strip pricing.

Range is primarily focused on its expansive footprint in the Appalachia region, and management previously said any potential asset sales are being made simply because they “cannot compete with the Marcellus for capital.” RRC plans on exiting 2015 with five rigs in the field – none of which are in the STACK. In all, 11 STACK wells are expected to be turned in line in 2015, accounting for less than 7% of the company’s new wells. The region’s current production accounts for less than 1% of Range’s overall output.

Due to the minimal contribution to Range’s production profile, a note from Capital One Securities says that “any material proceeds… should reduce RRC’s projected leverage ratios.” Range previously said the intention of these asset sales were to pay down debt and stabilize its balance sheet, even though the company has $1.75 billion in liquidity under its current bank commitments and does not have any note maturities until 2021.

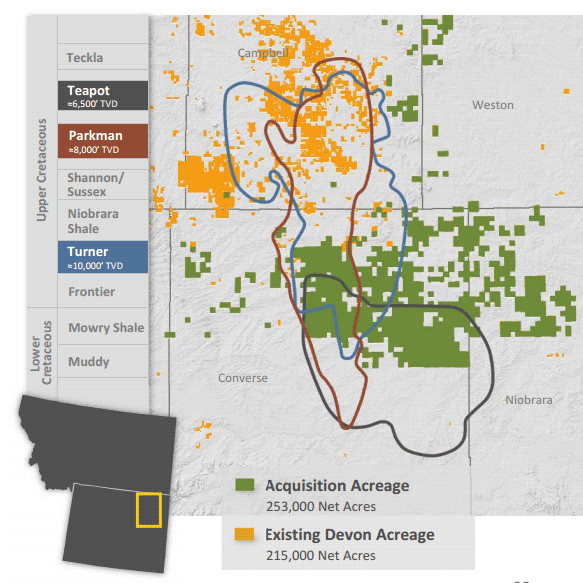

Devon Energy’s Stomping Grounds

The STACK play made waves last week when Devon Energy (ticker: DVN) and a subsidiary purchased STACK-focused Felix Energy and associated midstream assets for $3.45 billion. Devon President Dave Hager described the STACK as the “best emerging development play in North America” in a conference call with analysts and investors.

Management sure backed up its words with its wallet: metrics on the deal shook out to $23,750/acre and about $210,000/flowing BOE, compared to a similar Devon transaction in May 2014 that involved costs of less than half that amount. Analyst firms acknowledged the attractiveness of the play but, overall, questioned the selling price.

Devon, pro forma the closing of the sale, is the STACK’s largest acreage holder and has a footprint of more than 430,000 net surface acres. It will have more than doubled its position since the beginning of the year.

Scouting the Field: Potential Buyers

RRC’s acreage is spread throughout four different counties and scattered throughout operations orchestrated by majors like Cimarex Energy (ticker: XEC), Continental Resources (ticker: CLR), Devon Energy, Marathon Oil (ticker: MRO) and Newfield Exploration (ticker: NFX). More than 40 rigs are currently active in the STACK, which is one of the few plays who has actually increased its rig count in the depressed commodity environment. Bank of America Merrill Lynch has been retained to market the assets, and Range plans on receiving proposals and then completing the sale in February and March of 2016, respectively.

All of the active STACK companies mentioned above outlined similar stories in their recent quarterly calls, with many drilling to satisfy lease requirements and qualify the properties as “held by production.” All are in the general early stages of development, with only Newfield Exploration expecting to reach the full development stage in 2017. All were looking at acquisitions in “opportunistic” fashion.

Cimarex Energy is conducting an 11-well pilot in the near term, and even though the STACK and its Meramec is a relatively new name to the casual oil and gas observer, those tied close to the industry hold it in high regard. “The Meramec is not a secret,” said Tom Jorden, Chief Executive Officer of Cimarex, in a recent conference call. “There are a couple of really aggressive private equity players out there, there are public companies that are extremely aggressive and there are new entrants every time we turn around. So valuations are pretty challenging when you look at per acre costs.”

Market Reaction

Analysts referred to the Devon transaction to line up a valuation, with a note from Stifel saying, “Valuing 20% of RRC’s acreage at the $24k/acre DVN transaction price (given its acreage proximity to the Felix assets) and the remaining 80% of the RRC position at $5k/acre to $10k/acre, implies the package could fetch $250mn to $360mn.”

A note from Capital One Securities points out that “a decent chunk of the acreage is located in Major County, which is generally to the north and northwest of where the bulk of industry activity in the STACK has occurred to date and generally to the northwest of the Felix properties.”

The firm laid out two scenarios. The first (and best case) scenario, assuming the same acreage valuation in the Felix deal, would imply a payout of about $570 million. The second (and much more likely) scenario implies a valuation of about half that amount, staying in the ballpark of the Stifel estimate. Assuming a sale of about $285 million, Capital One estimates RRC’s year-end net debt/EBITDA ratios for 2016 would decline to 4.7x from 5.2x, based on current strip pricing.