Increasing takeaway capacity, reduced debt, creating profit from byproducts, 20% growth rate

As the oil and gas industry dives into 2016, energy executives and investors alike are hoping the new year can distance itself from the bull market of 2015. Despite the 14 (going on 15) month commodity price downturn, some companies have positioned themselves for capturing the inevitable rebound through advantageous acquisitions, reliable takeaway capacity, attractive hedges and low-cost production. Or a combination of factors.

Range Resources Corporation is a low-cost producer focused on the Marcellus/Utica in the northeast United States. Range and its Chief Executive Officer, Jeff Ventura, are generally regarded as the founders of the Marcellus Shale play and used their early entry and expertise in the region to fuel America’s natural gas revolution. Many other Appalachia players have entered the fold since RRC’s discovery, but the Fort Worth-based company remains a key figure in the U.S.’s largest gas field.

Below are some of the strengths of Range Resources Corporation:

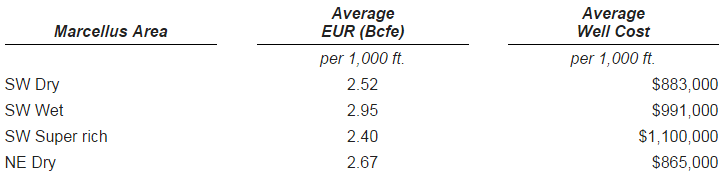

- A track record of being a low cost producer. Analysis from Wood Mackenzie reveals RRC has both the highest net risked resource and lowest breakeven price when considering only the Marcellus region.

- The company ranks 5th out of 88 companies based on three-year finding and development costs, according to information from EnerCom’s E&P Weekly Benchmarking Report. Even though Range is one of the most tenured companies in the Marcellus, there is still room for improvement. In the company’s Q3’15 conference call, management said it completed a five-well pad in Southwest Pennsylvania at 45% less cost per foot compared to 2014. Laterals are expected to average nearly 7,000 feet in 2016.

- Consistency: Ventura explained it best in a recent conference call: “For over a decade, the Range team has grown production at almost a 20% compound annual growth rate despite periods of declining prices and high service costs.”

- Efficiency: Range maintained its 20% growth rate despite a 2015 capital budget that was revised to be roughly one-third below its initial guidance.

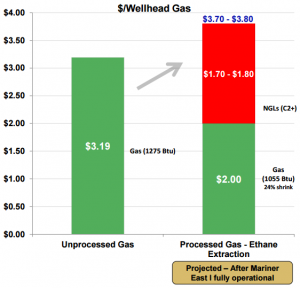

- Turning byproducts into benefits: Range has created its own marketing agreements and contracts based on generally unwanted byproducts (like ethane).

- Incoming capacity options: the commissioning of the Mariner East pipeline will increase RRC’s ethane and propane takeaway by 20 MBOPD apiece, and is part of a 15-year contract. The new pipeline will “give [RRC] a lot of optionality to work around seasonality demand,” said Chad Stephens, Senior Vice President of Range. The Mariner East, along with two more incoming pipelines, is projected to increase the company’s annual net cash flow by $90 million.

The company made a significant divestiture to close the year, selling non-core assets in Virginia for $876 million to bolster its balance sheet. Range is also marketing its STACK acreage in Oklahoma – an asset valued at roughly $300 million by sell-side analyst firms. Following the Virginia asset sale, Range reduced its debt level by approximately 24% and its earliest debt maturity does not occur until 2021. The company had more than $1.7 billion in liquidity upon completion of the sale. For 2016, Range expects to establish a budget near estimated annual cash flow, not including the upside from potential asset sales.

The company made a significant divestiture to close the year, selling non-core assets in Virginia for $876 million to bolster its balance sheet. Range is also marketing its STACK acreage in Oklahoma – an asset valued at roughly $300 million by sell-side analyst firms. Following the Virginia asset sale, Range reduced its debt level by approximately 24% and its earliest debt maturity does not occur until 2021. The company had more than $1.7 billion in liquidity upon completion of the sale. For 2016, Range expects to establish a budget near estimated annual cash flow, not including the upside from potential asset sales.

Management believes its track record of growth will continue into the current year as well as into 2017, supported by a busy Q1’16. “The first quarter is going to be big,” said Ray Walker, Chief Operating Officer. I think you’re going to see us add a couple more frac crews in the first quarter and probably pick up a rig – all of those things we do every year when we start out a brand new budget.”

[conf_link_button]