The Utica is growing.

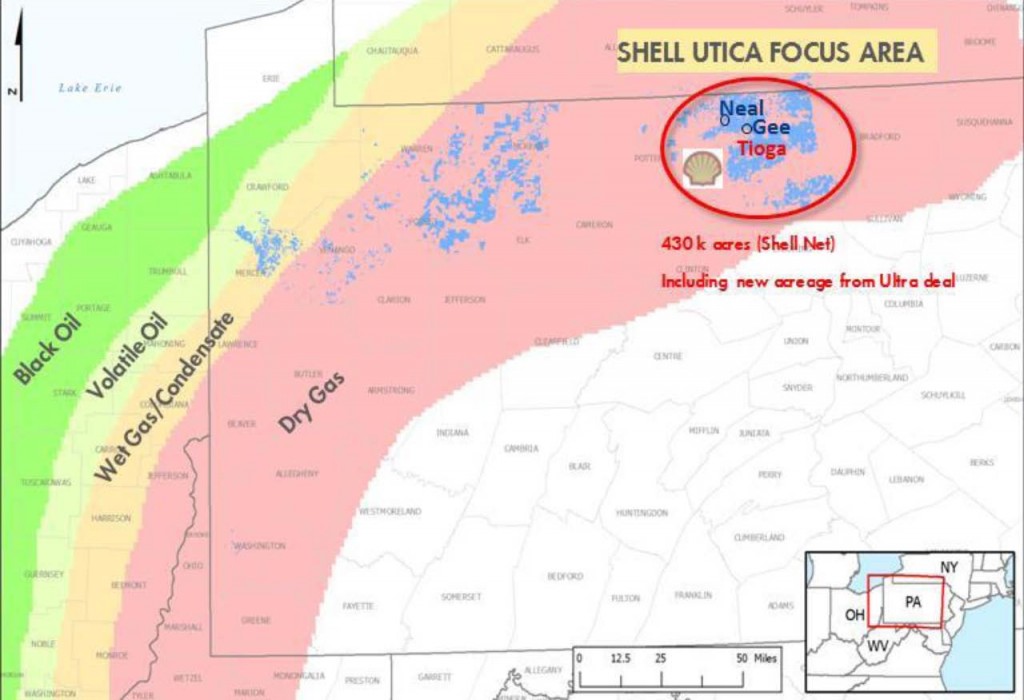

Royal Dutch Shell (ticker: RDS.B) successfully drilled two Utica wells 100 miles northeast of the nearest producer in the play, the company announced in a press release on September 3, 2014. The wells, located in Tioga County, Pennsylvania, not only extend the sweet spot of the play, but are “comparable to the best publically announced thus far in the emerging Southeast Ohio Utica dry gas play,” the release says.

The Gee well was drilled to 14,500 feet with lateral lengths of 3,100 feet and has been on production for roughly one year. Initial flowback rates reached 11.2 MMcf/d. The Neal well is deeper – 15,500 feet of depth with lateral lengths of 4,200 feet. Neal has been on production since February 2014 and observed peak flowback rates have reached 26.5 MMcf/d.

Shell holds approximately 430,000 acres in the region and is awaiting results from four additional Utica wells. Production is expected from all of them within the year. It comes as no coincidence the company bolstered its Marcellus/Utica portfolio last month with the acquisition of 155,000 acres from Ultra Petroleum (ticker: UPL). Kayla Macke, a spokeswoman for Shell, said the company held off on announcing its well results in order to minimize competition. She added the Utica “could be much bigger” than previously mapped, according to an interview with Bloomberg.

How Big is the Utica?

The EIA’s Drilling Productivity Report shows gas production from the Utica will exceed that of the Bakken as early as next month. Overall gas production has grown at a monthly compounded rate of 6% since January 2012, and overall resource estimates are 15.7 Tcf.

Goldman Sachs reports the Marcellus/Utica region will account for 85% of net production growth in the United States from 2014 to 2018. Raymond James estimates the Utica will have a “somewhat similar” production profile to the Marcellus, which currently accounts for nearly 40% of natural gas production in the United States.

New York has Front Row Seats

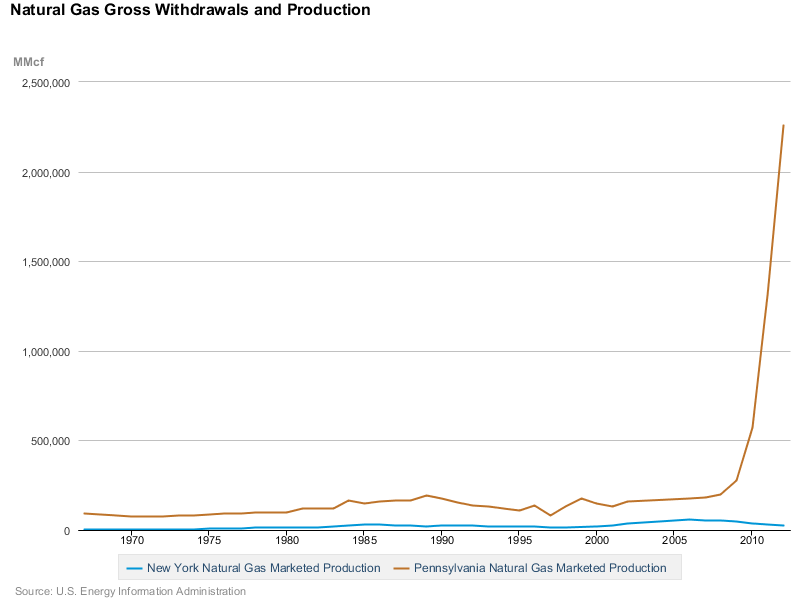

Columbus Business First says the true “sweet spot” of the play has yet to be identified, and, as Shell said in its release, its Tioga County (PA) wells yielded production rates similar to those in Ohio. Tioga County borders New York – a state that has passed hydraulic fracturing moratoriums in 150 towns and counties since 2008. As OAG360 published in July, Pennsylvania is producing 85 times more natural gas than its neighboring state. A 2011 report entitled The Economic Opportunities of Shale Energy Development, authored by University of Wyoming professor Timothy Considine for the Manhattan Institute, estimates New York is missing out on $11.4 billion in economic output and $1.4 billion in tax revenues. The report says 15,000 to 18,000 jobs could be created in Southwestern New York alone. The United States Labor Department said 21,000 jobs existed in Pennsylvania’s oil and gas industry in 2012, representing a 259% increase compared to 2007. Only Texas has added more jobs in that time frame.

Approximately 70,000 New York landowners are embroiled in a suit against the state demanding royalties lost in the fracing moratoriums. Popular opinion in New York, however, starkly opposes the drilling method. In a study conducted by the University of Michigan, only 29% of New Yorkers support shale development. When asked to gauge the environmental effects of fracing on a scale of one to ten, 23% responded with 10, or “extreme risk.” Another 78% believe that drilling poses a major risk to water resource, and 75% believe drilling would worsen the quality of life.

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. A member of EnerCom, Inc. has a long only position in Shell.