Investment is expected to double current production

Venezuelan President Nicolas Maduro said that Russia’s top oil producer, Rosneft (ticker: RNFTF), agreed to invest around $14 billion in the South American OPEC country’s oil and gas sector. Maduro met with Rosneft CEO Igor Sechin and Venezuela state-owned PDVSA’s president, Eulogio del Pino, Wednesday, reports Reuters.

“We had a great meeting and agreed on investment of over $14 billion,” Maduro said in a televised broadcast, adding funds would go toward doubling Venezuela’s oil production. Maduro did not provide a breakdown of the investment plan.

Rosneft said in an email to Reuters that the $14 billion dollars was the total amount of investments of the company in Venezuela during the lifespan of current and future projects. The company already invested $1.8 billion from 2010 to 2014, and sees its own oil production in Venezuela rising to 8 million tons per annum (160 MBOPD) by 2019.

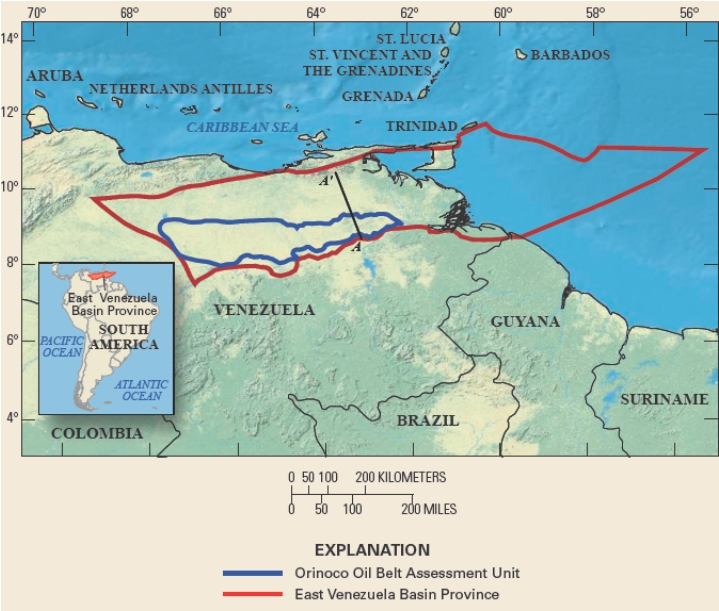

PDVSA said on Twitter the two countries agreed to “create companies together” to boost crude production, adding both nations want to expand crude extraction in the Orinoco Belt, where Rosneft already has joint ventures with PDVSA. The Orinoco Belt is a territory encompassing the southern strip of the eastern Orinoco River Basin and sits on top of one of the world’s largest petroleum deposits.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.