Sale of Aneth completed

Resolute Energy (ticker: REN) announced fourth quarter results today, showing a net loss of $3.9 million. Over the full year, the company reported a net loss of $7.7 million, much improved from the $161.7 million loss the company took in 2016.

Resolute closed the sale of its Aneth field in Q4, so the results represent a period of transition, from a company producing from EOR and unconventional fields to a pure-play Permian producer. While the company saw production decline this quarter due to the sale, from 28.6 MBOEPD in Q3 to 27.6 MBOEPD this quarter, this drop was not without compensation. Resolute’s LOE expense on a per-barrel basis fell, as the Aneth field had significantly higher-cost operations. The company reports LOE per BOE dropped 36% to $6.29.

~$380 million in CapEx

Resolute plans to spend around $380 million in the coming year, almost entirely on drilling and completing new wells. This spending should lead to significant growth, as the company’s Permian production is predicted to nearly double from current levels to Q4 2018. The company expects to run three rigs until mid-September, then two rigs through the rest of the year.

New completions design

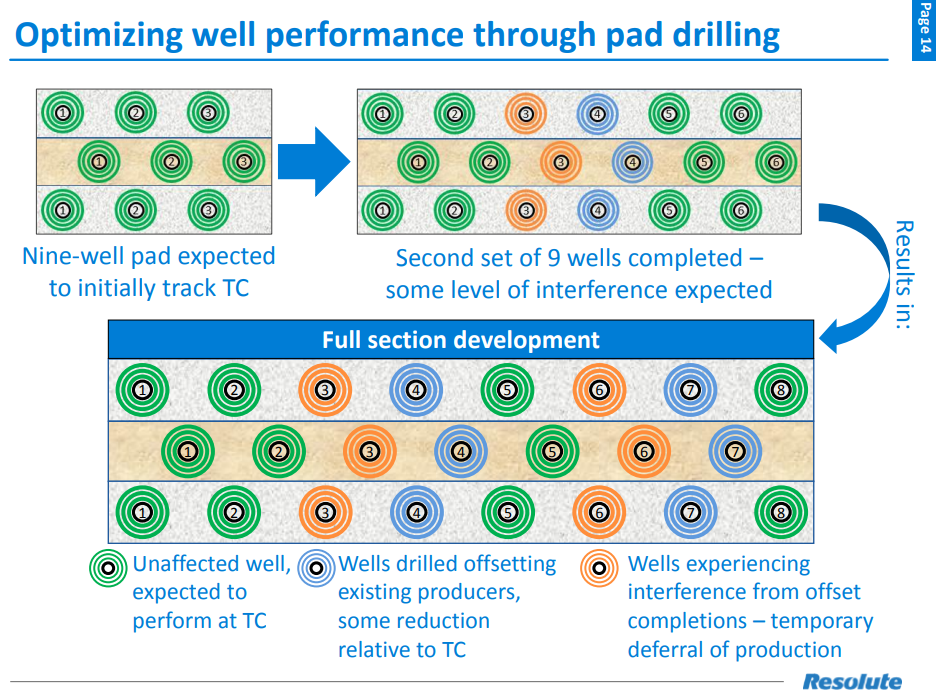

Resolute also unveiled a new design for its completions, involving using all three of the company’s rigs at once. The company plans to target the upper and lower Wolfcamp A and the upper Wolfcamp B, drilling one well into each zone from each rig for a total of nine wells. These nine wells would then be completed at the same time, allowing all to begin production simultaneously. Further activity with this design should ideally minimize the disruptions traditionally experienced by existing wells during full development.

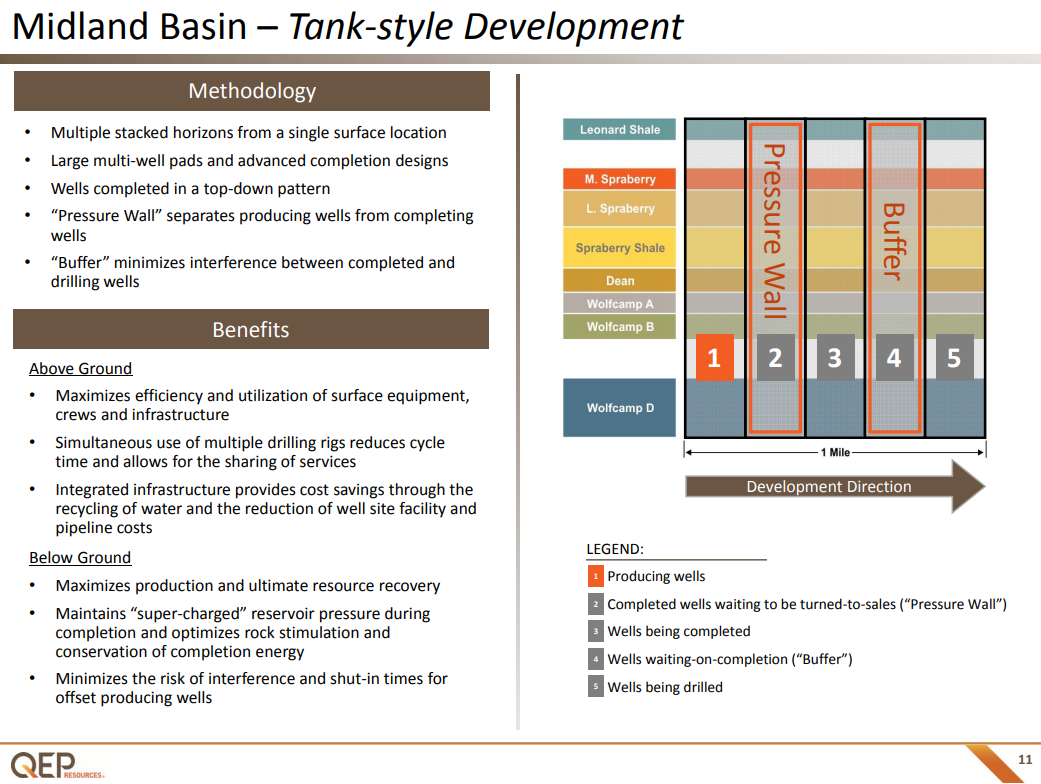

This design for Resolute is reminiscent of QEP’s “tank style” completions, as each involves drilling many wells into a single section in a precise order. One of the main differences between Resolute’s design and QEP’s tank-style completions is that QEP has all stages of constructing a well in progress in a section, with some wells producing, some waiting to begin production, some being completed, some waiting on completion, and some being drilled. Resolute, on the other hand, drills and completes a given group of wells before moving on to a new one.

Q&A from REN conference call

Q: Question on slide 14 here, just trying to interpret the difference, I guess color that you guys are looking at here. Is that the right way to interpret this is that the green dots generally perform kind of at the old type curve you guys talked about and then the blues I guess they performed toward the lower end of the range you guys have talked about and the orange maybe just see some deferral in production, but you guys are more or less what you guys have talked about it initially. I guess just generally trying to understand how these various colors kind of tie to the productivity outcomes you guys have on slide 15?

REN: That’s actually a fairly accurate representation. The guys in analytics put together a really sort of cool slides like this that sort of dozen animation that sort of shows how this all lays out, we just can figure how that – fit that into a static slide deck. So – and you know what we are trying to say is that, you know there you know we’re going to have a mix of wells over the course of this year. We’re going to have some wells that you know with the nine-well patterns as you say we expect are going to perform a lot like parent wells.

We certainly will have some wells in each nine-pack that are drilled offsetting a previous pad, which is going to result in, in some level parent child sort of relationships between those wells. Our objective with regard to those wells is to minimize for the greatest to be possible to time that occurs between the first pad and the second pad.

The faster we can get back and drill that second pad, the less depletion we have in the first pad, to less sort of parent child, you know negative relationship you have between the two pads. So, those are the, the you know the blue wells and again the [ph] extensive interference are those – extensive degradation is really a function of how quickly we get back, you know the orange wells in this, in this diagram, as you rightly point out, are wells that we expect will experience some interference from the actual offsetting completion. But as we’ve seen with the majority of our wells throughout the basin and now we’ve got over a year above or about a year I guess at this point of experience with this you know and we’ve repeatedly seen these walls come back to the original curve and we put some examples of that in our sort of guiding stack.

You know each wells are a little bit different, each well comes back at sort of a different pace, but by and large what we have seen is a return you know from a frac hit back to something and approaches original curve and in some instances, we’ve actually seen wells come back at better rates than original sort of a constructive interference if you will. So, yeah you described it accurately and yeah this is, this is a lot of what drove our decision to shift from you know where we were to originally sort of constructive interference if you will. So yeah, you describe it accurately and yeah this is a – this is a lot of what drove our decision to shift from you know where we were to originally sort of thinking about individuals to be we lost X to now being fully committed to this nine well pad you know program.

Q: I also had some questions on slide 14. And it sounds like the optimal plan like you said as to get back in as quickly as possible to limit the sort of degradation of well set forth. So, it seems to me that for step 3, it would be better to have the interference later because the well had those wells will have come off more. But I guess it’s more than offset by maybe the potential type curves degradation set forth. So, just kind of with that understanding, was it clear to me whether the plan going forward should be to avoid existing producers or actually go, create – create a set go, create – I guess, create a set like you said drill five around one existing producing well to create a six-well set whether you should be doing that as quickly as possible?

REN:. Now that is a – it’s sort of a back to light for us that we will be drilling what we get beyond Sandlot, which is sort of a somewhat unique situation. You know, because of all the historical drilling we’ve done out here, yeah, we’re sort of in a situation where we will obviously be drilling next to producing wells. We’ll be drilling some next producing wells that have been online for years and some that are online for only a short period of time.

One of things we are going to experiment with is as we approach pads with existing wells on them. Do we go in and refrac those wells. In fact, if we go in with a – it would be more of a bullhead job than a large stage job, but do we go in and refrac those wells, re-pressure them. It got two beneficial effects, right, one you get toward the pressure benefits of – on the new frac – the offsetting fracs.

We also think there is an opportunity to maybe see some virgin reservoir and some incremental production from the oil producer by doing that and it’s something we need to test and other operators, I think, are experimenting with the same ideas, but it’s all sort of a fact of life as we shift to this infill development mode.

So we’ll drill sort of on bounded virgin rock where we can. We think we’re going to see some great results out of Sandlot as a result of that. But we’ve also got some well thought-out plans for how we deal with large – other portions of the acreage block where we have drilled historic wells.

Q: Could you talk a little bit about the other kind of conservative components of your guidance? What where else there could be some upside or maybe where is the greatest risk to your guidance exists?

REN: Yeah. I mean – yeah again certainly we believe as I said the biggest upsize in the plan are around timing. And our ability to accelerate timing you know that’s both on the completion side as well as join side. The more completion assets we can bring to bear on the plan, you know occasionally using two and three different completion crews again the faster we can accelerate – again the faster we can accelerate the cycle time of the program with the positive facts we just talked about. You know certainly we try to be conservative looking at all of the sort of things that we know can go bump in the night, bad weather, you know equipment issues that Bob just sort of illustrated. And you know the – we but we baked in a significant amount of that, the less of that that we actually see come to there, that are the less outages we have, a fewer sort of issues we have around gas takeaway, all are net positives and that upsides the program. It hasn’t come out yet, but I think an important point to note on, on sort of the gas takeaway issue is, we feel this right now dedicated to ETC, we move all of our volumes to do energy transfer and for transmission and processing.

Caprock, our Midstream partner out there will take over the processing come January of 2019. But in advance of that, they’ve already constructed their connecter line from their plant and take those up to our field. So as we sit here today, we’ve got two separate exits out of the field for gas, so in previous years where I had ETC seeing an issue with highline pressures or downstream problems at their plant, our real recourse was to go to flare on gas while we continue to produce the oil.

We’ll now find ourselves in a situation where we’ve got an alternate tap out of the field that should ETC experience problems, we’ve got the ability to pivot our gas to Caprock, continue to produce and sell gas as opposed to flare again and obviously continue to produce the oil, flip back ETC on their back. Our expectation is that as we move forward into 2019 that, that relationship really reverses where Caprock becomes our primary takeaway, but we maintained all three takeaway capacity, ETC, should Caprock have any issues we can pivot.

So again, we’re proactively addressing all the things that we know can go bump and they are trying to create contingencies, trying to create alternatives, so that we can maximize produce and sell volumes over the course of the year.