Resolute Energy announces mid-point 2017 production expectations of 9.5 MMBOE

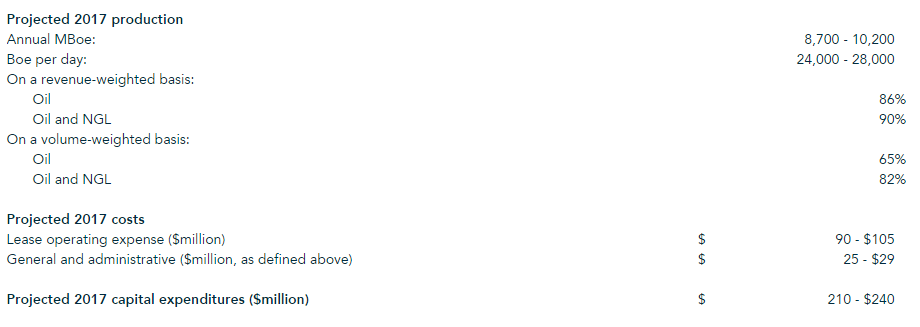

Resolute Energy Corp. (ticker: REN) announced its 2017 capital expenditure budget today along with production guidance for next year. Resolute plans to spend $210-$240 million in order to run a two-rig drilling program in the Delaware Basin targeting 22 gross (20.8 net) wells, all of which will be mid- or long-length laterals targeting the Wolfcamp, the company said in its press release.

“We have had very strong cash margins and rapid paybacks in our 2016 horizontal Wolfcamp drilling program, driven by superior early-time well performance, and we are excited about adding a second rig to our efforts,” said Resolute Chairman and CEO Nick Sutton. “The first rig is continuing to drill, and we expect the second rig to be in the field by mid-January.”

At the midpoint of the announced capex budget, 84% of capital spending will be focused on the Permian Basin, 9% on maintenance spending and development tests in Aneth Field, and the remainder will be spent on corporate level expenditures, including land and certain capitalized expense items, the company said.

The company expects to produce 8.7-10.2 MMBOE (82% oil and NGLs) over the course of 2017, an 85% increase year-over-year. REN anticipates that 2017 exit rates will reach 30 MBOEPD. In order to support the increased production, Resolute said it also plans to spend $7 million on field level facilities and $7 million for electrical infrastructure costs.

Resolute delevers even as it increases capex

Resolute expects 65% of the budget to be funded internally, with the balance being funded through borrowings under the REN’s credit facility. The company currently has $101 million available on its revolver, and $2 million due in 2017 on a term loan, according to information from Bloomberg.

“Comparing anticipated 2017 production to the high end of 2016 guidance, we expect to see production growth of more than 85 percent, and the associated increase in cash flow and resulting organic delevering will allow us to substantially strengthen our balance sheet,” said Sutton.

“Based upon our two rig drilling program and assuming commodity pricing [NYMEX 2017 average oil price of $55.00 per barrel, and an average Henry Hub gas price of $3.25 per MMBtu], we anticipate our leverage ratio of total debt to trailing twelve month Adjusted EBITDA will improve to approximately 3.2 times by year end 2017. These higher levels of lower cost production will also have a significant positive impact on our cost metrics, and we expect that both lease operating expense and overhead measured per BOE of production will decline significantly through the year.”

Company hedges

As of December 2016 approximately 6,300 barrels per day of oil is hedged in 2017. Of this total, approximately 1,500 barrels per day are covered by swaps with an average strike price of $51.10 per barrel, 3,700 barrels per day are covered by two-way collars with a weighted average floor price of $46.80 and a weighted average ceiling price of $57.63 per barrel, and 1,100 barrels per day are covered by a three-way collar with a short put price of $40.00, a floor price of $50.00, and a ceiling price of $60.10 per barrel.

Approximately 11,600 MMBtu of gas production is hedged in 2017. Of this total, approximately 2,000 MMBtu per day are covered by swaps with an average strike of $2.81 per MMBtu, 8,100 MMBtu per day are covered by two-way collars with a weighted average floor price of $2.57 and a weighted average ceiling price of $3.43 per MMBtu, and 1,500 MMBtu per day are covered by three-way collars with a weighted average short put price of $2.69, a weighted average floor price of $3.19 and a weighted average ceiling price of $3.75 per MMBtu. Approximately 300 barrels a day of NGL are subject to swaps with a weighted average strike price of $19.53 per barrel.

Resolute offers 3.8 million common shares

Following the company’s announcement of its 2017 capex budget, Resolute Energy announced that the company will offer 3.8 million of its common stock in an underwritten public offering. REN plans to use the net proceeds from the offering to repay the company’s second lien secured term loan, with any additional proceeds to be used to partially repay outstanding debt under its credit revolver, the company said in a press release Monday.

Resolute will grant the underwriters of the offering an option to purchase an additional 570,000 shares of common stock.