Resolute Energy (ticker: REN) announced Q3 today.

Resolute Energy Q3 financial highlights

- Closed the sale of Aneth Field assets to Elk Petroleum for up to $195 million

- Net loss available to common shareholders was $14.6 million or ($0.71) per diluted share

- Adjusted EBITDA (non-GAAP) was $42.9 million

- With the closing of the Aneth Field transaction, Resolute’s board has approved an expansion of its 2017 Permian Basin capital program, maintaining current level of drilling activity in the Basin through year-end

Resolute Energy Corporation CEO Rick Betz said, “With the sale of our Aneth Field EOR property we have now completed a multi-year strategic plan to transform Resolute into a Delaware Basin pure play company.”

Capital investment for Q3 was $97.2 million, excluding acquisitions, divestitures and capitalized interest, of which approximately 50 percent was funded through internally generated cash flow (including the earn out payments). Permian investment for the quarter accounted for 93 percent of total capital activity. Included in Permian capital were $69.5 million of drilling and completions expenditures and $20.7 million spent on facilities and infrastructure.

Operational highlights

Production was 28.6 MBoe per day, up 78 percent over the prior year quarter. This includes 22.6 MBoe per day from Resolute’s Permian Basin properties and 5.9 MBoe per day from Aneth Field. Weather related stress on field infrastructure and personnel reduced production by approximately 400 Boe per day over the quarter.

Resolute expects that the effect of the mid-period sale of Aneth Field will reduce Q4 production by 4,000 Boe per day. This is partially offset by contribution from the Delaware Basin assets acquired in the Bronco acquisition in Q2, as well as capital activity across the Reeves County asset base. Combining these factors, Q4 production is anticipated to be between 26,000 and 27,000 Boe per day.

Resolute is currently running two rigs in the Delaware Basin with a dedicated frac spread from its primary completions vendor. During Q3, Resolute spud seven gross horizontal wells, consisting of three long laterals and four mid-length laterals. There were three Wolfcamp A wells, one Wolfcamp B well, and three Wolfcamp C wells.

Eight wells were completed during the quarter, including four Wolfcamp B wells. Seven wells were turned to production. Additionally, two new wells were drilled. The South Elephant C207SL is Resolute’s first Wolfcamp C well. The South Elephant B307SL is Resolute’s first Lower Wolfcamp B well. Both wells are currently flowing back.

The Uinta L04HR established a new company record peak 24-hour rate of 3,470 barrels of BOEPD with 7,510 completed lateral feet. The Long Yuengling U04H established a new company record for spud to TD time of fourteen days.

Resolute has completed the 22 wells originally contemplated in its 2017 plan. Under an extended plan, Resolute will spud an incremental five wells and complete one incremental well beyond the original program. This should result in carrying eight drilled but uncompleted wells into Q1 2018. Resolute expects that these wells will be completed in early 2018. The total capital required to execute the extended capital plan will be approximately $19 million.

Resolute is currently completing the planning process necessary to potentially add a third rig in early 2018.

Conference call Q&A

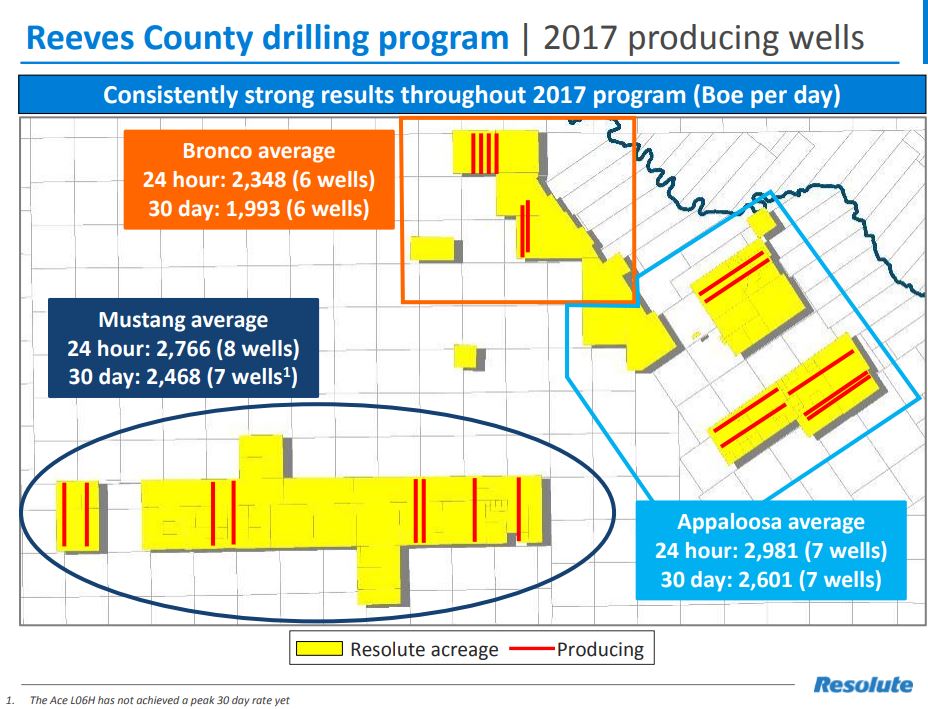

Q: When I look at the new well results, I noticed a couple of Bronco wells, despite having shorter laterals, seem to be producing in line with the 7,500-foot type curve. Any commentary there?

CEO Betz: Yeah. I’d love to sit here and say we did something specific to one of these wells that we could tightly tie cause and effect to. We’ve done some modification to our proppant loading, but in a fairly tight band. And honestly, we’ve tended to more skew back toward our traditional 1,800 to 2,000 pounds per lateral foot of proppant. So I’m not going to necessarily point to something dramatically different on the proppant loading side. We’ve done a few wells with this modified perf clusters design. I don’t recall if Uinta was one of them. But it’s early days to sort of say that. Again, that design is much more intended to address things like frac interference and – or frac hits and well interference than it is to an expectation of it significantly changing type curves.

So, I mean, part of this is just sort of a natural variation we see within the field, the different benches as we go through the progression. On Bronco, yeah, I think we’ve said consistently, we’ve been very impressed with the initial well production profiles up there. What certainly looks to be above type curve performances from a hydrocarbon production perspective, we’re also producing a tremendous amount of water up there.

So, certainly, we’ve got a system up there talking to the geos here, they do think it’s a little bit more fractured up that way and it’s something we’re acquiring some seismic to make sure we understand better. But that certainly could be contributing to both the above type curve production performance, but also the amount of water that we’re seeing, that we’re dealing with up there.

Q: A question on the Delaware Basin and the operations timeline. If you look back at the scorecard of that operations timeline, how have you met in terms of turning wells online versus that timeline?

CEO Betz: We’re continuing to see strong well drilling and completion efficiencies in the field. We’re lowering spud to TD times. We haven’t seen slippage in our stage count per day on our completion side. So now we’ve worked with the same two primary vendors out there, Nomac on the drilling side and Cudd on the completion side, going back to the fall of 2015. And they continue to do a phenomenal job for us in terms of efficiency.

Actually, if you look at our pace through our drilling program, we’re actually meaningfully ahead of schedule. In the first quarter, we talked about some delays we saw in February-March, but ever since that period, one of the things that we do on a monthly basis here is look at the pie charts about where are we seeing deviations in terms of production expectations. And delays have actually turned into a net positive, as opposed to a negative over the course of the year.

Now, as you think about production performance relative to expectations – again, I think we said this at the end of the second quarter, we do recognize we’re going to be at the low end of our original guidance, but still sort of within the original guidance on our legacy assets with some contribution from Bronco and then, obviously, the reduction from selling Aneth. But the biggest driver, honestly, has been the sort of continued effects we’ve seen from well interference, from frac hits.

Again, that type of stuff is – as we continue to drill wells, which you need to do, which are in close proximity to existing wells or depleted zones, until you sort of get going on this pad programming and get away from those initial zones, we continue to see that impact.

As we look at the numbers, Q3 impact from that type of event was probably still in that 1,200-barrel-a-day range. Now – and again, that should decline over time, but it’s going to take some time to see that go away. The wells continue to be very strong producers ahead of the type curve.

We continue to operate at a pace that’s in advance of our initial expectations. But really, with regard to legacy wells, wells that have been online for a year to two years, we do continue to fight the quarter-to-quarter impacts of well interference and frac hits.

Q: Can you discuss how you’re approaching your arrangements with Cudd on the completion side for 2018?

CEO Betz: I think there certainly could be periods during the program where you see six – theoretically, I guess, six wells in progress per rig. But realistically, a rig is going to drill those three wells, get off, and we should have that completion crew on location pretty quickly after that rig moves off. So, again, if you want to sort of talk about that rig moving to the next three well pads, and those first three wells being in some stage of the completion cycle, then I guess you could sort of get to that six wells in process. But that’s a short part of the cycle. Again, those wells should get completed inside 30 days of sort of – maybe it’s 40 days of the rig moving off.

Our conversations with Cudd, one of the great things about having a close relationship with those guys is that we provide them a lot of visibility on our program.

Our technical team, our completions team, and the Cudd guys are working hand-in-hand to line out Cudd’s ability to deliver against the completion schedule we’ve got laid out in the program. We’ll continue to move forward with the dedicated frac spread. We were talking to Cudd about the ability to supplement that from time to time with a second sort of floating frac spread, such that we’ve got a pretty good line of sight on how many stages we can get done a month.

So when we put this schedule out in its full form, we’ll be very confident that we’ve lined this out with the vendors ahead of time to make sure we can deliver against the schedule. And again, it will sort of – the wells in process will sort of flex in and out as you pick a specific day in the calendar. But typically, again, we think we can get a three-well pad drilled sort of in that 70 days in Appaloosa, let’s call it 70, 75 days in Appaloosa. A few days – a few weeks anyway to get rigs off, get completion crews in, and then 30 days to actually affect the completion. So that’s the cadence we’re talking about. And again, we’ll give more granularity on exactly how that lays out as we put out the 2018 formal guidance.