No oil and gas companies were in attendance for Major League Baseball’s winter meetings (baseball’s equivalent of Christmas with its free agent signings, discussions, swaps and trades), but two industry giants independently agreed to a swap of their own on December 11, 2015.

Norway’s Statoil (ticker: STO) and Spain’s Repsol (ticker: REPYY) will trade acreage positions in a non-cash, straightforward exchange. Much of the swaps on Repsol’s side stem from its $13 billion acquisition of Talisman Energy last year. Repsol’s global footprint spanned more than 50 countries upon completion. The Madrid-based E&P now plans on divesting $7.1 billion as part of its 2016-20 strategy, with a focus on increasing value and efficiency in a depressed commodity environment. The company gains 500 million euros in positive free cash flow in the 2015-17 period resulting from the latest transactions.

According to releases by both companies, Repsol and Statoil swapped various interests and positions in operations worldwide, including areas offshore Brazil (BM-C-33 license) and the UK/Norway (Alfa Sentral license), along with onshore operations in the US’ Eagle Ford Shale and Norway’s Gudrun field. A simpler comparison is listed below.

Before |

UK/Norway Offshore License |

Brazil Offshore License |

Eagle Ford Shale |

Gudrun Field |

| Repsol | 31%* | 35%^ | 50/50 joint venture | 0% |

| Statoil | 24%* | 35% | 51%, primary operator | |

After |

UK/Norway Offshore License |

Brazil Offshore Lease |

Eagle Ford Shale |

Gudrun Field |

| Repsol | 0%*, $20 million | 35%^ | 37% | 15% |

| Statoil | 55%*, operates nearby block | 35%, primary operator* | 63%, sole operator | 36%, primary operator |

^Per joint venture with Sinopec

*Pending government or partner approval

Acquisition Overview: Eagle Ford Shale

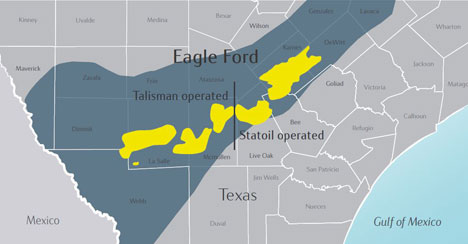

Arguably the flagship piece of the deal, Statoil will assume operatorship of the 118,000 net acres held by the joint venture. The play yielded 34.5 MBOEPD in 2014 with Statoil operating the assets. Statoil’s other existing assets onshore United States lie in the Marcellus and Bakken shales, and success in the Appalachia initially encouraged STO to jump into South Texas. In early 2015, STO management said it had improved Eagle Ford drilling efficiency by 70% in the past few years.

Repsol, on the other hand, was trying to work down its interest in the region. “We have a negative free cash flow now in Eagle Ford, and we are trying to reduce this situation by reducing the investment level in a huge way in Eagle Ford,” said Josu Jon Imaz San Miguel, Chief Executive Officer of Repsol, in an October 2015 business update conference call. “Producing more barrels per day is not our priority. The priority is to readdress and to balance the cash flow of the company.”

Repsol, on the other hand, was trying to work down its interest in the region. “We have a negative free cash flow now in Eagle Ford, and we are trying to reduce this situation by reducing the investment level in a huge way in Eagle Ford,” said Josu Jon Imaz San Miguel, Chief Executive Officer of Repsol, in an October 2015 business update conference call. “Producing more barrels per day is not our priority. The priority is to readdress and to balance the cash flow of the company.”

Miguel Martinez San Martin, Repsol’s Chief Financial Officer, also touched on the Eagle Ford in the company’s Q3’15 conference call. “To have two operators in the same asset doesn’t make much sense… We should reach agreements with Statoil in order to really improve the area.”

Statoil’s Prominence in Offshore

“Offshore” is a word that generates uneasiness in the current environment, but Statoil’s calling card has been bolstering its offshore positions on a global scale. Today, its offshore operations in addition to Norway and Brazil include a presence in Angola, Canada’s eastern seaboard, the Gulf of Mexico and Tanzania. Carbon value chains and offshore wind farms have also been recognized as possible opportunities, particularly in the Scandinavian region – the location of 15 different STO-led discoveries in 2014.

Approximately 67% of all proved reserves (about 2.8 billion BOE) in Norway are related to large offshore gas fields, such as the previously mentioned Gudrun Field. STO commenced operations in the field in April 2014 and delivered first production on January 2015. Total hydrocarbons in place are estimated at 184 MMBOE.

Approximately 67% of all proved reserves (about 2.8 billion BOE) in Norway are related to large offshore gas fields, such as the previously mentioned Gudrun Field. STO commenced operations in the field in April 2014 and delivered first production on January 2015. Total hydrocarbons in place are estimated at 184 MMBOE.

Operations on BM-C-33 block in Brazil’s Campos Basin are still in the appraisal stages, and Repsol management said a final decision was likely still “at least” two years away. San Miguel said divesting any non-operated Brazil assets were not a priority, but did say exploration was shelved at the moment due to the development of other projects. Statoil clarified the appraisal program was ongoing, but total estimated resources in the block are listed at 700 MMBO and 3 Tcf.

Brazil accounted for less than 5% of Statoil’s revenue in 2014, while Norway, on the other hand, provided about 44%. As of Q4’14, STO operated 167 different licenses throughout the North and Norwegian Seas.