Looming mergers and acquisitions is a popular debate in the sub-$60 oil market, and Spain’s Repsol (ticker: REPYY) made the first splash with the US$13.0 billion acquisition of Talisman Energy (ticker: TLM) on December 16, 2014. The deal includes $8.3 billion in shares, acquired entirely through cash, and the assumption of TLM’s debt of $4.7 billion. The deal includes a $270 million termination fee payable to TLM if the transaction is not completed.

Repsol Chairman Antonio Brufau said: “This is a transformative and exciting deal which will make us one of the world’s most significant players and which will allow us to grow as a company and reinforce Repsol as a solid and competitive integrated player.”

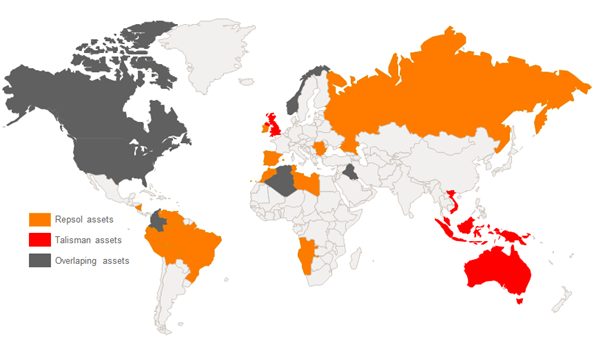

In a conference call following the release, management mentioned TLM’s assets provide Repsol with more exposure to OECD countries, and “employs our capital in areas with less risk,” said Josu Jon Imaz, Chief Executive Officer of Repsol. “Additionally, the combined portfolio will add new unconventional operations in the U.S. and when integrated will [deliver] a complimentary range of expertise that is key to improving competitiveness.”

Company Breakdown

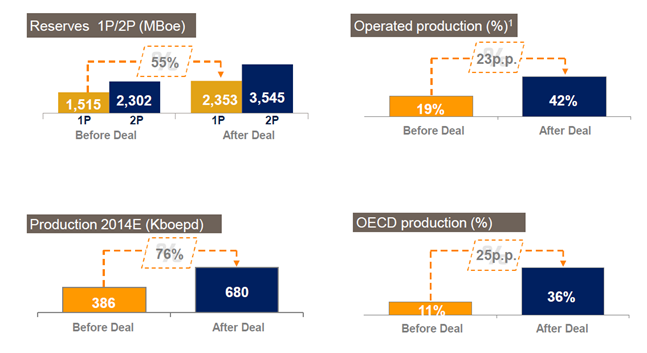

Repsol: Headquartered in Madrid, REPYY had operations in more than thirty countries prior to the acquisition. Its production of approximately 386 MBOEPD and a refining system with processing capacity of 998 MBOEPD made it a market leader in Spain. The company previously released a 2016 Strategic Plan, listing its intent to grow its upstream segment to 500 MBOEPD while boosting its downstream returns.

Talisman: Similar to its acquiring partner, TLM holds an international presence with operations in the Americas and Asia-Pacific. The company reported volume of 353 MBOEPD in its Q3’14 results, along with $679 million ($0.65 per share) in net income for the nine months ended September 30, 2014. The company divested $2.2 billion in non-core assets from Q1’13 to Q1’14 and announced the intent to divest another $2 billion in its 2014 guidance. The company confirmed it was engaged in transaction discussions with Repsol is two separate releases this month.

The New Repsol: Pro forma, Repsol’s production will increase by 76% to 680 MBOEPD, according to a company release. Reserves will increase by 55% to 2,353 billion BOE and operations will consist in more than 50 countries worldwide. Half of future capital expenditures will be focused on North America. Upon the completion of the transaction, Repsol will realize synergies of more than $200 million per year and expects the acquisition to close by mid-2015. Needless to say, many of the growth goals outlined in its 2016 Strategic Plan will be achieved. In a conference call following the release, management said financial benefits will be accretive moving past 2016.

A Win for Repsol?

Not assuming the $4.7 billion in debt, the $8.3 billion price tag for TLM breaks down to US$8 per share – a 24% premium over the average share price for the last three months. The two companies were engaged in merger discussions over the summer but talks reached an impasse as the groups “tried to reposition themselves,” according to The Wall Street Journal. At the time when talks stalled on August 26, TLM averaged a share price of $10.41 for the trailing three month period. The average share price trailing three months for the announcement of the deal on December 16 was $6.51, or 38% below the comparable price in August. The stock was trading below $4 prior to the announcement, the lowest since January 2003. Its share price on August 29 was nearly triple the price at the time of closing on December 15, 2014.

TLM held an enterprise value of $10 billion in EnerCom’s International E&P Weekly report for the period ended December 12, 2014, which is in line with the $13 billion price tag assuming the typical 30% premium. TLM’s previous divestures were aimed at paying down its debt, but the recent decline in commodity prices increased the company’s debt to market cap percentage to 94% in the latest E&P Weekly. The percentage is the third highest of the 24 Canadian companies listed in EnerCom’s Canadian equities list. When the companies were speaking in late August, TLM’s debt/market cap was 40% for the week ended August 29, 2014. Its enterprise value (defined as market cap plus debt, minority interest and preferred shares, minus total cash and cash equivalents) declined by more than $5 billion in the four month period.

“One of the many reasons for the drop of Talisman was the financial stress and the leverage, but this financial situation is totally different in the Repsol balance sheet,” said Imaz in the call. “By adding these assets to the Repsol balance sheet, we are giving value to the Talisman assets.”

Repsol Well Positioned Financially

One of the subheads in a Repsol press release on November 6, 2014, said “Financial strength and debt at a record low.”

Repsol listed available liquidity of 10.4 billion euros (roughly US$13 billion) at the end of September, with debt of approximately 2 billion euros – 72% lower than the prior year. In May 2014, the company gained $5 billion with the sale of YPF to the country of Argentina. Repsol said total proceeds from the divesture amounted to $6.3 billion.

The two billion euros in debt, combined with the $13 billion acquisition price of Talisman, will place net debt at approximately $15 billion. “If we look at the net debt to EBITDA ratio, under two hydrocarbon price scenarios, in the best case the ratio would be 1.9 times in 2015, improving to 1.2 times in 2017,” said Miguel Martinez, Chief Financial Officer of Repsol. “In the asset case, we’d expect to be at 1.7 times in 2017. In this case, the resulting metrics are still safe and there are credit rating and balance strength criteria.”

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.