Razor Energy Corp. (ticker: RZE) recorded a positive Q4 2017 net income of $2.3 million, or $0.14 per share. For 2017, the company had a net loss of $3.7 million, or $(0.27) per share. The company produced 4,534 BOEPD in Q4, and had a full-year average production of 3,813 BOEPD.

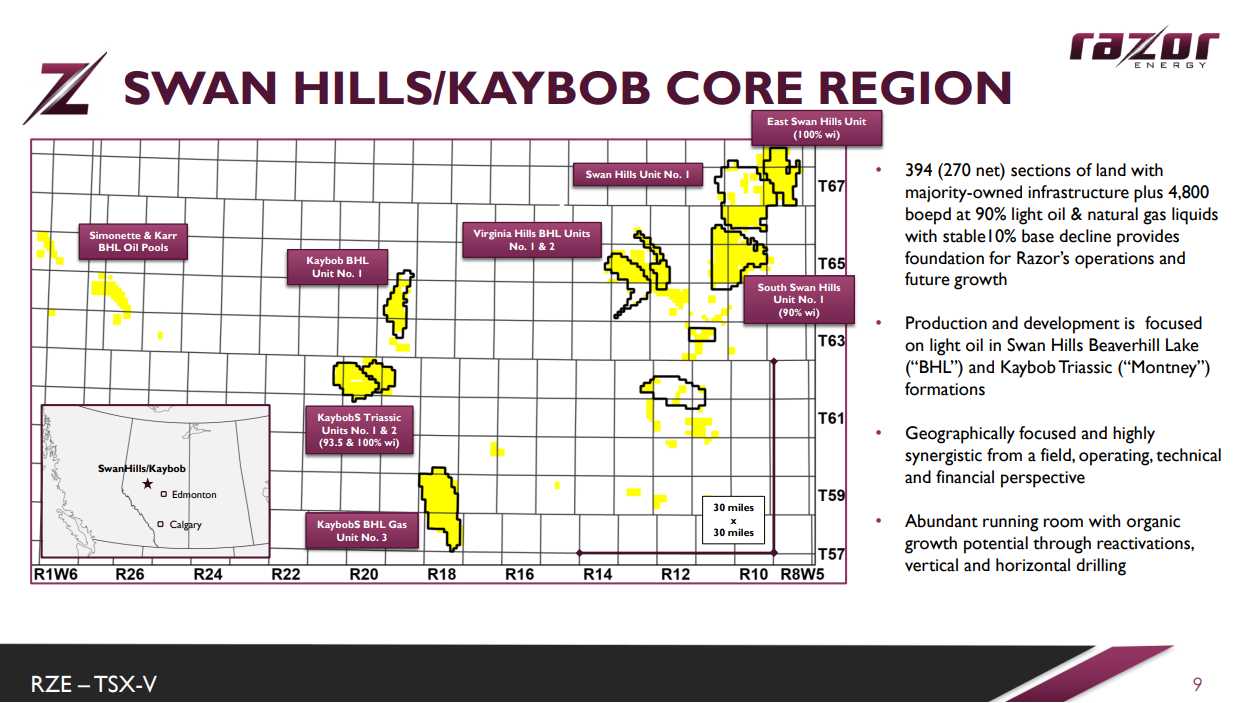

In 2017, the company completed three asset acquisitions in the Swan Hills and Kaybob areas for a total cash consideration $32.9 million.

Razor said its Kaybob South Triassic four well development program was recently completed. Aggregate production from the four well program was 2,705 barrels of fluid per day at 97.8% water-cut, resulting in 61 BOPD plus 148 Mcf/d, or 86 BOEPD.

CapEx

In 2017, Razor’s capital program of $9.9 million was invested on a combination of reactivations, re-entries, optimization activities, stimulations, pipelines, facilities and waterflood management.

The company reactivated 25 gross (18.9 net) wells during 2017, resulting in 880 BOEPD of additional production and exited the year with 15,072 MBOE of proved reserves and 20,326 MBOE of proved plus probable reserves. In Q4 2017, Razor reactivated 5 gross (3.7 net) wells, resulting in 225 BOEPD of net additional production.

For fiscal 2018, the Razor has approved a capital budget of $38.4 million, which includes end of life expenditures.