Sale expected to firm up Range Resource’s balance sheet

Range Resources (ticker: RRC) announced yesterday that it will sell its Southern Appalachian Nora assets for a purchase price of $876 million, according to a company press release. The Nora Field produces from multiple stacked pay horizons including coal bed methane, tight gas sand and Devonian shale. According to Range, the resource potential in-place at Nora is approximately 5-6 trillion cubic feet equivalent (Tcfe) of natural gas on approximately 465,000 net acres with approximately 3,500 operated wells.

Based on the company’s third quarter 2015 net production of about 109,000 Mcf/d and 465,000 net acres, the deal has an implied value of $8,036.70 per flowing Mcf/d and $1,883.87 per net acre. Considering Range’s current market valuation of $6,200 per flowing Mcfe/d represents a 30% premium. The sale price also implies about $1,900 per acre on an unadjusted basis, or $1,000 per acre for the raw undeveloped acreage after backing out $435MM of value attributed to the current production (assuming a valuation of $4K per flowing Mcf/d), a research note from Capital One reports.

In addition to the oil and gas assets included in the sale, Range also sold approximately 1,200 miles of pipeline and about 230 MMcf/d of gathering capacity as part of the deal. Assuming $7.7 million in annual midstream EBITDA, Raymond James believes the midstream assets were worth about $100 million of the total offering.

The purpose for the sale, according to the release from Range, is to help pay down debt, and firm up the company’s balance sheet. The Nora assets represent 7.5% of Range’s net production, and the proceeds will be used to reduce total debt by an expected 24%.

The reduction in debt will help to further strengthen Range’s metrics compared to its peers. In EnerCom’s E&P Weekly for the week ended October 30, 2015, Range has a 70% debt-to-market ratio compared to a median of 99% for the group of 88 E&Ps tracked. Combined with the company’s low asset intensity of 45%, compared to an 88% group median, and trailing twelve month (TTM) capital efficiency of 268%, compared to a group median of just 117% , Range appears to be well positioned to continue weathering the commodity down-cycle. Pro-forma the sale, Range’s FY15 net-debt-to-EBITDA should decline to about 2.8x from 3.7x, assuming the entire purchase price received for the Nora assets goes towards paying down debt.

Range’s Chairman, President and CEO Jeff Ventura commented, “While these are great assets operated by a talented team, bringing the value forward through a sale was the best decision for our shareholders.” Ventura went on to say that Range will continue to look for assets to sell as the company focuses on its core position in the Marcellus, Utica and Upper Devonian.

According to a company presentation from October, Range has $1.9 billion in liquidity under a $3 billion borrowing base. Range hopes to use that liquidity to support 2016 growth of 10%-20%.

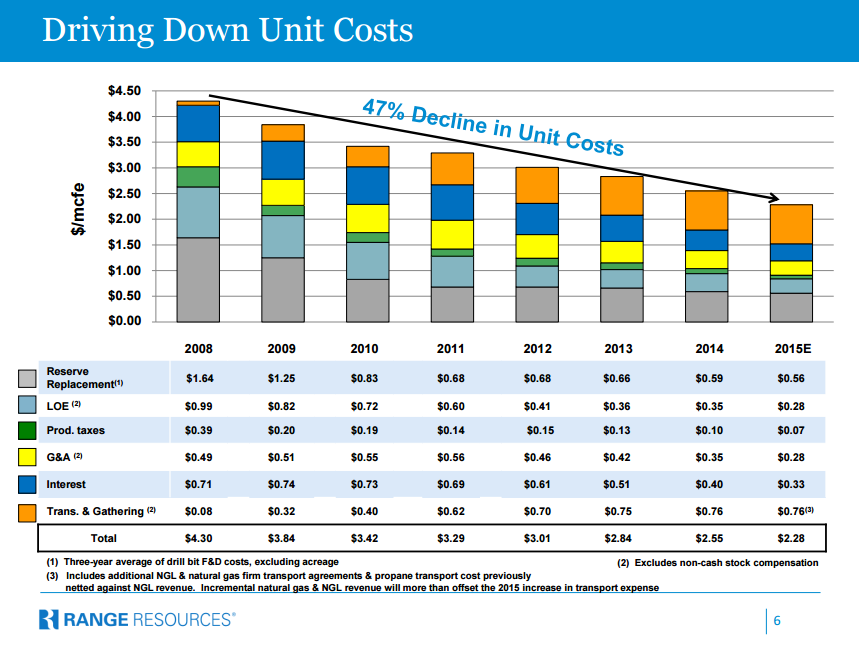

The benefits of the deal extend beyond Range’s ability to pay down its debt though, Kevin Smith with Raymond James points out. “First, we expect operating margins will improve as Range’s Marcellus production has lower operating costs. Additionally, we expect this transaction frees up more capital to invest in developing the Utica shale,” he wrote in an analyst note this morning.