EnerCom presenter focus: Range is presenting at EnerCom’s 22nd The Oil & Gas Conference August 13-17, 2018

When Marcellus gas giant Range Resources (ticker: RRC) announced it would acquire Memorial Resource Development in May of 2016, the deal was an attention getter in an industry beset by severe downturn doldrums. The Range-Memorial deal was an all-stock transaction valued at $4.4 billion that added a new dimension to the company that was credited with discovering the Marcellus shale.

The acquisition by Range of Memorial placed the Terryville natural gas asset in northern Louisiana into Range’s portfolio.

“We believe the returns in Terryville rival the Southern Marcellus,” Range CEO Jeff Ventura said at the time the acquisition was announced.

In its Q1 2017 conference call, Range Resources (ticker: RRC) outlined its intent to better define the Terryville assets.

Range’s Louisiana assets are situated in the Lower Cotton Valley and contain approximately 220,000 net acres of stacked potential pay, according to the Q1 2017 Range investor presentation.

Targeting Upper and Lower Red intervals

As of Q1, Range Resources has completed 27 wells in the Lower Cotton Valley formation, with a specific emphasis on the Upper and Lower Red intervals.

Range said that 21 of the 27 wells were drilled before Range acquired the field, and, according to Range COO Ray Walker in the Q1 earnings call, the wells were drilled with no input from Range. Range believes that the wells in place do not offer a decisive outlook on the producing potential of the field and the company said it intends to drill and complete 29 more wells before the end of the year.

Some of the new wells are undergoing final completion operations now.

Range, an E&P that has been heavily focused on the Appalachian basin and the Marcellus shale, said it wants to delineate its new asset and develop a greater understanding of the reservoir boundaries in the Terryville asset. Range will use the drilling 2017 program to optimize future production targets and completions designs.

Range has emphasized on lowering the average cost of drilling and completing from $8.7 million per well, prior to the acquisition, to $7.4 million per well going forward. Range expects the 15% reduction in well cost will offset an anticipated 5%-25% inflation in well servicing costs that it expects to occur in 2017.

Range has also looked to extension areas outside of the immediate Upper and Lower Red intervals, and has drilled two wells—one to the east and another to the west of the Vernon field. These wells have already produced approximately 1 Bcf each.

Positive Expectations for the Marcellus

Range has expressed confidence in future Marcellus-based operations, largely due to decreases in operating costs and differentials.

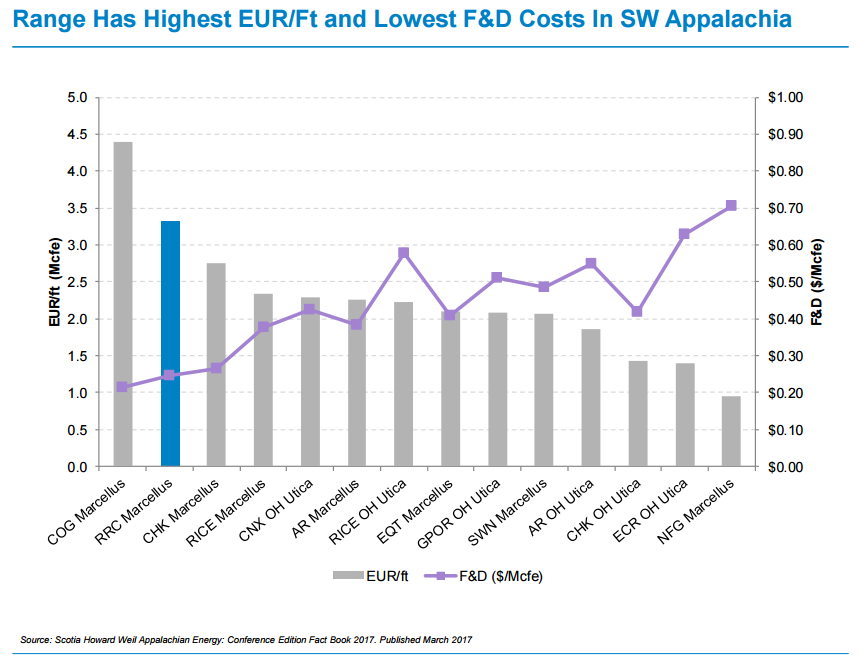

Among its peers in the Marcellus, Range reports the highest EUR/ft. value at 3.35 Mcfe/ft. and the lowest F&D cost at $0.23/Mcfe.

According to its investor presentation, Range’s confidence in future Marcellus operations was further bolstered by expected improvements in multiple differentials, including in the local natural gas differential, moving from $0.45 in 2016 to $0.30 in 2017. The NGL value as a percentage of WTI is also expected to improve from 26% in 2016 to 28-30% in 2017. Condensate differentials are also expected to improve in the coming year to $5.00-6.00/Mcfe from $9.13/Mcfe in 2016.

In addition to the positive expectations for future differentials, the company has reported the lowest breakeven cost among operators in Southwest Appalachia at $2.43/Mcfe.

Range presenting at 2017 EnerCom conference

Range Resources will be the lead-off presenting company at the upcoming EnerCom conference in Denver, Colorado—The Oil & Gas Conference® 22.

The conference is EnerCom’s 22nd Denver-based oil and gas focused investor conference, bringing together publicly traded E&Ps and oilfield service and technology companies with institutional investors. The conference will be at the Denver Downtown Westin Hotel, August 13-17, 2017. To register for The Oil & Gas Conference® 22 please visit the conference website.