EnerCom conference presenter QEP adds 730 potential Hz drilling locations in the new acreage

QEP Resources (ticker: QEP) followed its southwestern Wyoming Pinedale anticline divestiture with an acquisition of more acreage in the Permian.

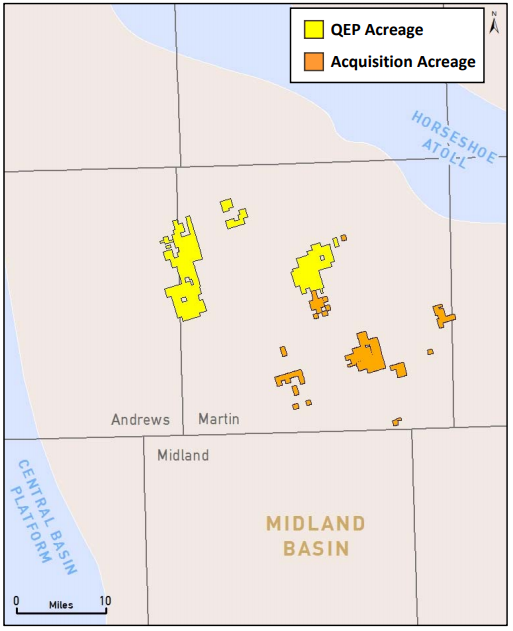

QEP said its subsidiary company, QEP Energy Company, had purchased 13,800 net acres in Martin County, Texas, for a sum of $732 million. The new purchase includes an inventory of over 730 potential horizontal drilling locations within four horizons—all of which are de-risked.

The company reported that over 60% of the identified drilling locations are candidates for laterals of 10,000 feet or longer. The acreage itself is currently producing out of the Wolfcamp formation, with net production of approximately 635 BOEPD. QEP believes that the acreage represents 44 MMBOE of net proved reserves and potentially 295 MMBOE of net recoverable resource.

After the acquisition, QEP will hold approximately 43,000 net acres in the northern core Permian and approximately 1,900 potential horizontal drilling locations within that acreage.

Funded with cash from the Pinedale sale

QEP is using the acquisition as a means to increase its focus on oil-production. Cash from the Pinedale anticline asset divestiture—which totals approximately $777.5 million—will be used to finance the Permian acquisition.

QEP Resources is presenting at EnerCom’s The Oil & Gas Conference® 22

QEP will be a presenting company at the upcoming EnerCom conference in Denver, Colorado—The Oil & Gas Conference® 22.

The conference is EnerCom’s 22nd Denver-based oil and gas focused investor conference, bringing together publicly traded E&Ps and oilfield service and technology companies with institutional investors. The conference will be at the Denver Downtown Westin Hotel, August 13-17, 2017. To register for The Oil & Gas Conference® 22 please visit the conference website.