Pinedale divestiture and Permian Basin acquisition accelerate transition of QEP to a crude-oil company, successful Haynesville refracs push production up 60% – without a drilling rig

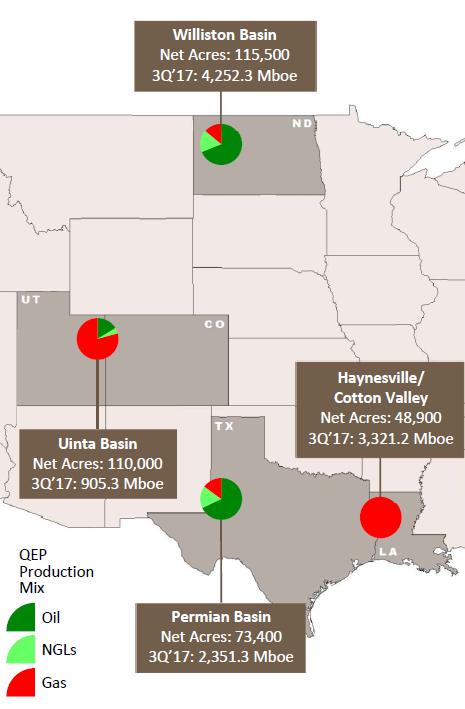

The third quarter was good for QEP Resources (ticker: QEP). QEP closed its acquisition of 13,000 net acres in Martin County, Texas for $683.5 million and it completed the sale of its Pinedale Anticline assets for $718.2 million. These transactions have transitioned the company into an oil-focused E&P.

- Increased net equivalent production in the Permian Basin to a record 25.6 MBOEPD, a 57% year-over-year increase

- Increased net equivalent production in the Haynesville/Cotton Valley to 216.6 MMcfe/day, a 63% year-over-year increase

- Completed four Williston Basin refracs with a nearly six fold increase in average 30-day incremental oil production

- Completed the sale of Pinedale Anticline assets for net proceeds of $718.2 million (Pinedale Divestiture) on September 20, 2017

- Closed 2017 Permian Basin Acquisition for approximately $683.5 million on October 24, 2017

Higher production values, capital expenditure

In QEP’s earnings conference call today, Executive VP and CFO Richard J. Doleshek said that production in Q3 was 14.1 MMboe, 263,000 BOEs higher than the 13.9 MMboe QEP reported in Q2 2017. Permian Basin oil volumes were up about 243,000 barrels to 1.7 million barrels, which is up 17% from the Q2 2017, and up 71% from Q3 2016.

NGL production was 19.9 Bcfe, up 19% from the Q2 2017, and up 65% from Q3 2016. NGL volumes were 1.5 million barrels, which is up about 12% from Q2 2017. The midpoint for oil production is 19.75 million barrels. The midpoint for gas production is 167.5 Bcf, and the midpoint for NGL production is 5.5 million barrels.

Permian and Williston CapEx

Capital expenditure for the Permian Basin was $191.5 million, which included $26.7 million for mid-stream infrastructure. Capital expenditure in the Williston Basin was about $67 million, and the capital expenditure in the Haynesville was about $49 million.

Doleshek said that there was $54.5 million worth of acquisitions in Q3 2017; $36.6 million was part of a deposit. He also said that QEP’s 2017 capital expenditure guidance remained unchanged.

Q3 Operations

- Nine rigs drilling oil and gas wells on QEP assets

- Six in the Permian Basin

- One in the Williston Basin

- One in Pinedale

- One in Haynesville as of mid-Sept.

- One rig in the Permian Basin drilled water disposal wells

- Haynesville and Williston Basin properties had refrac programs running

Chairman, President, and CEO Chuck Stanley said during the Q3 conference call that Permian net production volumes averaged a record 25,600 BOEPD, 88% of which were liquids. Stanley also said, “QEP completed in terms of sales ten new wells during Q3. At the quarter’s end, all of these wells were still cleaning up and had not hit peak rate.”

During Q2, 22 completed wells in the Midland Basin were turned to sales. However, QEP is still in the early phases of flowback at the end of the quarter. There are 16 County Line wells and 6 Mustang Springs wells.

Early in Q3, the 16 wells on County Line achieved an average 24-hour IP rate of 1,151 BOE, and an average peak IP 30 of 935 BOEPD, with an average lateral length of 6,327 feet, while the six Mustang Spring wells, completed late in Q2, achieved an average IP 24 of 1,238 BOEPD, and an average peak IP 30 of 779 BOEPD, with an average lateral length of 7,087 feet.

QEP said that early Mustang Springs well performance was impacted because of shifting from a two tank to single tank development design. In addition to changing the sequence of drilling and completion, the shift also caused some unscheduled downtime.

Refracturing programs

Influenced by the successful refrac program in Haynesville, QEP plans to restimulate Williston South Antelope, and Fort Berthold wells. Prior to restimulation, four wells averaged 112 BOEPD per well, after restimulation the average peak 30 day uplift was 627 BOEPD per well.

QEP ran and cemented a string of casing inside the existing sliding sleeve chasing string, then operators did a traditional plug and perf restimulation with over 30 stages. An average proppant concentration of approximately 1,000 pounds per lateral foot was used in the refract, the company said.

QEP Resources conference call Q&A

Q: What kind of outspend do you envision in 2018?

QEP: We’re trying to manage our outspend to around $100 million EBITDA, minus capital expenditure.

Q: In regard to the Williston acreage, can you talk more about the refrac program, and whether or not you can apply this at South Antelope?

QEP Resources CEO Chuck Stanley: The four wells we did this year on the Fort Berthold Reservation were very encouraging. Our initial focus has been on going after the generation one, completions which were stimulated with roughly 300 pounds per lateral foot of proppant. In those first four wells we saw over a six fold increase in production from pre-refrac levels.

We’re currently drilling out and beginning flowback on our first five South Antelope wells. Those refracs are also targeting generation one completions. We have one well with a couple of days of production performance; it IP’d at over 1,800 BOEPD. It’s been on a grand total of two days, but it looks pretty strong, so let’s see how the other four look, but obviously we’re quite excited about the early performance of the South Antelope wells. We’ve got five in progress right now in South Antelope and another four over on the Fort Berthold Reservation that we plan to get done before year-end and get online.

Q: I’ll follow-up with a question about the Permian. The tank style completions are moving from two buckets to one bucket, could you explain that a little bit? Are you effectively going to just complete them all at once together? Is that how it’s going to work?

CEO Stanley: That’s a great, simple summary. We’ve simply turned the tank on its side, so that we’re working on all four target horizons simultaneously. You’ll recall that two conference calls ago we talked about some of the issues that we had encountered early on in our development, where we saw fractures from frac jobs going on in the Wolfcamp, travel all the way and hit drilling wells in the Sprayberry, which caused us to rethink the design and architecture of the tank style completions. So by doing all four at the same time we are basically energizing the entire section with frac energy, which we think ultimately results in higher stimulated rock volume, more complex fractures, and we would hope, better recovery of oil in place over the entire interval.

Q: Can you talk about what you’re seeing as far as the cost side, and maybe the potential payback period on the refracs, given the success you’ve had in Haynesville?

QEP: So these wells – the refracs cost between $4 million and $5 million. The load is on South Antelope, it costs a little more on the Reservation just because of logistics, $4.5 million average, $4.5 million per well average. These refracs from early stage – at least the first four that we did, look like mid-30’s after tax returns, so payout is within a couple of years. The ones that we’re doing right now on Antelope, if the first well is any harbinger of performance, would be even better than that, so give us a couple more days of production performance before we pound the table. But obviously, as I said, we’re very excited about the very early time performance, and we’re in the middle of South Antelope with this five well refrac program, and the wells are flowing – the first well is flowing, which is a good sign as well.

Q: It’s kind of been a high single-digit quarterly production decline in North Dakota. Should we assume the intensity of this activity that you would expect to kind of pull out of that decline here in 4Q? I’m just trying to think about QEP heading into winter, so operations are going to be a little bit challenged there, but how should we think about the Bakken – I know you can’t give full year guidance, but how about the projection trajectory over the next couple of quarters?

CEO Stanley: Let’s see how these refracs perform. We had forecasted them to be similar to the uptick that we saw from the Fort Berthold wells, so we just need more time before we can really give more granular outlook for the performance of the Williston asset. Just keep in mind, we’re running one rig there, and one rig in and of itself will not keep production flat. We’re still going to see decline, so we’re hoping that the refrac program will help bolster that ongoing drilling activity and further reduce the decline, if not, hopefully, eliminate it.

Q: I just wanted to talk a little bit about operations on the Permian side. As you look at your 30-day rates and kind of what’s happening in the Spraberry and Wolfcamp, kind of natural flow rates, and artificial lift is one of the things that we’ve been watching. Can you talk a little bit about how you think about, first, your outcomes on their assets, and kind of what the transition is on how you’re operating your Permian assets?

CEO Stanley: The results that we’re seeing on Mustang Springs have been a little surprising to us. We expected the Wolfcamps to flow for a while. The Spraberrys on the other hand are flowing initially as well, and obviously they’re making abundant water early on. And we really think this is a reflection of the frac energy we’re putting on the ground. We’re obviously supercharging the interval around the wells, and it’s causing a couple of things.

As I mentioned in my prepared remarks, the wells are flowing naturally. Our initial artificial lift design was to utilize electric submersible pumps, or ESPs. We can’t run those in the wells while they’re flowing naturally. So we have to let the wells basically decline down to a point where we can enter them and run the ESP to bottom without causing severe problems with the power cords that run to those pumps, which can get tangled up and create a bird’s nest in the wellbore if the well is live and trying to flow while you’re running the pump in.

As a result, we’re rethinking our lift. A lot of operators are successfully utilizing gas lift in these wells, which would allow us to set the well up initially when it first starts producing for artificial lift, which will allow us to help the well from day one rather than having to go through this basically two-step process of letting the well decline down, the supercharge energy come off, and then running an electric submersible pump.

And as I commented in my prepared remarks, I’d caution folks not to read too much into the very early performance, because we’re basically going through this two-step process. I think 180-day, 365-day cumulative rates will be at or above our expected type curves. And we’re still forecasting these wells, on average, across all four zones to be 100 barrels or 110 barrels per lateral foot of EUR.