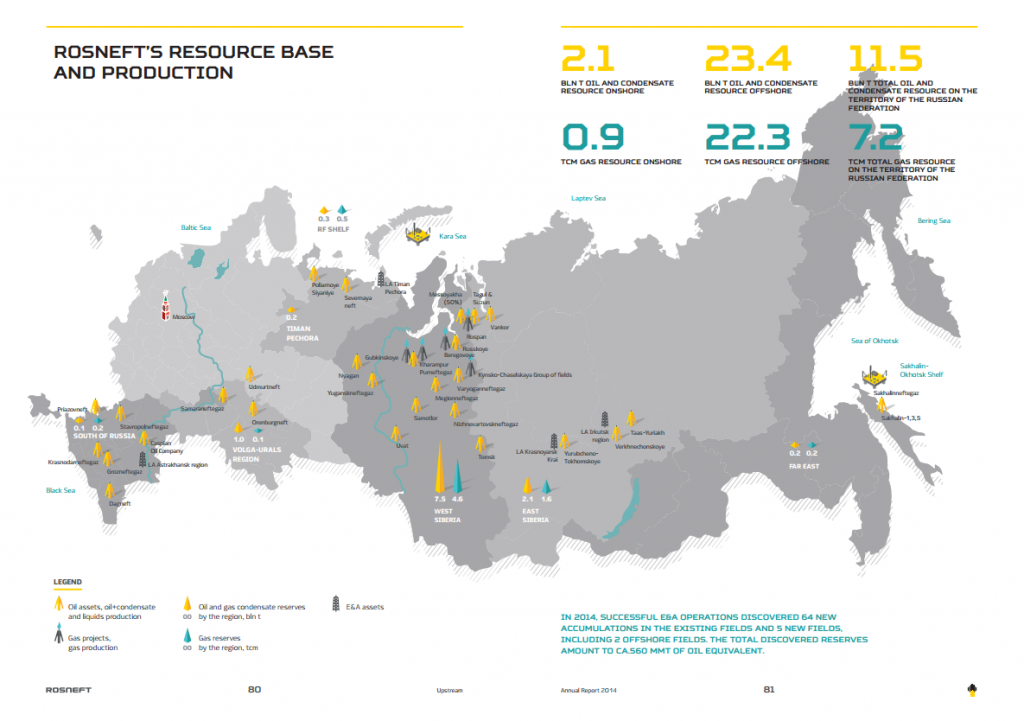

Chunk of Rosneft could bring Moscow as much as $11 billion

Russia still plans on selling a 19.5% stake in its oil giant Rosneft (ticker: RNFTF) to help ease its financial deficit, and it could happen within the next 90 days, if the company can find “appropriate strategic investors,” said Russian President Vladimir Putin.

“The Russian government has no need to hold such large stakes and we are committed to carrying out our plans,” Putin said in an interview with Bloomberg. “The question isn’t whether we want to or not, the question is whether it makes sense or not and at what moment?”

The stake sale could generate as much as $11 billion, based on its current market value. That money could be used to help support the government as it wrestles with a balance sheet weakened by lower oil prices.

Russia has been trying to privatize many of its state-owned companies as it looks for ways to bring in more capital. The sale of Rosneft, the country’s most valuable company, would go much further than the sale of a 10.9% stake in diamond miner Alrosa, which netted the government roughly $793 million.

The government cannot afford to be too picky about who buys the stake in the oil giant either, Putin said.

“In the end, the important thing for the budget is who gives the most money,” he said. “In this sense we can’t discriminate against market participants, not a single one of them.”