Permian-concentrated oilfield service provider ProPetro Holding Corp. (ticker: PUMP) had a net income of $12.6 million, or $0.16 per share for 2017. In Q4 2017 the company had a net income of $10.1 million, or $0.12 per share. The company reported total revenues of $981.9 million for 2017 and total revenues of $313.7 million for Q4 2017.

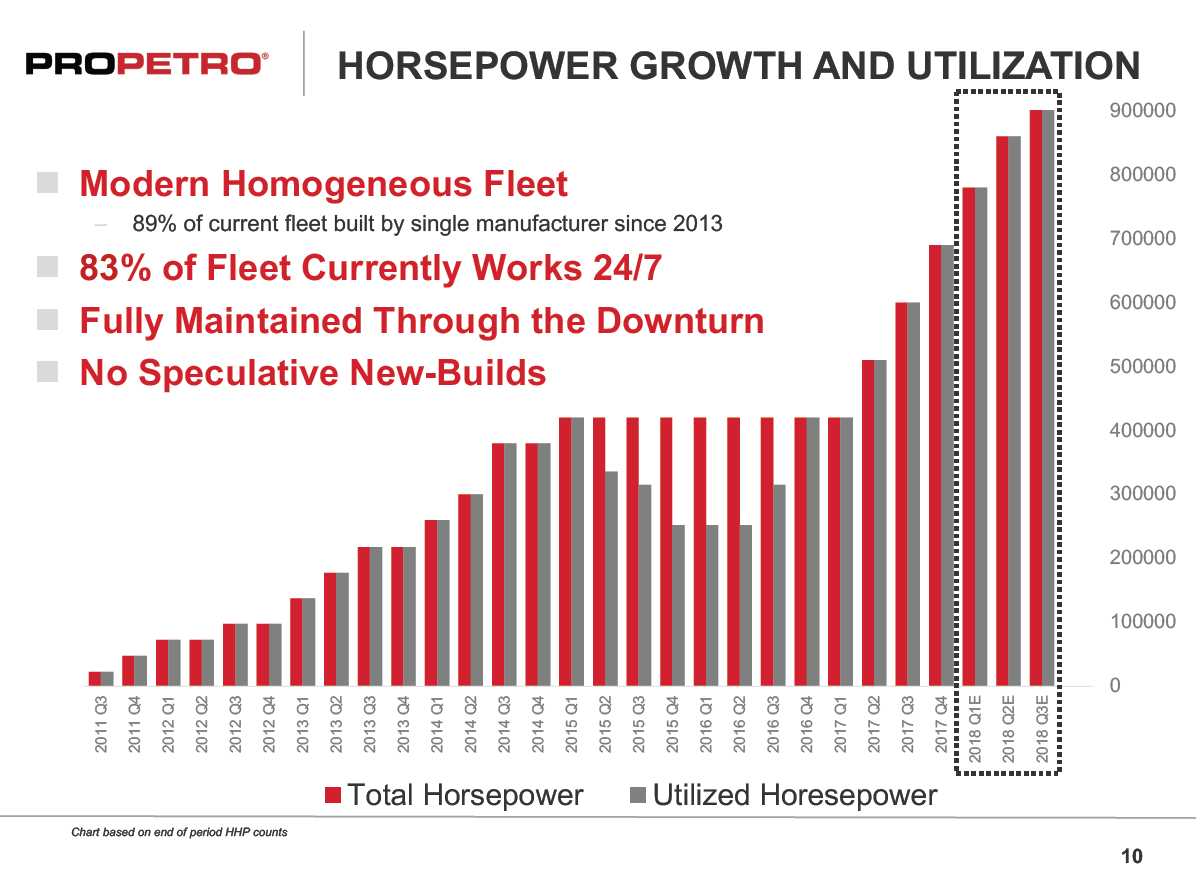

Yearend capacity grew 64% to 690,000 HHP, or 16 fleets – this is up from 420,000 HHP, or ten fleets, at the end of 2016. ProPetro said it had 100% fleet utilization throughout the year. The company has also expanded into the Delaware Basin.

Fleet expansion almost a million horses strong

An additional 90,000 HHP, or two fleets, recently commenced operations under multi-year dedicated agreements in January and February 2018, bringing active horsepower to 780,000, or 18 fleets.

According to ProPetro, demand has grown for the company’s pressure pumping services to the point where the company plans to further expand its fracturing capacity by an additional 90,000 HHP, or two fleets – this is in addition to the January and February fleets mentioned above.

Fleets 19 and 20 are expected to be deployed in the second and third quarter of 2018, respectively. Both fleets will be deployed to new customers and are supported by multi-year dedicated agreements, ProPetro said.

In the second quarter of 2018, the company also plans to enhance its legacy fleet by an incremental 35,000 HHP, which will bring average pressure pumping capacity to 45,000 HHP per fleet. The combination of the two new build fleets and enhancement of existing fleet capabilities will bring total capacity to 905,000 HHP, or 20 fleets, by the end of the third quarter of 2018.

Additionally, the company recently deployed one new build coiled tubing unit and one new build cementing unit, both of which will operate under long-term dedicated agreements. This brings total coiled tubing capacity to three units and total cementing capacity to 16 units.

ProPetro said it plans to further expand its cementing unit fleet capacity with two additional new build units, with operations to commence later this year.

CapEx

ProPetro invested $305.3 million in capital expenditures in 2017, which was inclusive of seven new build frac fleets, 68 additional Tier 2 diesel engines, a small amount of growth in ancillary services and maintenance capital expenditures.

Conference call Q&A excerpts

Q: If we look at the growth plan you’ve laid out to get to 20 fleets deployed this year, how much gross CapEx should we assume falls in 2018 to accommodate that plan? And to the extent you’re able to provide any insight into how you think about the cash that you could harvest by the end of the year in terms of just navigating the balance between looking toward potential new fleets or delevering/shareholder returns?

CFO Jeffrey David Smith: With regards to 2018 CapEx, considering that the bulk of the cost of fleet 17 actually was accrued in December of 2017. Total growth CapEx, with what we’ve announced, is probably in the neighborhood of about $100 million.

Beyond that, I can tell you that with the cash flow that we’re generating, the plan is first of all to use operating cash flow to pay for that growth CapEx and to then also pay down debt throughout 2018. The projections we have right now would lead you to believe with what we’ve announced, that we will actually be debt-free once again by sometime in the first quarter of 2019.

So those are the two highest priorities. And as we go through the year, we will re-evaluate what we’re going to do beyond that point. All options are open and nothing is off the table for our consideration. But we will continue to evaluate the – or maintain our optionality as we go throughout the year in making that decision.

Q: Can you give us a sense of where zipper work as a percentage of stages was for 4Q and 1Q? And if you could, if you could give us an idea of what you think could be in the cards for 2018 as a whole?

CFO Smith: I can tell you that the progression has been steady from the second half of 2017 forward. In the third quarter, 60% of the stages we pumped were zipper. In the fourth quarter, it was 65%. And of course, we’re not complete for the Q1 yet but looking at numbers quarter-to-date, that number has escalated to 69%.

Q: Going forward from here, is it fair to expect that to stay at that 70% range, or do you think it could actually trend higher?

CFO Smith (continued): It could actually trend higher.

Q: If you were to order new fleets today, or to contemplate ordering new fleets today, what would the lead times be? And then what would the cost of that horsepower be, either just for an overall fleet or per unit of horsepower?

CFO Smith: Well, the most recent information that we’ve been provided would lead us to believe that lead time for these new fleets, which are Tier 4, would probably be in the neighborhood of seven to eight months.

And the cost of that would probably escalate – for a 45,000 horsepower fleet, it would be $34 million to $35 million. So I think that calculates out to about $766 per horsepower.