In the context of the total business sector, the global private equity industry raised a record $453 billion from investors in 2017, leaving it with more than $1 trillion to pour into companies and new business ventures, Reuters reported at the beginning of the year. The capital raised in 2017 surpassed the previous landmark of $414 billion set in 2007.

Private equity players have been stepping up the pace of investments in the energy sector since the recovery took hold last year.

In 2017 the industry was clawing its way out of a miserable two-and-one-half-year downturn during which IPOs and secondary public securities offerings were postponed or cancelled. And private equity was in position to take up the slack. Private equity funds are flush with cash.

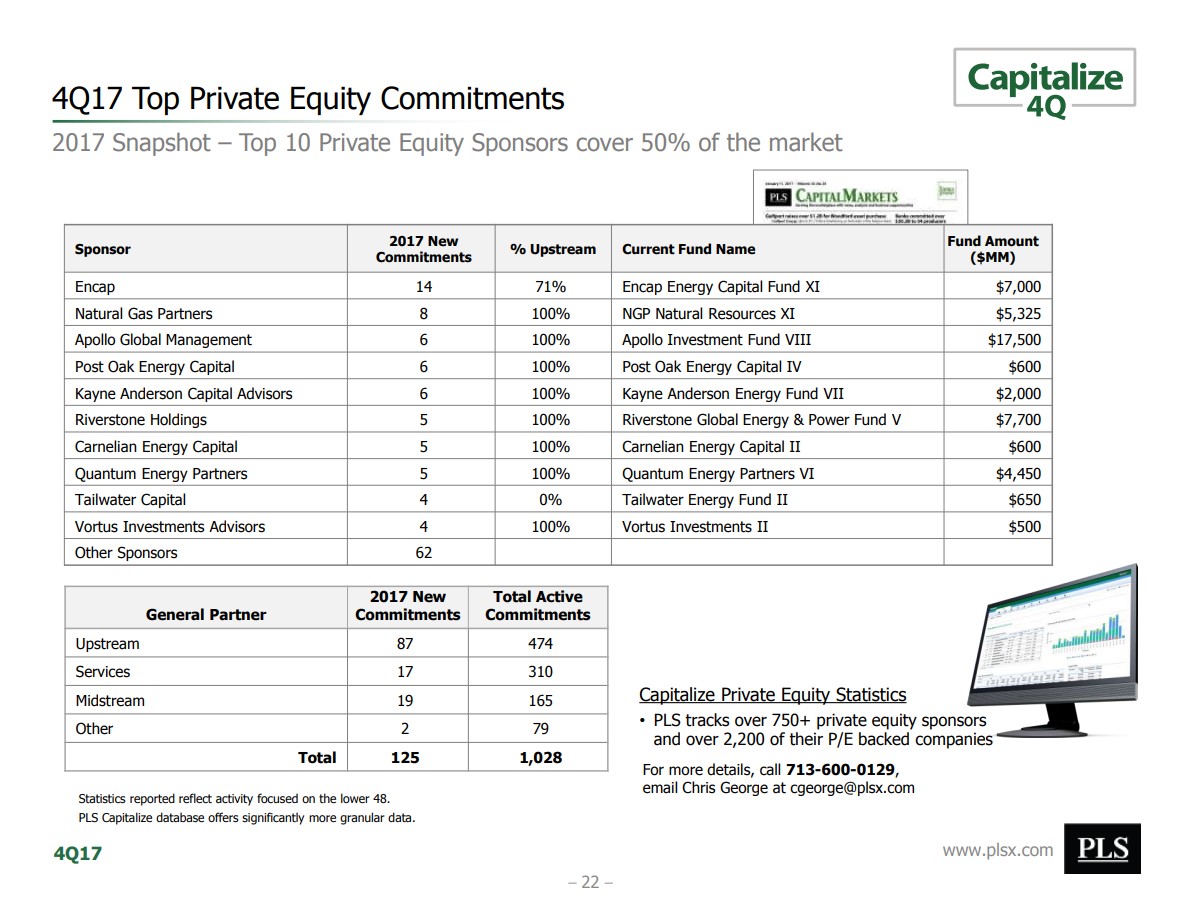

Private Equity sponsors issued 125 commitments in 2017, and the upstream sector was tied to 70% of them.

Out of 125 PE commitments tracked by PLS in 2017, upstream accounted for 87 commitments, oilfield services had 17 and midstream had 19. Private equity-backed companies were involved in 29% of all upstream M&A transactions in 2017.

Capping off $7 billion

EnCap had 14 new commitments in 2017, with 71% of $7 billion going to upstream.

When it exceeded its original target by December 4, 2017, EnCap closed Fund XI. According to EnCap, the firm realized at least five investments in 2017.

In 2015, American Resource Development LLC (Ameredev) received an equity commitment of $250 million. Two years later, EnCap realized its investment in Ameredev. This successful investment led to even more investing – EnCap followed up by committing another $400 million to the company’s second iteration (Ameredev II, LLC) in 2017. EnCap invested $250 million in Black Swan Oil & Gas, LLC in 2017.

Bold Energy III LLC was a portfolio company of EnCap until the company was sold to Earthstone Energy, Inc. (ticker: ESTE) in 2016. The transaction was organized in a manner commonly known as an “Up-C” structure, under the agreement and structure, Earthstone recapitalized its common stock into two classes – Class A and Class B, and all its existing outstanding common stock was converted into Class A common stock. EnCap said its investment in Bold Energy was realized in 2017.

Apollo Global Management’s Fund VIII closed in 2013, exceeding its cap of $17.5 billion.

Success breeds success, and 2017 was a good year for EnCap and Apollo alike. But Apollo topped the private equity leaderboard with its ninth fund at $24.6 billion. It was the largest private equity fund ever.

The previous record was held by Blackstone Group LP from 2005 to 2007 at a weighty $21.7 billion.

Apollo-Double Eagle Threepeat

Double Eagle Energy Holdings III secured equity commitments of more than $1 billion earlier in 2018. Coming back for round three, the commitments for Double Eagle III were anchored through funds managed by affiliates of Apollo.

The first Double Eagle Energy was formed with Apollo in 2013, when the partnership focused on the Anadarko and Ardmore Basin. This company sold most of its assets to American Energy at the end of 2014. Immediately after this transaction, Double Eagle Energy II was formed.

Double Eagle II was then bought by Parsley Energy (ticker: PE) in 2017. At the time, this deal made Parsley the second-largest publicly traded E&P in the Midland Basin.

Closing out 2017

In Late 2017, ATX Energy Partners secured a $780 million commitment from Warburg Pincus, Yorktown Partners and Pine Brook. CEO Gene Shepherd leads the privately held oil and gas company. The team is composed of former management of Brigham Resources, LLC.

Brigham Resources sold its Delaware Basin assets to Diamondback Energy in February 2017 for $2.6 billion, and before Brigham Resources, there was Brigham Exploration, which was sold to Statoil ASA in 2011 for $4.4 billion.

It’s a new year

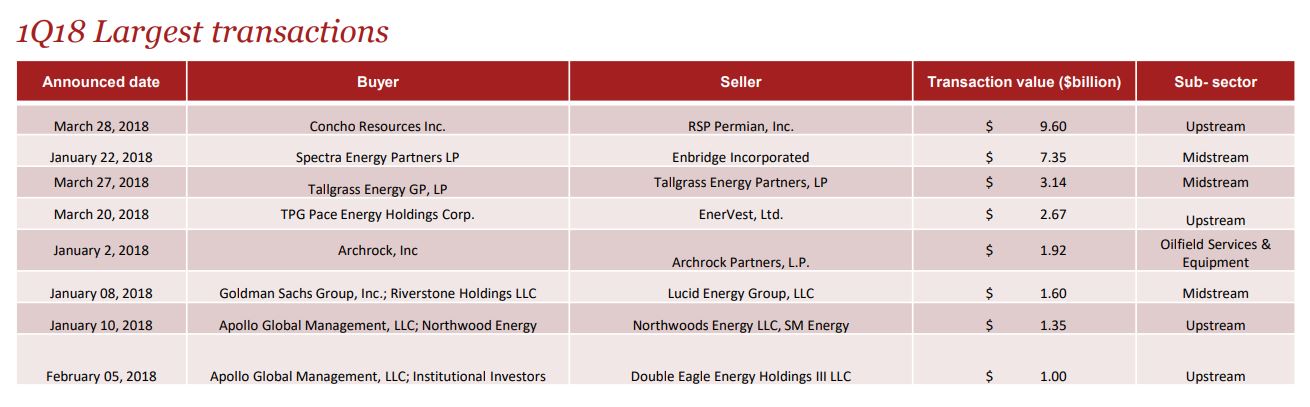

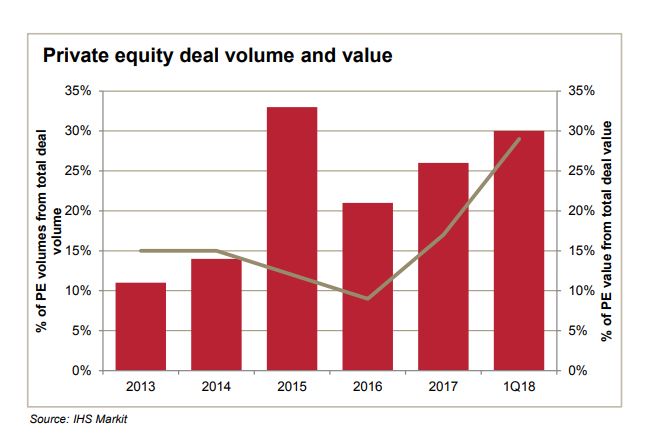

PwC recapped oil and gas-focused private equity deal value in the first quarter of 2018 in a new report.

Private equity generated nearly a third of deal value and volume in Q1 of 2018. Equity commitments hit record highs, generating 10 deals worth $4.14 billion, PwC reported. There were seven deals worth $2.34 billion in the fourth quarter of 2017, and six deals worth only $1.63 billion in the first quarter of 2017.

“The majority of these equity commitments were in the upstream space, which remains an attractive choice for investors who have an abundance of dry powder. Exploration and production technology advancements and a sustained rebound in commodity prices are making this segment very attractive to financial investors,” PwC reported.

Launching their own PE fund

Looking at the success of private equity in 2017, a coalition of sovereign funds pooled resources to launch their own private equity group called Capital Constellation. The financial coalition includes the Alaska Permanent Fund Corporation, the Public Institution for Social Security of Kuwait, RPMI Railpen and Wafra, a manager of private equity and alternative investments.

The group said that Constellation will provide catalytic investment capital to next generation private equity and alternatives managers and will be advised by Wafra. Combined, the founders will initially commit $700 million to the venture and Constellation is expected to deploy over $1.5 billion in the next five years.

For additional insight into oil and gas private equity deals, Oil & Gas 360® spoke to Justin T. Stolte, a corporate partner in the Houston office of Gibson, Dunn & Crutcher, and a member of the firm’s mergers and acquisitions, energy and infrastructure and oil and gas practice groups.

Stolte said he represents exploration and production companies, midstream companies, private equity clients and other financial institutions in complex transactions across the energy sector. His conversation with Oil & Gas 360® follows.

OIL & GAS 360: What upstream private equity deals have you worked on?

Stolte: I have worked on a number of them, representing portfolio companies and sponsors, and companies opposite of private equity, dating back to 2008, which is when we really saw private equity become active in oil and gas. From that point on, almost every oil and gas lawyer or M&A lawyer in Houston has either represented a private equity sponsor or portfolio company, or has been opposite them on a transaction.

OIL & GAS 360: What sparked that?

Stolte: The driver was the unconventional oil and gas resource boom in the United States, which resulted from technological advances in the industry.

A continued low-interest-rate environment has allowed private equity funds to raise a tremendous amount of capital. Their initial investments in the unconventional resource plays were very successful, and that success led to more funds being raised for oil and gas investments. The U.S. is now the world’s largest oil and gas producer, and private equity has played a significant factor in that.

Multi-billion-dollar acquisitions

When Concho Resources (ticker: COG) announced its merger with RSP Permian Inc. (ticker: RSPP), Stolte was part of Gibson Dunn’s legal team for Concho. Stolte took this deal on in addition to the TGP Pace Energy (ticker: TPGE) acquisition of EnverVest’s South Texas Division, where Gibson Dunn acted as legal counsel to EnerVest.

These two ten figure deals happened at the end of Q1. Only eight days separated the EnerVest acquisition from the Concho merger, which were publicly disclosed on March 20, 2018 and March 28, 2018, respectively.

More recently, Stolte represented ArcLight Capital in its $1.12 billion acquisition of Midcoast Operating from Enbridge.

OIL & GAS 360: How do you approach an oil and gas private equity deal?

Stolte: Well, it depends on who you are representing and in which role, whether it be on the seller or the buyer. Private equity has certain things that it can do and cannot do with its investments, and one has to be mindful of that. But, a deal is a deal, and many of the issues that we face in transactions arise irrespective of company type or role.

OIL & GAS 360: Why is private equity in the oil and gas industry increasing in popularity?

Stolte: When talking about private equity and unconventionals, I do not believe that people fully appreciate the transformation that the U.S. oil and gas industry has seen over the last 10 years.

When I was an engineer, not that long ago, most E&Ps were looking internationally to make investments.

Now their focus is in the United States. And it’s because we have so much resource here – whether it be oil or natural gas. We have a tremendous amount of resource that needs to be developed – and that requires a tremendous amount of capital. Private equity has helped satisfy the need for this capital.

OIL & GAS 360: From a private equity perspective, can you tell us what has changed before and after the oil price crash in 2014?

Justin T. Stolte: For anyone who is making an investment in the oil and gas sector, whether it be public investors or private investors, it leads to caution, and a laser focus on results and healthy financials.

This is not unique to the private equity world. Any oil and gas investor coming out of the prolonged downturn from ’14 to ’16 is cautious. Right now, with the recovery of oil prices, there is a cautious optimism, and a goal to avoid the pitfalls we saw during the crash.

OIL & GAS 360: Can you talk about midstream private equity?

Stolte: Midstream follows upstream, and the tremendous growth in the upstream space has resulted in a significant need of capital for infrastructure development, whether it be midstream, downstream or LNG.

There are a number of private equity firms that are infrastructure-based, so it has really created an opportunity for these firms. We are increasingly seeing private equity looking at opportunities in the midstream space, whether it be via acquisitions of existing systems or working with upstream companies or midstream companies in joint-venture arrangements where they build and own and operate systems—pipeline-gathering systems or transportation systems.

OIL & GAS 360: What brought you into the oil and gas industry?

Justin T. Stolte: During undergrad at Colorado School of Mines, I attended an introductory session for the petroleum engineering department and really fell in love with the industry – when looked at in its totality, the industry is pretty fascinating with elements of interest to almost everyone – namely, geologic, engineering, geopolitical, legal, regulatory and investment components. My experience in the industry has only reinforced its appeal.

OIL & GAS 360: And what made you want to get into law after you finished your petroleum engineering degree?

Stolte: I always wanted to be a lawyer, with the reasons changing over time. But, part of the reason I went to law school arose from an experience that I had with a transaction during the tail-end of my time as a petroleum engineer at Chevron – I really liked what the lawyers and the commercial leads were doing as part of that deal and a light bulb went on. I saw an opportunity to wed my desire to be a lawyer with my technical background, and I decided to attend law school and become an energy-transactional attorney. When I graduated from law school, Houston was the best location to do oil and gas M&A and it still is.