In its monthly Oil Market Report, the IEA reported slowing production and signs of increased demand in the future

Brent crude oil rose more than $2 to reach a high of $50.36 yesterday on news from the International Energy Agency (IEA) that there are signs of prices taking a turn up in the future. In its Oil Monthly Report (OMR), the IEA said, “How low the market’s floor will be is anybody’s guess. But the selloff is having an impact. A price recovery – barring any major disruption – may not be imminent, but signs are mounting that the tide will turn.”

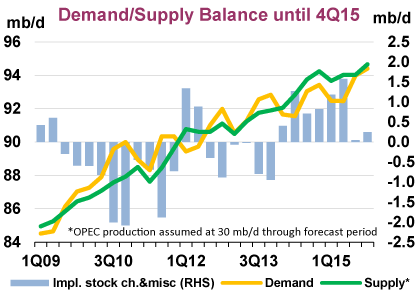

The message from the IEA that boosted prices was that low oil prices are starting to have an effect on production, lowering output around the globe. In the report, the agency said supply growth for 2015 is beginning to affect non-OPEC nations, with Canada and Colombia leading in declines. Growth for non-OPEC members in 2015 was downgraded from December’s OMR by 350 MBOPD and even more steeply for 2H’15. The report said cuts for U.S. light, tight oil production growth was only cut by 80 MBOPD from the previous month due to many producers being well hedged against short-term drops.

Signs of demand change have remained more elusive, however, according to the report. “With a few notable exceptions such as the U.S., lower prices do not appear to be stimulating demand just yet.” The IEA said this is due largely to weak underlying economic factors, but that demand growth was still expected to grow modestly in 2015. The report said that it did not expect demand growth to exceed 900 MBOPD, an unchanged estimate from the agency’s report in December.

OPEC output rose by 80 MBOPD in December to 30.48 MMBOPD with supplies from Iraq more than offsetting deeper losses in Libya. Iraqi supply surged to a 35-year high. Downward revisions to the non-OPEC supply outlook raise the ‘call’ on OPEC for 2H’15 to an average 29.8 MMBOPD.

The note from the IEA also mentioned that the OECD commercial inventories drew less than usual in November, falling by 8.7 MMBO to 2,697 MMBO. “As OECD refiners hiked runs, crude stocks drew while product stocks increased. Preliminary data indicate a 12.5 [MMBO] build in December, which would see stocks rise to their widest surplus versus the five-year average since August 2010.”

Despite indicators that supply and demand are headed towards a convergence, the IEA does not expect a return to the old status quo. “It is clear the market is undergoing a historic shift,” says the report. Even though the report indicates a turn for the better, the IEA still believes there is a “reckoning” in store for the industry.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.