Permian Operator Will Use Equity Proceeds to Pay Debt

While the oil and gas industry is battening down the hatches, issuing bailing buckets to all hands and looking for a solid toehold as forty-six dollar crude oil sloshes under and around it, North American shale player Diamondback Energy (ticker: FANG) is a point of light. The company zoomed to the market yesterday by announcing and pricing an equity offering.

Yesterday the Midland, Texas-based independent E&P announced it planed to sell 1.75 million shares in an underwritten public offering that would generate gross proceeds of $106 million. The company said it will use the net proceeds from the offering to repay a portion of the outstanding borrowings under its revolving credit facility. The offering is expected to close January 26, 2015, according to a company press release. Credit Suisse Securities (USA) LLC is acting as sole book-running manager for the offering.

Shoring up a balance sheet is generally viewed as a wise move in times of uncertainty, and Wunderlich Securities’ Houston analyst Jason Wangler applauded the Diamondback move, saying in a research note: “Frankly this is a rare opportunity in the E&P (if not energy in general) space, given oil’s decline and the tough environment that comes with it; but Diamondback has performed better than most, as it did on the way up, due to its strong asset base, solid balance sheet and impressive management/strategy. In these tough times it makes sense for investors to migrate toward quality names and we feel Diamondback is high on that list and as such we remain “Buy” rated and raise our price target [to $80 from $70] as we look for the company to show solid organic growth while also remaining acquisitive.”

If oil prices stay low in 2015, many analysts expect to see assets held by highly leveraged operators to go on the block later in the year, and Diamondback will be financially positioned to take action. In a telephone interview with Oil & Gas 360®, Wangler characterized the action by saying “Their stock has done better than most, there’s been a lot of demand for it and right now cash is king. They had a chance to take a little risk off the table and they did. I think they’re going to be a consolidator in the basin.”

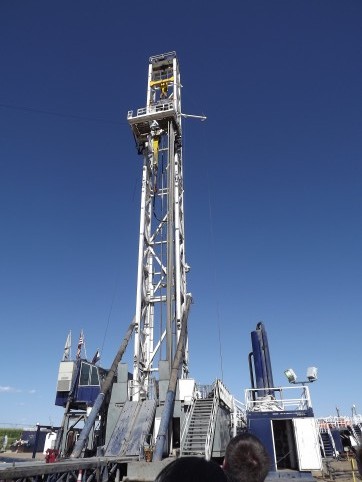

Diamondback’s activities are primarily focused on the horizontal exploitation of multiple intervals within the Wolfcamp, Spraberry, Clearfork and Cline formations in the Permian basin. Shares of Diamondback Energy closed today at $67.98.

Diamondback’s activities are primarily focused on the horizontal exploitation of multiple intervals within the Wolfcamp, Spraberry, Clearfork and Cline formations in the Permian basin. Shares of Diamondback Energy closed today at $67.98.

Wangler told Oil & Gas 360® he believed a handful of other companies are in a similar position “in terms of dry powder”: Gulfport Energy (ticker: GPOR), Matador Resources (ticker: MTDR), Memorial Resource Development (ticker: MRD) and Synergy Resources (ticker: SYRG).

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.