Forecasts cashflow of approximately $3.2 billion at current strip prices for the remainder of 2018 – $66 per barrel for oil and $2.80 per Mcf for natural gas

Running 20 Permian Hz rigs

Pioneer Natural Resources Company (ticker: PXD) reported Q1 2018 net income of $178 million, or $1.04 per diluted share.

Companywide production was 312 MBOEPD in the quarter, but freezing temperatures in early January caused production losses of ~6MBOEPD and a compressor station fire in the West Panhandle field also decreased production by ~2 MBOEPD. WPX said that West Panhandle production resumed in early April at ~8 MBOEPD.

President and CEO Timothy L. Dove said, “Our transition to a Permian Basin ‘pure play’ is progressing according to plan… When the divestiture of these non-Permian assets is complete, the company will report stronger cash operating margins and corporate returns due to an increase in revenue per BOE and a decrease in operating cost per BOE.”

Permian well completion upgrades slated

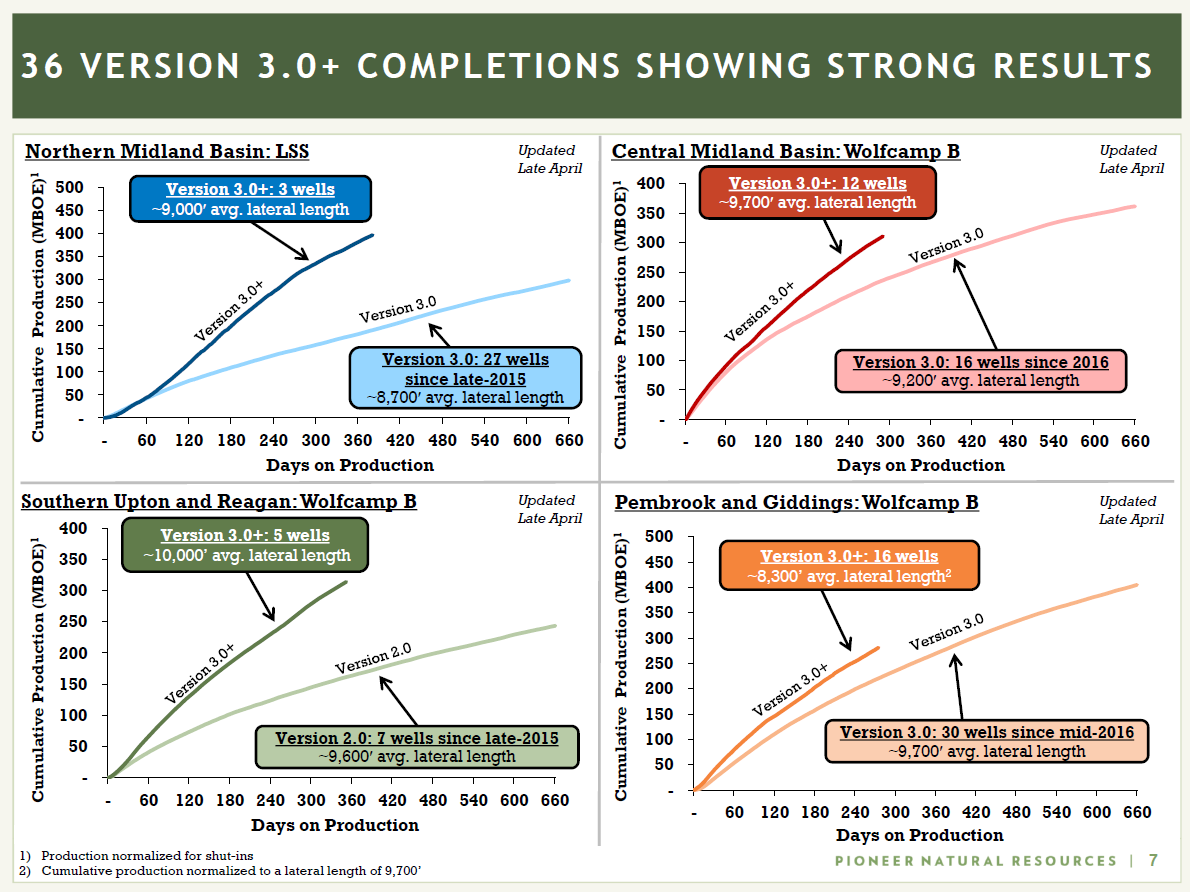

Pioneer said it placed 47 Version 3.0 wells on production during the first quarter of 2018.

The company also said it placed 16 wells on production during the first quarter of 2018 that utilized higher intensity completions (compared to Version 3.0 wells) – these are referred to as “Version 3.0+” completions.

Results from the 20 Version 3.0+ wells completed in 2017 and early production results from the 16 Version 3.0+ wells that were placed on production in the first quarter of 2018 significantly outperformed production from nearby offset wells with less intense completions.

The company originally planned to test approximately 45 Version 3.0+ completions during the first half of 2018, with the remaining wells for 2018 expected to be predominantly Version 3.0 completions. However, based on the success of the higher intensity completions to date, the company is evaluating adding more Version 3.0+ completions in the second half of 2018.

Rigs, capital

Pioneer is operating 20 horizontal rigs in the Permian and the company expects to place 250 to 275 wells on production during 2018. Pioneer said it is currently evaluating the timing of rig additions later in 2018 to support the 2019 plan.

The company is funding 2018 capital spending from a forecasted cashflow of approximately $3.2 billion at current strip prices for the remainder of 2018 ($66 per barrel for oil and $2.80 per Mcf for gas).

The 2018 capital budget of $2.9 billion is expected to increase due to additional Version 3.0+ completions, late-year rig additions and inflation.

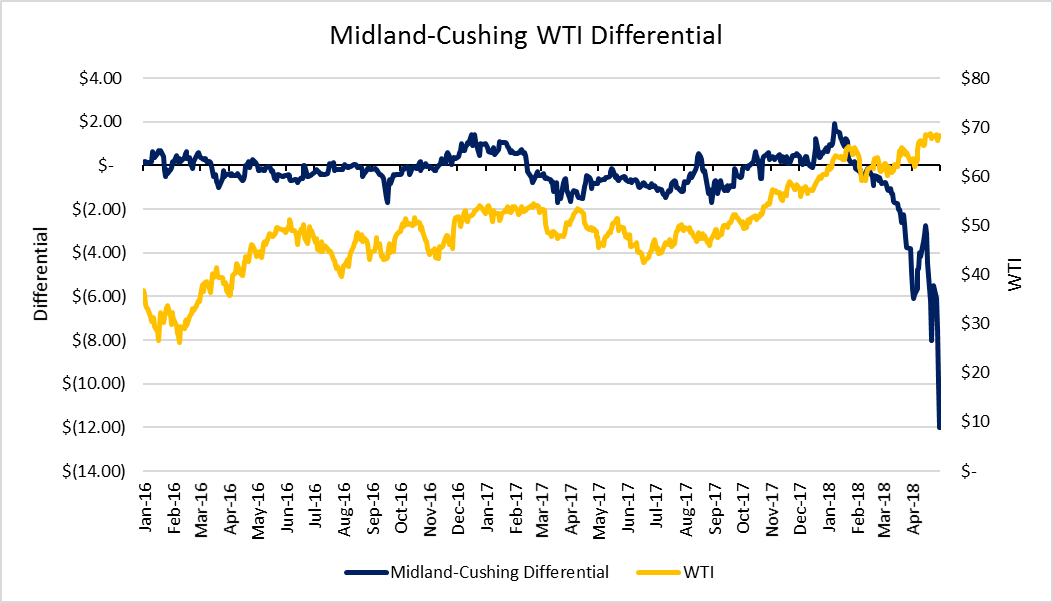

Getting premium pricing: pipeline commitments insulate Pioneer from widening Midland-Cushing differentials

Firm pipeline commitments will allow Pioneer to deliver ~160 MBOPD, or 95% of current Permian Basin net oil production, to Gulf Coast refineries and export markets. In Q1, the company delivered 160 MBOPD to the Gulf Coast, of which 87 MBOPD was exported.

The firm pipeline contracts insulate Pioneer from the recent widening of the Midland-Cushing oil price basis differential by providing exposure to Brent-related pricing.

According to Pioneer, as a result of this premium pricing, Gulf Coast refinery and export sales added $16 million of incremental cash flow in the first quarter of 2018.

Gas takeaway secured

Approximately 75% of Pioneer’s Midland Basin gas production is transported under firm pipeline transportation agreements to southern California. The remainder is primarily sold under term contracts at Waha.

Additional firm pipeline transportation has been secured on Kinder Morgan’s Gulf Coast Express pipeline, which is anticipated to be on line late in the third quarter of 2019. Firm transportation on the Gulf Coast Express pipeline will provide access to LNG exports, refineries, petrochemical facilities and Mexican markets.

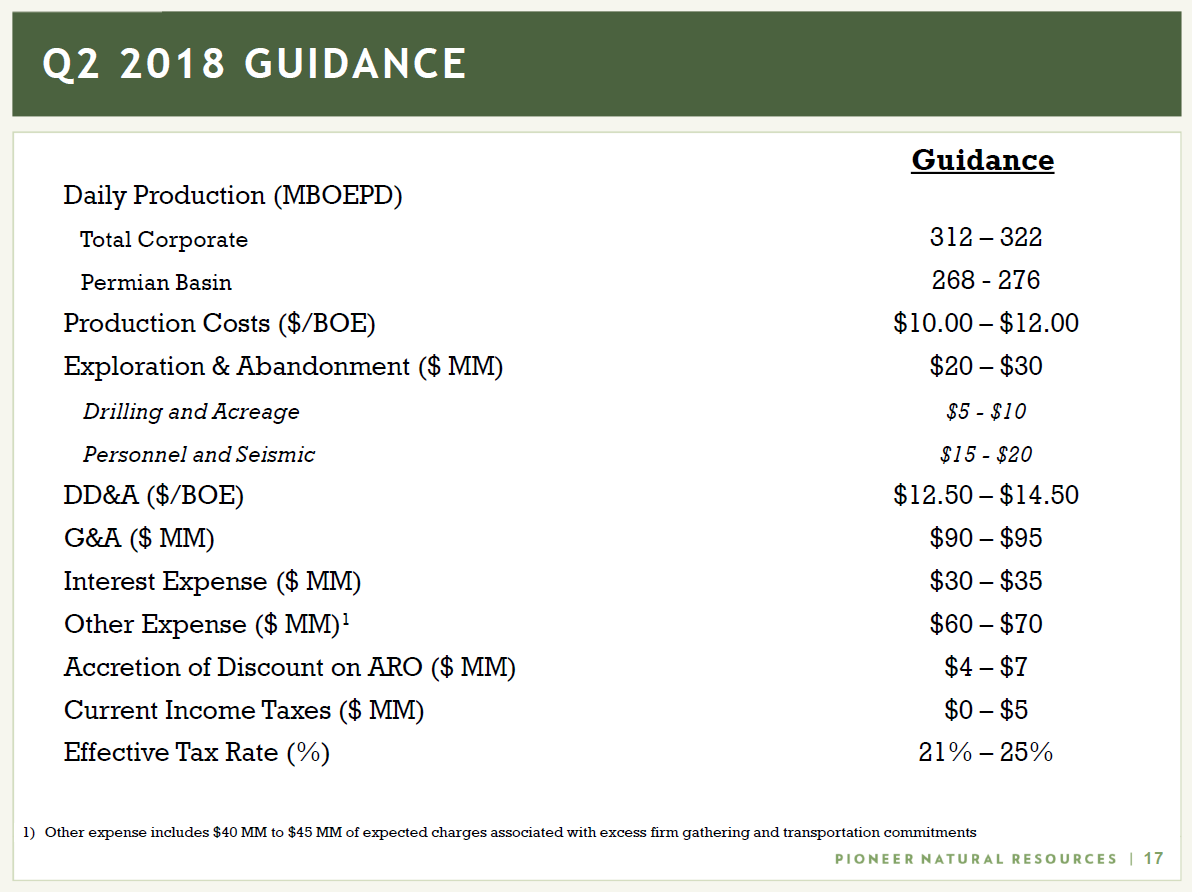

Q2 2018

Total production is forecasted to average between 312 MBOEPD to 322 MBOEPD and Permian Basin production is forecasted to average between 268 MBOEPD to 276 MBOEPD.

Production costs are expected to average $10.00/BOE to $12.00/BOE.

Conference call Q&A excerpts

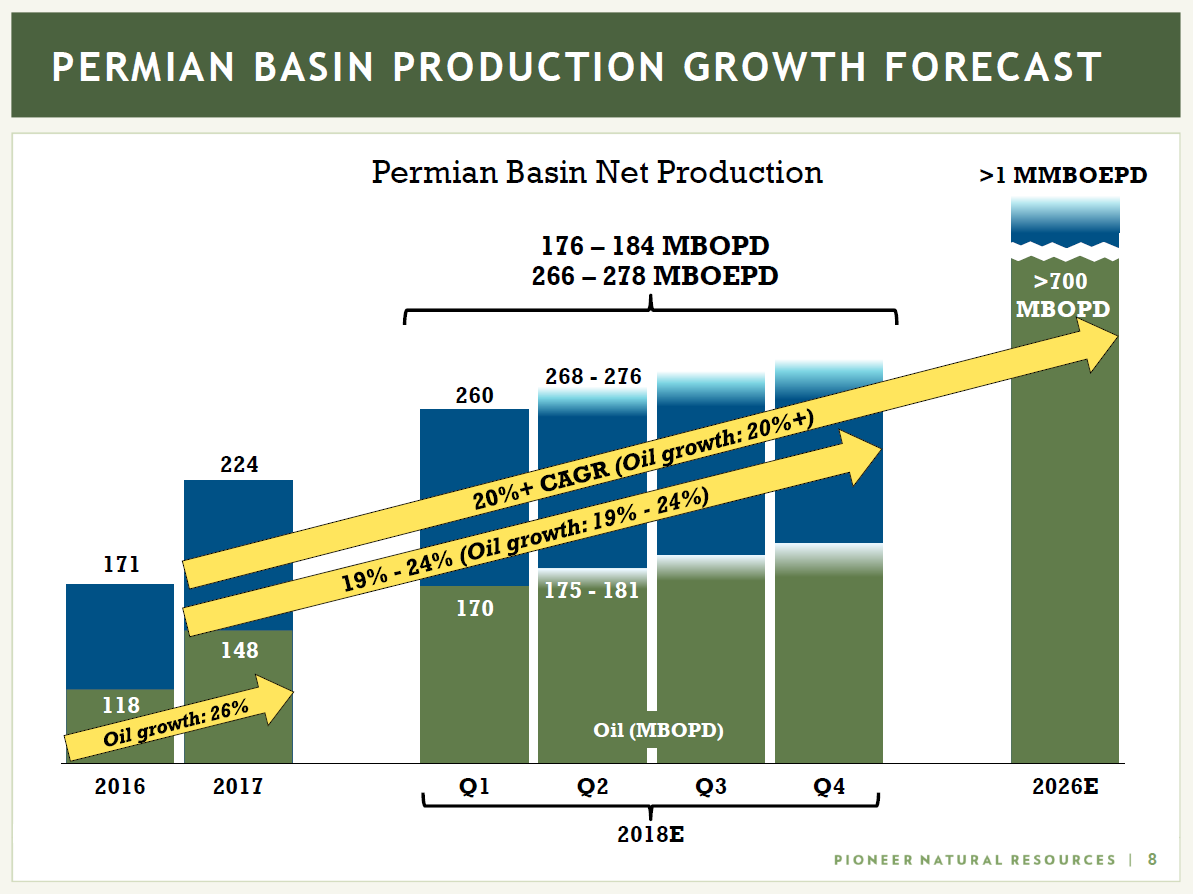

Q: The company is tracking towards the upper end of the 19% to 24% Permian Basin growth range. Does that just contemplate the 45 Version 3.0+?

President and CEO Timothy L. Dove: I think first of all, the production numbers we’re seeing so far have been outstanding, and we continue to operate at a strong rate of growth.

So I think the numbers we’re reflecting today really don’t yet contemplate adding additional 3.0+ because we haven’t determined that number yet.

What I’m pointing you to is the fact that we are going to increase the number of 3.0+. And as a result, we’ll come out with production guidance at that time. But needless to say, one of the reasons we’re hitting the top end of our range is because of 3.0+.

The more we drill, the better we’re going to do.

Q: What is the cadence of infrastructure spending, and do you still anticipate the breakeven trending down to $50 and then ultimately $40 level?

President and CEO Timothy L. Dove: First of all, on your question regarding the cadence of incremental spending above just D&C, we have some significant projects this year that you’re familiar with.

One of them is our Midland wastewater plant investment, so as to them being able to take 240,000 barrels a day of effluent water from the system. That’s easily $100 million-plus this year we think that’s going to be spent later as we get into the year, in addition to which we have regular capital needs for our pumping services fleet as well as other items corporately.

The other thing to note is we do continue to spend money on a relatively even cadence on tank batteries and saltwater disposal systems. Our estimate continues to be that by the end of this year, we’ll be about 65% completed on the whole field-wide implementation of that, so we do have a few more years of spending at that level.

Our longer-term modeling is to add roughly $300 million per year. When we put out our ten year plan, that was the number we included. And it could be a combination of things. It could be gas processing. We have two gas processing plants coming in this year, two coming in next year. So this is an important part of our capital in the sense that it prepares us for the long term.

Q: As you all are now contemplating these additional rig adds, you all previously talked about considering revamping and renovating a couple of your frac fleets. And I’m just wondering if there’s been any decision made on that front.

President and CEO Timothy L. Dove: Yes, first of all, the fleets – we have one or two fleets that probably need some refurbing. One in particular is really on ice today, and that was something we have to evaluate really for as a late 2018-2019 decision, realizing today of course we’re using, depending upon the day, six or seven of our own fleets and one outside fleet. The calculus is such that we need about one fleet for every three rigs.

So let’s say, for example, we were at 24 rigs at any particular time, we would need eight fleets. So we’re within the bandwidth. We might just refurb one of ours or bring in a third party. We’re evaluating it. It’s sort of a lease versus buy decision. Going further, though, we would have to make that decision in a bigger sense. That really becomes a 2020 issue, so we’d have to make the decision really in 2019.