Pioneer Natural Resources continues to escalate the size of completions in the Permian

The last year proved to be a difficult time for many oil and gas companies, but many were able to prosper even as oil prices hit multi-year lows and began a slow recovery through the second half of the year. Pioneer Natural Resources (ticker: PXD) was able to increase production 15% year-over-year in 2016, an impressive growth target even when prices were higher, but the company doesn’t plan to stop there.

Pioneer announced in its fourth quarter and year-end release in February that the company plans to continue that record of growth over the next 10 years and eventually reach 1 MMBOEPD of production by 2026. The key to being able to make that claim is the company’s assets, said Executive Vice President of the South Texas Asset Team, Western Asset Team and Corporate Engineering Ken Sheffield.

“We have a world-class asset that allows us to grow organically over the next 10 years while spending within cash flow starting in 2018, and generating free cash flow thereafter,” Sheffield told Oil & Gas 360.

Running 18 rigs in the Permian

The company’s 2017 capital expenditure plan will consist of approximately $2.8 billion focused primarily on Pioneer’s Spraberry/Wolfcamp horizontal drilling program. PXD will run 18 rigs in the Permian, which it believes will lead to another year of 15%-18% production growth on a BOE basis.

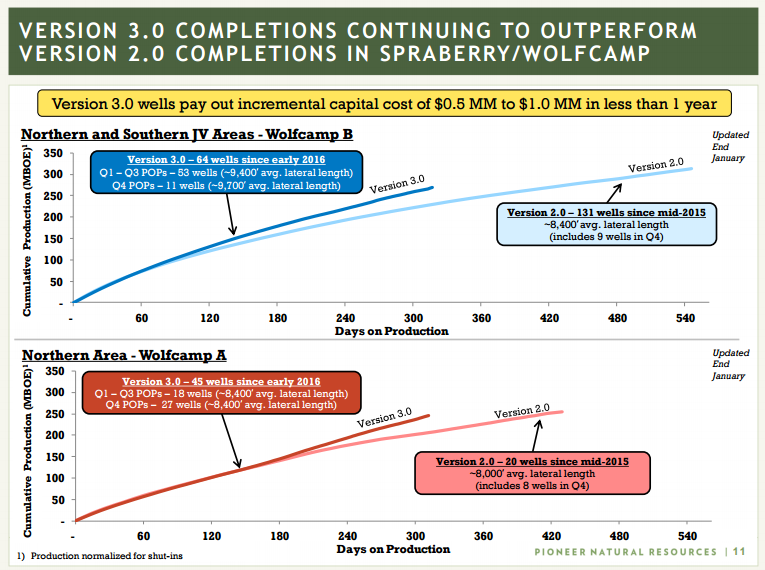

“We’ll be increasingly using our Version 3.0 completions on the majority of our wells,” said Sheffield, referring to the company’s higher intensity, tighter spacing completion designs. “We’re also going to be testing even larger completions in 12 wells,” he added.

“We’ve seen consistent increases as we’ve gone from version to version of our upgraded completions, and we may not have yet found the limit of the optimal point on those. We’re going to continue to push the envelope,” said Sheffield.

Pioneer looks abroad to find customers for increased production: the “ability to export is increasingly important”

Pioneer’s rapidly growing production needs a place to go, and, with the end of the crude oil export ban, PXD is looking to international markets more and more. The company has already exported to Europe and Canada, and plans to send two cargoes of crude to Asia in the first quarter of 2017, according to the company.

“We’re in the early innings of international crude exports today, but we’re engaged in it and learning about it. We’re preparing ourselves for the future. With the increase in our production, that ability to export is going to be increasingly important,” explained Sheffield.

“We believe there is incremental value attached to light sweet crude going to more transportation fuel-focused refineries,” said Sheffield. “U.S. refineries are a little oversupplied for light sweet crude, and they’re more geared to handle heavy crude. If we can redirect lighter sweet crude to hungrier markets, we think that’s a money winning proposition for the company.”

Pioneer Natural Resources presenting at EnerCom Dallas

Pioneer Natural Resources will be presenting its story at the Tower Club Downtown Dallas on Wednesday, March 1, as part of EnerCom Dallas, an investor conference which is modeled after EnerCom’s The Oil & Gas Conference® in Denver.

The Dallas conference is designed to offer investment professionals a unique opportunity to listen to a wide variety of oil and gas company senior management teams update investors on their operational and financial strategies and learn how the leading independent energy companies are building value in 2017.

To sign up for EnerCom Dallas and hear Pioneer Natural Resources, or to find out more information about presenting companies and industry experts speaking at EnerCom Dallas, click here to visit the conference website.