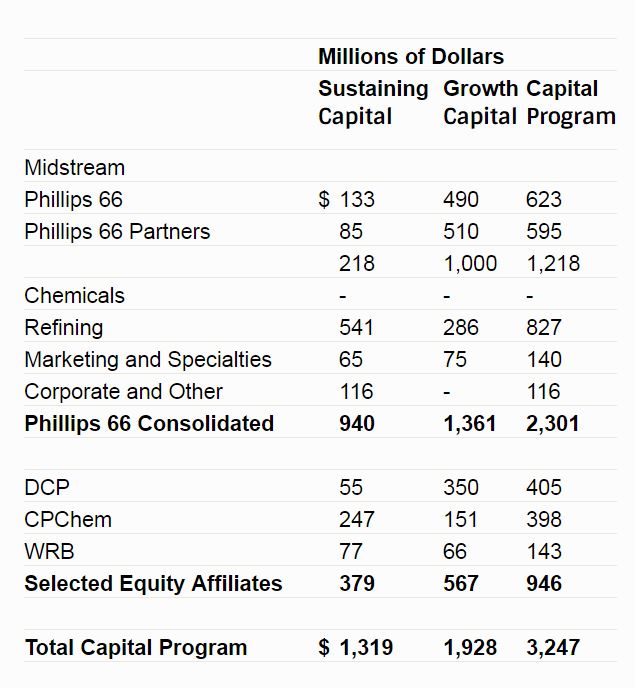

Phillips 66 (ticker: PSX) recently announced its 2018 capital budget of $2.3 billion, which includes $1.4 billion of growth capital and $0.9 billion of sustaining capital.

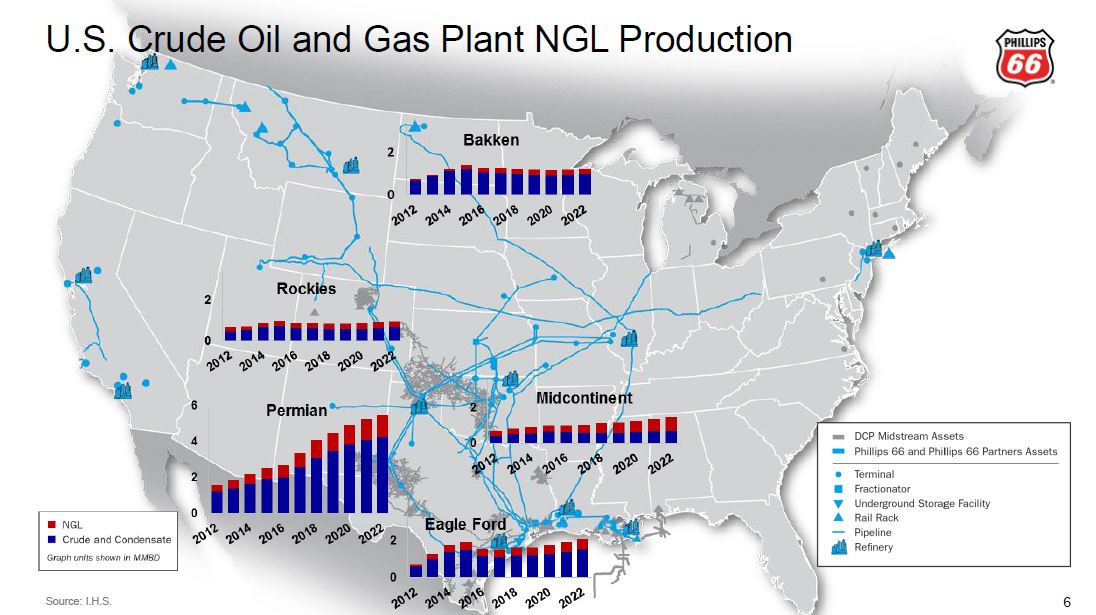

In midstream, the company plans to invest $1.2 billion, including $1 billion of growth capital in its natural gas liquids and transportation businesses.

Phillips 66 said that the Beaumont Terminal is still undergoing expansion and that there are plans to add more Gulf Coast fractionation capacity. Additionally, the company will invest in pipeline and other terminals that are currently integrated with its assets.

Midstream capital includes a budget of $595 million by Phillips 66 Partners, with $85 million directed towards maintenance.

Growth capital at the partnership will support the Sand Hills Pipeline expansion, completion of the Bayou Bridge Pipeline’s eastern segment, and an isomerization unit at the Phillips 66 Lake Charles Refinery.

“Long-term, we continue to target re-investing 60 percent of our cash flow back into the business and returning 40 percent to our shareholders,” said Phillips 66 Chairman and CEO Greg Garland.

Phillips 66 holds a 50% interest in DCP Midstream, LLC, which maintains significant interest in DCP Midstream, LP, a leading NGL and natural gas processor.

The company plans $827 million of capital spending in refining, with $541 million for reliability, safety, and environmental projects. Refining’s growth capital of $286 million will be used for small, high-return, quick payout projects aimed at increasing clean product yields. Projects include completion of the fluid catalytic cracking (FCC) unit modernization at the Bayway Refinery and FCC optimization at the Sweeny Refinery.

In marketing and specialties, the company intends to invest $140 million of growth and sustaining capital. The growth investment will increase retail sites in Europe. In corporate and miscellaneous spending, the company plans to fund $116 in projects primarily related to information technology and facilities.

Phillips 66’s proportionate share of capital spending by joint ventures Chevron Phillips Chemical Company LLC (CPChem), DCP Midstream, LLC (DCP Midstream) and WRB Refining LP (WRB) is expected to be $946 million. Including these equity affiliates, the company’s total 2018 capital program is projected to be $3.2 billion.

In chemicals, Phillips 66’s share of CPChem’s 2018 capital expenditures is expected to be $398 million, a decrease of about 45 percent from 2017 due to completion of the U.S. Gulf Coast Petrochemicals Project. The new polyethylene units included in this project started up during the third quarter of 2017, while commissioning of the ethane cracker at the Cedar Bayou facility is expected to begin in the first quarter of 2018.

Phillips 66’s expected share of DCP Midstream’s 2018 capital spending is $405 million, with $350 million targeted for growth projects including the Sand Hills Pipeline expansion and two DJ Basin gas processing plants. The company’s expected share of WRB’s capital expenditures is $143 million, and includes completion of the Wood River Refinery FCC unit modernization to increase clean product yield. Capital spending by these three major joint ventures is expected to be self-funded.

Open season for the Gray Oak Pipeline

Enbridge Inc. (ticker: ENB) and Phillips 66 announced today an open season for the Gray Oak Pipeline. The Gray Oak Pipeline will provide producers and other shippers the opportunity to secure crude oil transportation from West Texas to the destination markets of Corpus Christi, Freeport, and Houston, Texas, with connectivity to over 3 million barrels per day (BPD) of refining capacity and multiple dock facilities capable of crude oil exports. Shippers will have the option to select from origination stations in Reeves, Loving, Winkler, and Crane counties in West Texas.

The Gray Oak Pipeline is expected to have an initial throughput capacity of 385,000 BPD. Phillips 66 and Enbridge will evaluate expansion of the system beyond 385,000 BPD, depending on shipper interest in the open season. The pipeline system is anticipated to be placed in service in the second half of 2019.