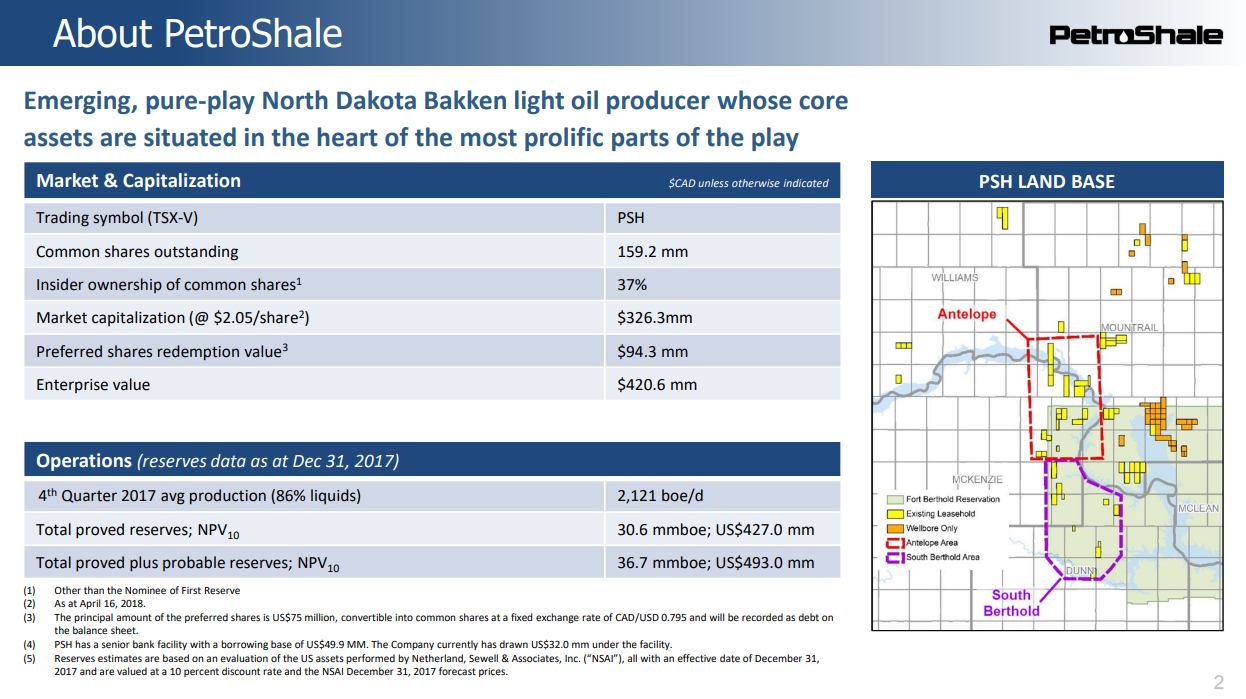

Bakken-focused PetroShale Inc. (ticker: PSH) released financial and operating results for the year-ended December 31, 2017. Production averaged 2,121 BOEPD in the fourth quarter and 2017 production averaged 2,445 BOEPD, an increase of 50% over 2016.

Financially, PetroShale reported 2017 revenues of $44.0 million (an increase of 89% over 2016) and 2017 EBITDA of $21.2 million (an increase of 123% over 2016). The operating netback in 2017 was $27.46/BOE and the company had capital expenditures of $67.1 million in 2017, which was mainly directed toward D&C and acquisitions.

Increased DAPL takeaway capacity has narrowed the average differential between PetroShale’s realized crude oil price and WTI to an average of $2.46/barrel in the fourth quarter, down from $6.21/barrel in the fourth quarter of 2016 and $5.14/barrel in the third quarter of 2017.

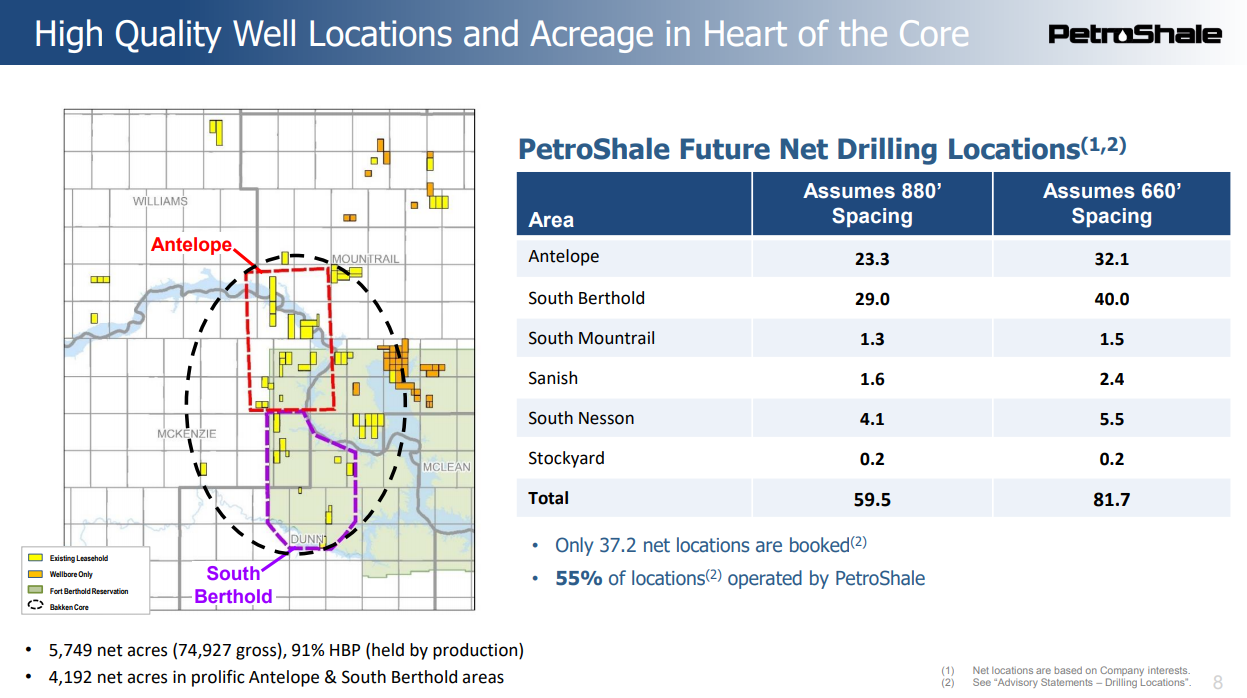

PetroShale recently completed four gross (3.7 net) operated wells, resulting in average production of approximately 5,300 BOEPD in March – an increase of approximately 150% over Q4 2017. The company also acquired additional undrilled acreage in its core South Berthold area.

Reserves

Netherland, Sewell & Associates, Inc. generated the reserves report for PetroShale. The company had total proved reserves of 30.6 MMBOE ($427 million PV-10). Total proved plus probable reserves were 36.7 MMBOE and FD&A costs were $20.30/BOE for 2017.

“In 2017, we increased our acreage position through a number of acquisitions totaling $15.9 million and participated in 94 gross (7.0 net) operated and non-operated wells. The company’s activity contributed to average annual production volumes of 2,445 BOEPD, an increase of 50% over the prior year,” PetroShale President and CEO Mike Wood said.

The company provided results of 3.7 net operated wells on its Primus and Horse Camp DSUs that were brought on-line during the first quarter of 2018. These wells generated net production increases to an estimated 5,300 BOEPD in March of 2018, the company said.

“Although crude oil prices have remained volatile, both WTI benchmark prices and differentials improved during the fourth quarter. The commencement of operations of the Dakota Access Pipeline, which significantly enhances takeaway capacity from the Bakken to the Gulf Coast and other markets, contributed to stronger realized pricing and helped to slightly offset a lower US$/CAD$ exchange rate,” Wood said in a statement.

The company said it plans to drill approximately seven to eight net wells, five – six operated, beginning in Q3 2018 and continuing into the first quarter of 2019 with completion and tie-in operations.