Correction: An earlier version of this article attributed quotes from The Oil & Service Conference to PetroQuest CEO Charles Goodson.

PetroQuest asset sale acts as a catalyst to pay down debt

PetroQuest Energy (ticker: PQ, PetroQuest.com) presented today at EnerCom’s The Oil & Service Conference ™ in San Francisco at 11:00 a.m. PST. PetroQuest Energy, Inc. is an independent energy company engaged in the exploration, development, acquisition and production of oil and natural gas reserves in the Arkoma Basin, East Texas, South Louisiana and the shallow waters of the Gulf of Mexico. The company recently completed a debt exchange helping to position it to withstand the current downturn in prices.

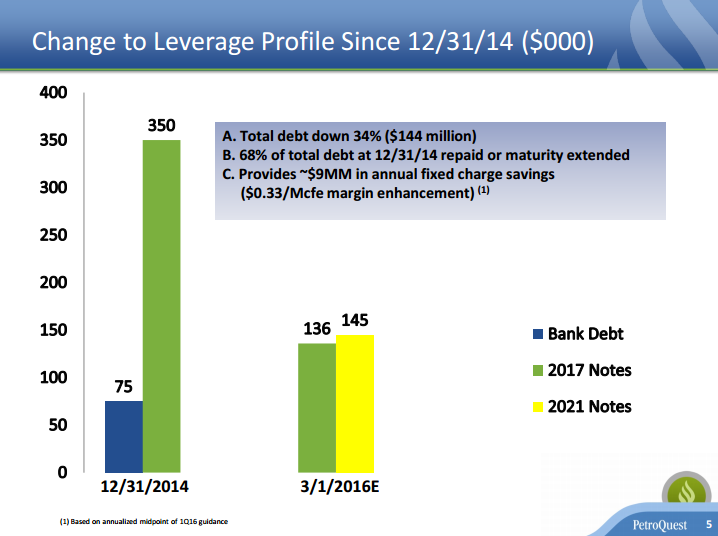

In addition to the debt exchange, which cut the amount of notes coming due in 2017 by more than half, PetroQuest also sold $280 million in Woodford assets, which acted as a catalyst for the company to shore up its balance sheet, said PetroQuest Executive Vice President and CFO Bond Clement. The company received 9x cash flow for the sale, Clement said in the presentation.

PQ used the money from the asset sale to pay off the company’s bank debt, leaving PetroQuest with nothing currently drawn on its revolver. Paying down its bank debt, plus the debt exchange, totaled up to about $144 million in debt paid off since 2014, said the PetroQuest CFO.

”When you think about that in terms of fixed charge savings, it adds up to about $9 million a year,” said Clement. “$9 million doesn’t sound like a lot of money, but if you put it in the context of our production profile, it equates to about $0.33 per Mcfe of margin enhancement. When you look at the April contract, which is trading, unfortunately, around $1.70, and you add $0.33 to that bottom line, it’s a meaningful piece of business.”

The Gulf remains a ‘cash cow’ for the company

Since the sale of the company’s Woodford assets, PetroQuest’s production is now split about 50/50 between its Cotton Valley assets and those in the Gulf of Mexico. The Gulf remains a “cash cow” for the company, according to Clement.

“The strategy for the Gulf has always been to use it as a cash cow,” he said. “Since 2007, our Gulf Coast assets have generated around $800 million in cash flow. We turned around and invested about $0.50 on the dollar back into those assets, so capex is about $400 million in that time. They’ve also generated $400 million of cash flow that we’ve used to build out our other assets.”

“That strategy of reinvesting $0.50 on the dollar to keep production flat and using the free cash flow to develop other resource plays has worked fairly well.”

The company plans to keep production flowing from its Thunder Bayou well by recompleting the well sometime in the middle of this year from the lowest section of pay, to the main section. The well is currently producing 30 MMcfe/d, which the company expects to decline to 10 MMcfe/d through the first half of the year. Once the well hits that low point, PetroQuest will recomplete for about $800,000, and bring the well back online around 60 MMcfe/d.

“This is the tool that allows us to keep production relatively flat this year while spending very little capital,” said Clement.

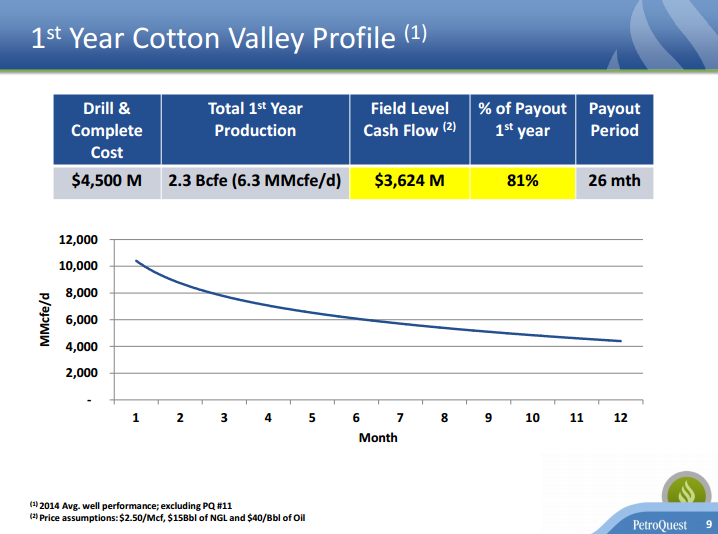

Well costs under $4 million per well in Cotton Valley

PetroQuest has drilled and completed two wells in its Cotton Valley assets this year, and has decided not to drill the additional three wells it had originally planned for 2016. Clement explained PQ made this choice both because of commodity prices, and because the company has been able to prove that it can drill wells in this region for less than $4 million.

With the reduced well cost, PetroQuest expects its wells to payout in about 26 months.