Low oil prices continue to hurt Chinese oil major PetroChina

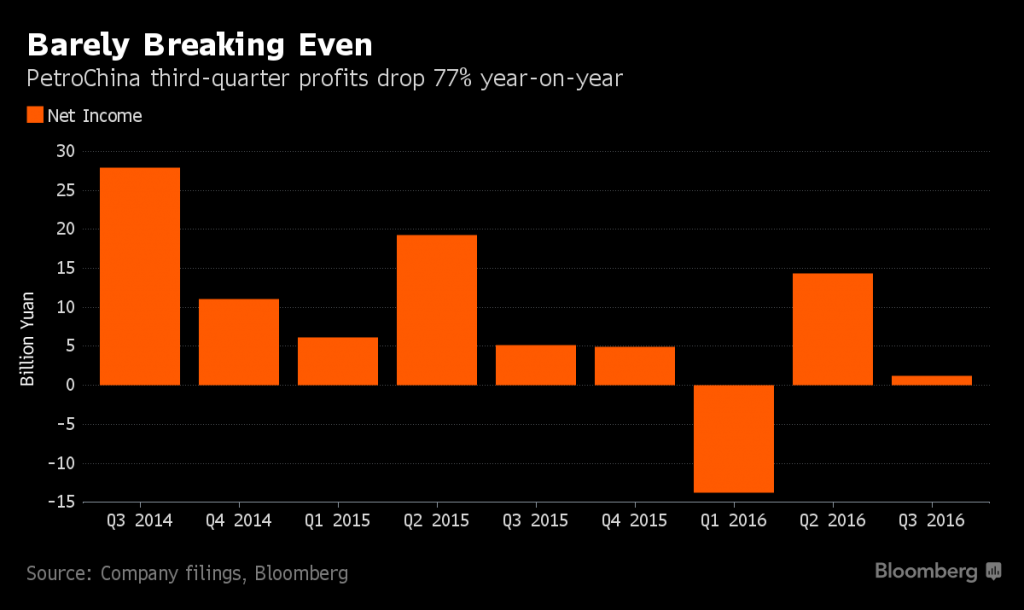

China’s largest crude oil and natural gas producer, PetroChina (ticker: PTR), released its third-quarter results today, reporting substantially lower income amid the global crude oil glut. Net income during the first nine months of the year fell 94% to 1.73 billion yuan ($255.2 million), the company said in its press release Friday.

PetroChina reported its first-ever loss during the first quarter of 2016, and managed to break even in the first half of the year after a 24.5 billion yuan ($3.6 billion) pipeline sale, but the company expects full-year results to “decrease substantially” from 2015 as oil prices remain near $50 per barrel.

PetroChina’s situation is far from unique, however, with all of China’s state-owned oil and gas companies reporting much lower revenue. Sinopec (ticker: SNP), for example, reported an operating loss of nearly 31 billion yuan in the first three quarters of the year, up from 4 billion yuan during the same period last year.

Chinese oil companies sitting on a mountain of cash

All of China’s oil majors reported another similar theme in their quarterly reports: their cash stockpiles are climbing.

China’s oil and gas companies appear to be sitting on capital looking for the best spot to put it to work rather than continuing to develop uneconomic fields. PetroChina and Sinopec both reported lower domestic production (5% and 14%, respectively) as Chinese producers shut down costly production at home.

This has not been without its benefits for companies like PetroChina. In the company’s Q3 report, the state-run company said cash on-hand increased 25% in the first nine months of the year compared to the same period last year.

China’s government has been pressuring oil companies to rein in spending and avoid risky investments or losses, but PetroChina and others may soon start deploying that capital overseas.

A source close to the company’s leadership told The Wall Street Journal the company had been looking at deals from Africa to the Middle East and North America to boost overseas reserves, and said there would likely be an uptick in overseas purchases next year if oil prices remained under $60 per barrel.

Chinese producers could potentially find good deals from oilservice providers in some of the most prolific plays in the United States, too. During ConocoPhillips’ (ticker: COP) conference call Thursday, the company’s EVP of Production, Drilling and Projects Al Hirshberg said the flight of capital to the Permian has created opportunities in other plays like the Eagle Ford and the Bakken.

PetroChina’s crude oil output fell 3.6% in the first nine months of the year compared to the same period last year. Of the 696.6 million barrels the company produced, approximately 82% was from domestic sources, according to the company’s filing. International oil and natural gas equivalent output from overseas operations increased 7.8% compared to last year, the company said Friday.

China’s interest in U.S. oil and gas plays is here to stay

Exactly a year ago, CNN reported that Chinese investment firm Yantai Xinchao “is shelling out $1.3 billion to buy giant oil fields in Texas, reflecting growing interest from China in U.S. energy resources.”

The Chinese were interested in buying oil assets in the western Texas Permian Basin that belonged to Tall City Exploration and Plymouth Petroleum. “The deal which includes acreage in Howard and Borden counties, has already been approved by the U.S. Committee on Foreign Investment,” CNN said.

China Daily reported in June of this year that Yantai Xinchao is looking to invest in deals sized up to $1 billion in the Permian Basin, seeking operated positions where its U.S. subsidiary Blue Whale Energy North America can make the decisions as to how to best develop the assets. Blue Whale bought 7,100 acres of leases from Juno Energy last year in a $315 million deal, in addition to the $1.1 billion Tall City/Plymouth transaction.