Analysts expected Petrobras to report positive numbers this quarter, but write-downs dragged

Brazil’s state-owned Petrobras (ticker: PBR) saw its stock drop about 5% in the opening minutes of its call as the company reported a 16.5 billion Brazilian reais ($5.1 billion) net loss due in large part to write-downs on the company’s assets. The company’s stock recovered slightly throughout the call, but today’s earnings has investors worried that the road to recover for the company – which holds the designation as the world’s most in-debt oil and gas company – could be longer than originally anticipated.

Petrobras’s bottom line was hit hard by 15.29 billion reais in write-downs for the quarter. The company attributed the write-downs in both its upstream and downstream businesses to a “review of projects in the investment portfolio,” exchange-rate fluctuations and a “review of the set of premises, such as the price of Brent and the long-term exchange rate.”

Analysts had predicted the company would post around $400 million in profits for the quarter, reports BBC.

“The message we want to convey is that these impairments are non-recurring, and that we don’t expect them to happen, not at least in this magnitude, in the coming future,” said Petrobras CFO Ivan Monteiro.

The company also reported 1.2 billion reais in provisions to settle investor lawsuits against the company related to its role in a corruption scandal. Since 2014, the company has been at the center of an investigation which has exposed a scheme in which Brazil’s construction companies were overcharging the state oil company, and then paying kickbacks to PBR’s executives. The company has changed management, but Thursday’s write-downs bring Petrobras’s total since 2014 to around $37 billion at the exchange rates of the time.

Petrobras sees slower sales, but its share of Brazil’s crude feedstock climbs to 91% for first 9 months of 2016

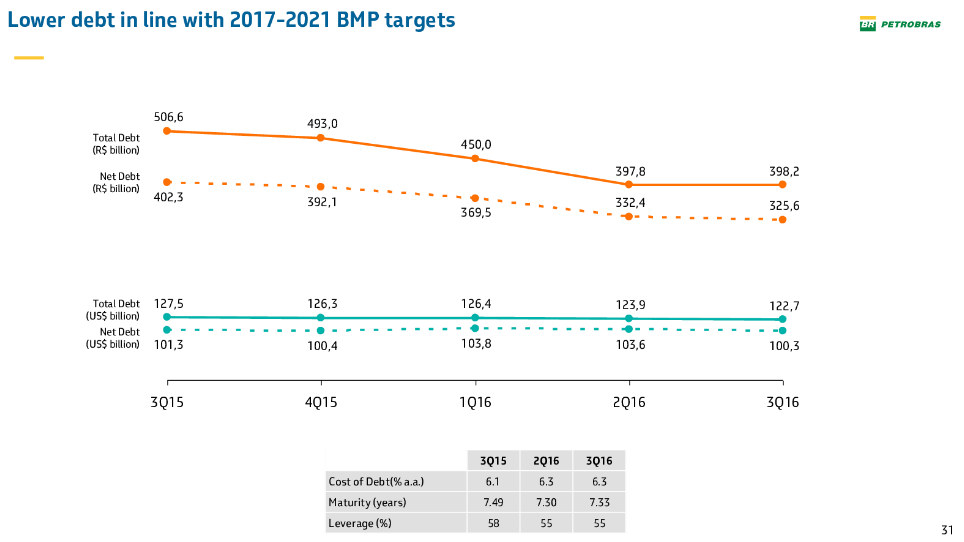

The company is looking for ways to pay down its $122.7 billion in debt, $50 billion of which is coming due through 2019, while still maintaining production. The company reported capital expenditures were down 26% for the first nine months of the year. Sales were also down 14% from the third quarter of last year.

The company did increase its share of the total feedstock used in Brazil, however. Petrobras’s crude made up approximately 91% of Brazil’s feedstock in the first nine months of the year – 6% more than for the same time period last year, and the fourth consecutive quarter in which the company has increased its share of processed crude at domestic refineries.

Petrobras releases October production numbers

PBR also announced Friday that production for October was 2.8 MMBOEPD, of which 2.7 MMBOEPD was produced in Brazil. Average crude oil production in the country was 2.2 MMBOPD, a 2% drop from September.