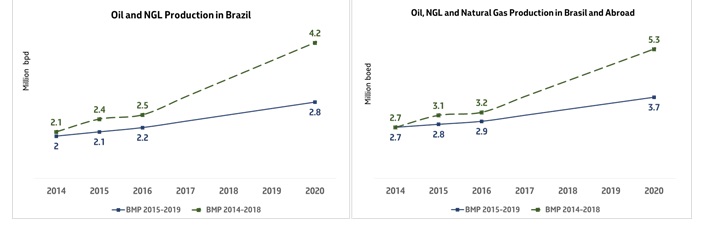

Volumes Revised Downward to 3.7 MMBOEPD from 5.3 MMBOEPD

Petrobras (ticker: PBR) has made all the headlines for all of the wrong reasons in the last several months, and the company is taking initiatives to shed its image as the most indebted oil major in the world.

In a business management plan outlining operations for 2015 to 2019, PBR set company goals of reducing net leverage to below 40% by 2018 and to 35% by 2020. Net debt/EBITDA is planned to drop to 3.0x and 2.5x, respectively, in those years.

In doing so, the company is drastically cutting back on investments. Its capital expenditure plan through 2019 is estimated at about $130 billion, which is roughly the same amount of its current debt but still 37% below its previous guidance. Additional capital-raising measures include the continued divesture and restructuring of its current business. PBR estimates proceeds to reach $42.6 billion by 2018.

The majority of the exploration and production efforts will focus largely on the pre-salt area offshore Brazil, which will expectedly supply about half of all oil output by 2020. Its production forecasts were scaled back dramatically to reflect the reduced expenditures – its 2020 guidance of 3.7 MMBOEPD is down 30% from initial estimates of 5.3 MMBOEPD.