Firm sees $6.7 billion CapEx going into Permian pipeline construction in 2018-2019

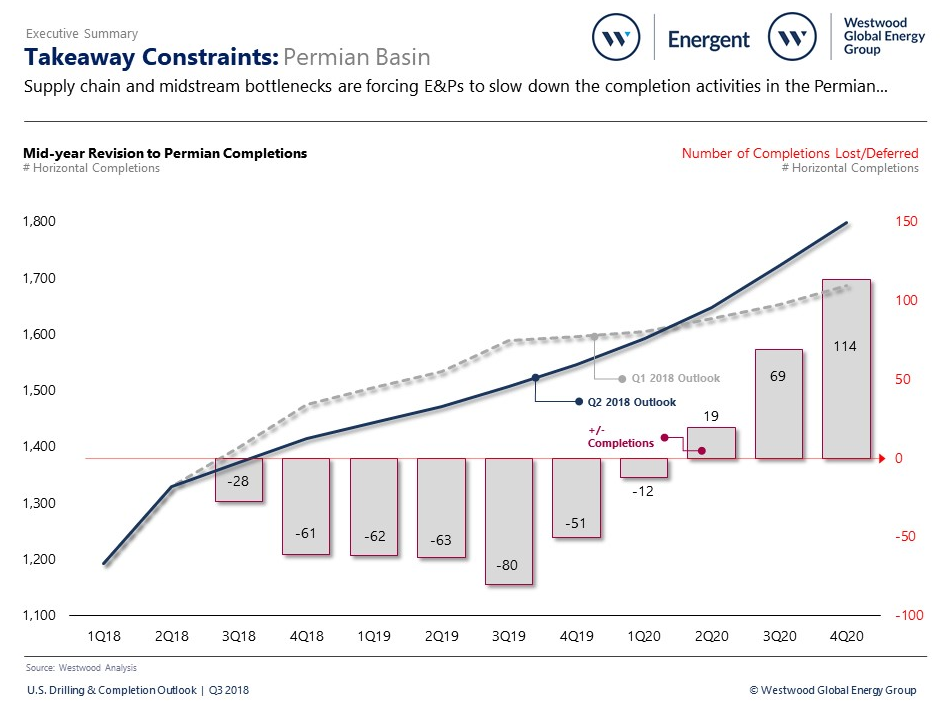

Research firm Westwood Global has quantified the result of takeaway constraints in the Permian Basin.

Westwood calculates 345 completions are likely to be deferred by the end of 2019 due to pipeline takeaway capacity constraints, according to the firm’s latest US Drilling & Completion report.

“Pipeline capacity is arguably the number one factor in determining completion schedules for operators, the report said. This is the major reason behind the Permian basin’s lower basin oil differentials, currently trading $16/bbl discount for the month.”

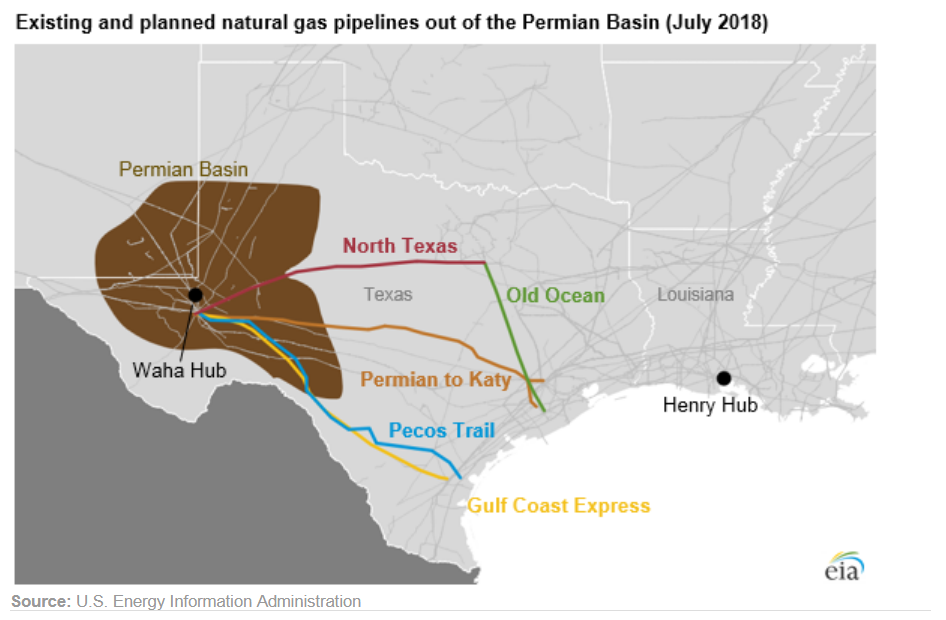

Gas processing is no longer limited to gas basins, Westwood said in the report. The Permian basin is the second largest gas producing basin in the Lower 48 given its large amount of associated gas. With nowhere for it to go, this is creating strain on operators who are worried that tighter flaring regulations will result in choked production, the report said.

“Staffing the growing number of frac crews necessary to reach completion targets set by operators has proven difficult, especially in strong growth regions like the Permian basin. Despite the undersupplied frac crew markets, public pressure pumpers, like FTSI and C&J, are not seeing the pricing needed in the Permian to justify new fleet additions, as a result of the low price differentials in the basin.”

The firm said it expects 2.5 million tons of sand and 5 billion gallons of water will be directly impacted by the deferred completions. Demand for 1.6 million horsepower for pressure pumping “will evaporate” in the second half of 2018 and $1.4 billion of CAPEX for completion operations will also be delayed or reallocated on other basins such as Eagle Ford, DJ Niobrara, Bakken, and MidCon, Westwood said.

Demand for takeaway thrusts midstream into a second heyday

Westwood Energy Group VP Todd Bush said, “Midstream industry, on the other hand, is experiencing a second heyday thanks to unconventional plays. Crude and NGLs need to be moved, often from areas with little or no infrastructure, so you can expect operators to be more creative to find and fund new projects to lessen the current constraint.

“We estimate $3.1 billion in 2018 of CAPEX and $3.6 billion in 2019 will be spent on pipeline construction which equates to a 21% increase from 2017. This also confirms the urgency and the level of activity in the basin needed to alleviate pressure,” Bush said in a statement.

Over 500 E&P holdings, 60-75 pressure pumpers, and 13 frac sand companies are engaged in activities in the Permian, the report says.

“With 3,546 drilled but uncompleted wells (DUCs) as of Q2 2018 and improving well economics for E&Ps in the basin, the Permian is poised to continue growing,” Westwood concluded.

Key Conclusions for U.S. Unconventionals:

- Permian. Westwood projects supply-chain and takeaway capacity concerns to result in over 345 Permian completions deferred between 2H18 and Q4 2019, with much of the planned CAPEX reassigned to other basins. Planned commissioning of new pipelines will alleviate bottlenecks and drive completions in Q1 2020, outpacing the drilling activities in the region.

- DJ-Niobrara. Oil production is being stifled by natural gas processing constraints, resulting in CAPEX being delayed to 2H18 until new infrastructure comes online. The potential risk stems from a changing regulatory environment, as industry supporter Gov. Hickenlooper (D) will step down in 2018 after two terms in office.

- Eagle Ford. Operators in the basin are reporting higher price realizations on NGLs and oil. Given increasing amounts of exports from Corpus, the shale play is expected to have a strong tailwind in the near future, lasting into late 2019. After 2019, drilling activities will slow down as available prime acreage positions, i.e. high oil-in-place zones, are becoming scarce.

- Haynesville. Haynesville’s shale gas production is surging with extensive midstream infrastructure in place and proximity to U.S. Gulf Coast markets. Pure-play Haynesville operators will benefit from supply chain improvements, proximity to Gulf Coast, and refrac success in the shale play.

- MidCon. MidCon is experiencing a heightened effort to maximize returns in the next 18-24 months in the midst of Permian bottleneck issues. Costs reductions are achieved via supply chain optimization, local frac sand, and longer laterals with high-intensity completion techniques.

- Williston. Bakken shale operators are benefitting from enhanced completions, low breakevens, and favorable oil prices, but gas capture requirements, rough winter weather, and service cost inflation could hinder completion growth in the medium term (until 2019).

- Appalachia. Following the conclusion of takeaway constraints hindering production within the Appalachia basin, operators are now facing backwardation due to excessive hedging strategies, likely impacting future production schedules.

The seven regions covered (DJ-Niobrara, Eagle Ford, Haynesville, MidCon, Permian, Appalachia, and Williston) have seen a significant uplift in activity following oil prices rallying in early 2018.

A continuation of recovery through 2018 has led to rising prices across the supply chain. Based on an expectation of rising consensus commodity prices through to 2022, Westwood expects the US market to enter a period of sustained growth in both activity and expenditure.