Lucid Energy Group and EnCap Flatrock Midstream have agreed to sell Lucid Energy Group II, LLC to funds owned by Riverstone Holdings LLC and the Goldman Sachs Group Inc. (ticker: GS) for approximately $1.6 billion.

The participating investment funds managed by Goldman Sachs MBD are West Street Capital Partners VII, L.P., West Street Global Infrastructure Partners III, L.P., and West Street Energy Partners, L.P.

The debt financing will be provided by Jefferies LLC.

Closing is expected in the first quarter of 2018.

Lucid II will retain its name and operate as a Riverstone and Goldman Sachs MBD portfolio company. The members of the Lucid management team will remain in their current roles with Lucid II. Both companies are led by President & CEO Michael J. Latchem, Executive Vice President & COO Jay L. Langham and Senior Vice President & CCO Scott Brown.

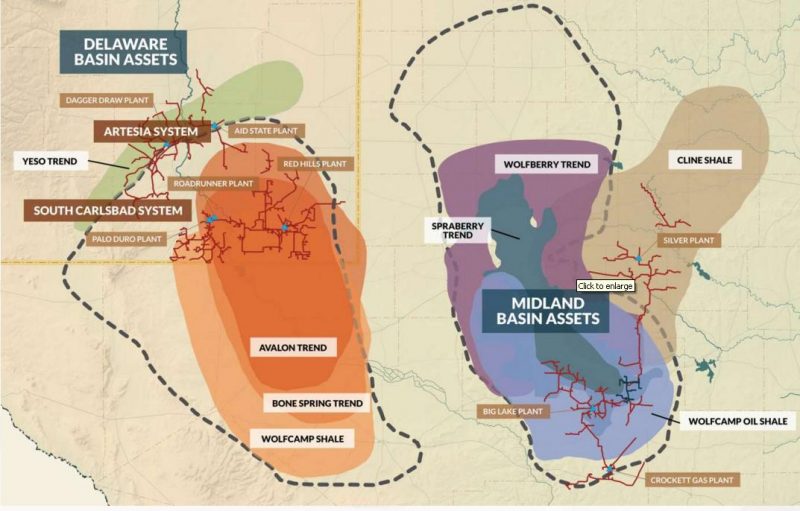

The Lucid II assets are located in the core of the northern Delaware Basin and are known as the South Carlsbad Natural Gas Gathering and Processing System and the Artesia Natural Gas Gathering and Processing System.

Assets include approximately 1,700 miles of natural gas gathering pipelines and 585 million cubic feet per day (MMcf/d) of processing capacity, with an additional 200 MMcf/d under construction and scheduled to be in service by mid-2018.

Lucid II serves the region’s oil and gas producers, which together have made long-term dedications and production volume commitments from approximately 450,000 acres spanning Eddy and Lea counties in southeast New Mexico.