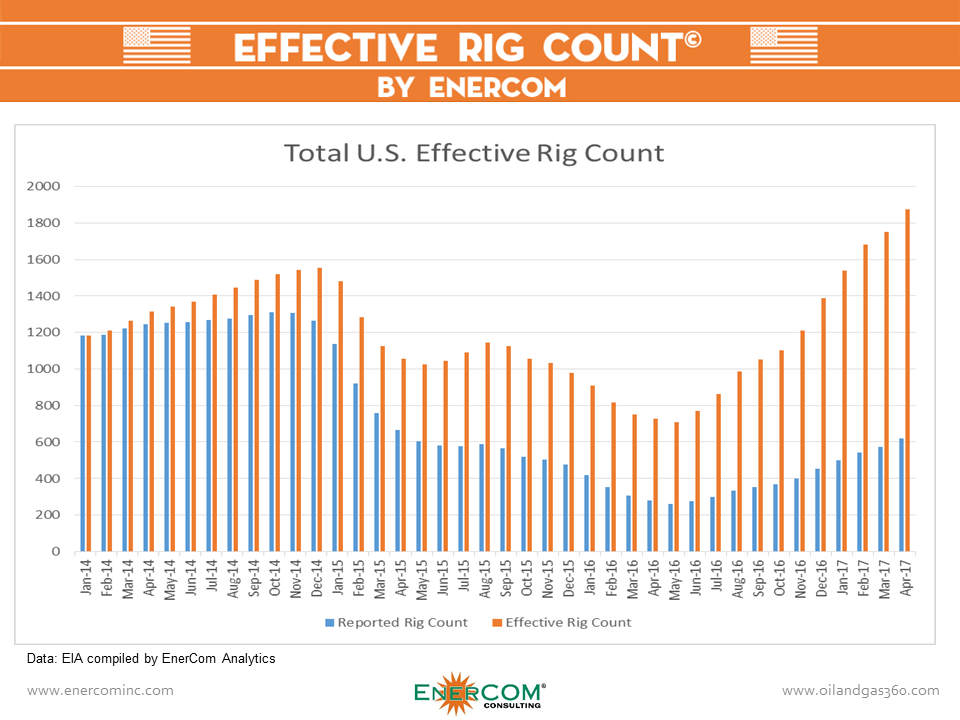

Nationwide EERC higher than ever at 1,873

EnerCom released its monthly EnerCom Effective Rig Count today. Launched in January, the EnerCom Effective Rig Count seeks to account for improved productivity in recent developments.

The downturn forced companies to innovate and develop new technologies and techniques to remain economic. These advancements have allowed companies to drill better, faster wells than they were able to before the downturn.

Based on the Effective Rig Count, rigs in the U.S. were three times as productive in April 2017 (the last month with data available for both rigs and production) than rigs in January 2014. After adjusting for this productivity boost, the total U.S. Effective Rig Count is 1,873.

On an individual basis, the Utica has seen the most advancement in productivity. Current rigs in the Utica are yielding 4.5 times more barrels of oil equivalent than January 2014 Utica rigs. There are currently 22 rigs active in the Utica area, but the production from these rigs equates to 99 January 2014 rigs.

Ground Zero

In the Permian basin, the heart of current unconventional activity, rigs are currently yielding 3.3x more production than Permian rigs did in January 2014. This means that the Permian Effective Rig Count is 1,109, which is higher than the nationwide Effective Rig Count from September 2015 to November 2016.

Permian, Eagle Ford, Haynesville growth expected

In the EIA’s monthly Drilling Productivity Report the agency outlined recent drilling and production activity. In today’s report, the EIA provided estimates for production growth from May to June. As might be expected, the Permian is projected to see the largest oil and gas production growth.

The region’s oil production is projected to rise 70 MBOPD to 2,492 MBOPD, while gas production rises 169 MMcf/d to 8,391 MMcf/d. The Eagle Ford is projected to see the second-largest growth in oil production, while the EIA estimates the Haynesville will experience the second-largest growth in oil production.

In a turnabout from prevailing strategy last year, drilling activity continues to outpace completions, according to the EIA. The agency estimates that there were 5,721 drilled uncompleted wells in the U.S. in April, up 187 from March. This growth is led by the Permian, where the recent surge in activity has drawn about half of all U.S. drilling rigs. Of the major basins, only the Utica saw completion activity outpace drilling, as the region’s DUC inventory decreased by six from March to April.

The EIA also released estimates of new well oil and gas production per rig, an estimate for the productivity of rigs in individual basins. The EIA estimates that rigs in the most productive oil rigs are found in the Eagle Ford, where rigs are yielding 1,448 BOPD. When considering gas, Marcellus rigs are the most productive, with each active Marcellus rig yielding 13,427 Mcf/d.