Projected 125% production growth through 2018

Day three at The Oil & Gas Conference® featured Penn Virginia (ticker: PVAC) President and CEO John Brooks, who discussed the company’s operations.

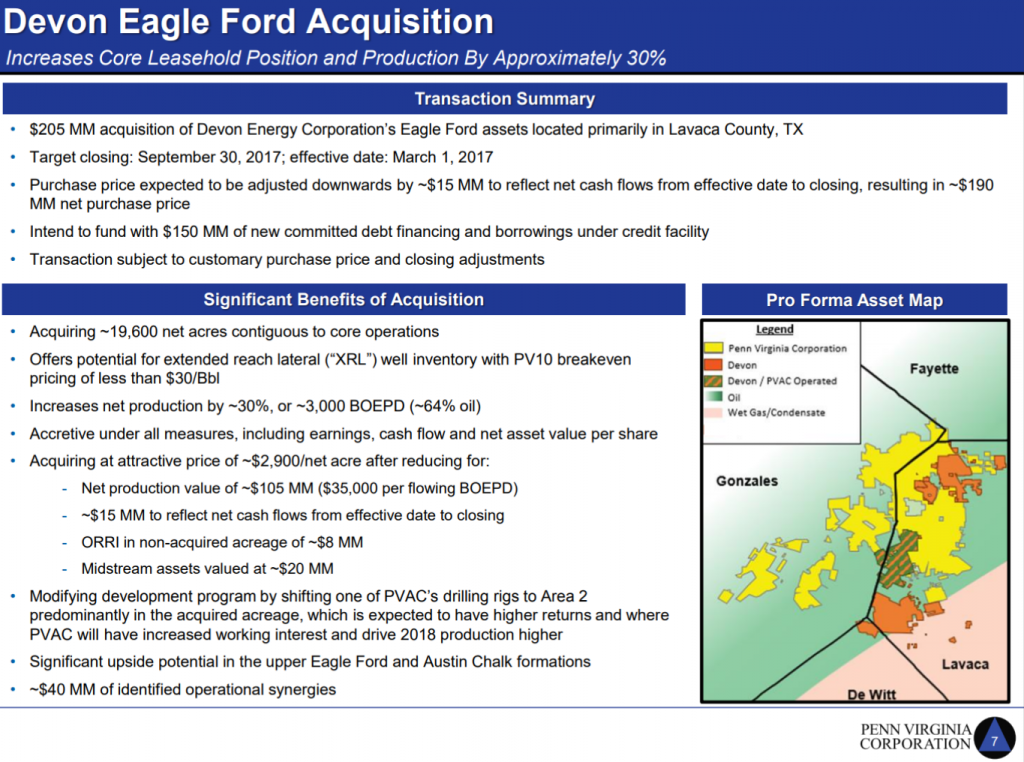

As might be expected, Brooks’ presentation centered on Penn Virginia’s recent Eagle Ford acquisition from Devon Energy (ticker: DVN). At the end of July Penn Virginia paid Devon $205 million for about 19,600 acres in Lavaca County, with 3,000 BOEPD of production. This immediately increased Penn Virginia’s production by about 30%, and has given the company about 6.3 MMBOE of PDP reserves.

In his presentation, Brooks emphasized the operational efficiencies that Penn Virginia will be able to take advantage of in operating this new acreage. Because the acquired properties are almost entirely contiguous with Penn Virginia’s current acreage, for example, much of the operations will be covered by the company’s current midstream takeaway agreements. In addition, the new acreage significantly expands the possibility of extended range lateral development.

Current operations primarily target the Eagle Ford itself, but the Austin Chalk is seen as a potential upside. One of Devon’s best wells targets the Austin Chalk, and is only a few miles away from Penn Virginia’s properties.

According to Brooks, Penn Virginia’s properties are largely de-risked, unlike operations in some unconventional basins. The company does not need to step out to prove property, Brooks said. Instead, much of the wells drilled are infill wells.

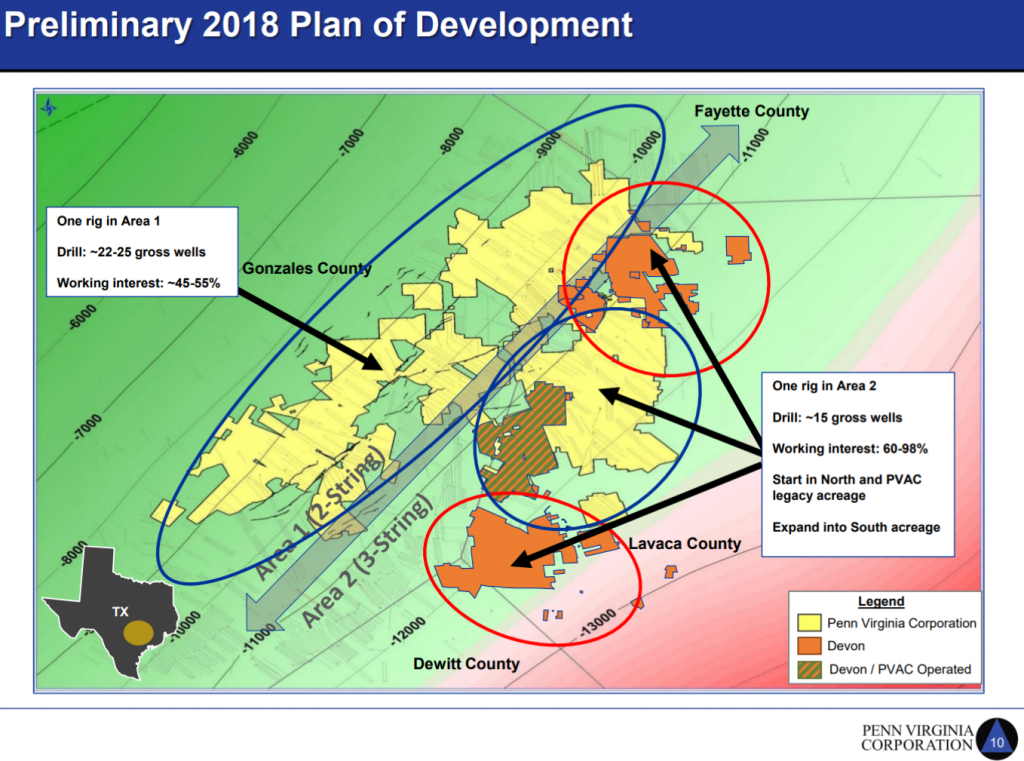

Penn Virginia currently plans to run two rigs in 2018, drilling about 40 gross wells. Operations will first focus on the company’s legacy acreage and the northern portion of the acquired properties. Later in the year activity will expand into the southern part of the acquisition. The current activity plan calls for around 50% production growth from current levels to the end of 2017, then 50% further growth through 2018.

John Brooks’ webcast presentation at the EnerCom conference is available to view and download here.