Wattenberg power player PDC is confident ballot initiatives will not reach the number of signatures required for certification

Colorado ballot initiatives No. 75 (local control over oil and gas) and No. 78 (mandatory 2,500-foot setback) have been a major concern for oil and gas companies as groups that hope to effectively shut down drilling in Colorado collected signatures for two proposed constitutional amendments.

After boxes of collected signatures were turned in at Monday’s 3:00 p.m. deadline, Denver-based PDC Energy (ticker: PDCE) said it is confident that the anti-fracing groups will not have enough signatures to get the ballots in front of voters in November.

“Unofficial reports indicate that it will be unlikely for either of these measures to make the November ballot,” said PDC Senior Vice President of Operations Scott Reasoner in the company’s second quarter conference call today.

“In the event that these do make the ballot, the industry is extremely organized, sophisticated and well-funded in its efforts to prevent them from passing. We are confident in our efforts to defeat this initiative, and we continue to educate the voters on the negative impacts of these proposals on the State of Colorado.”

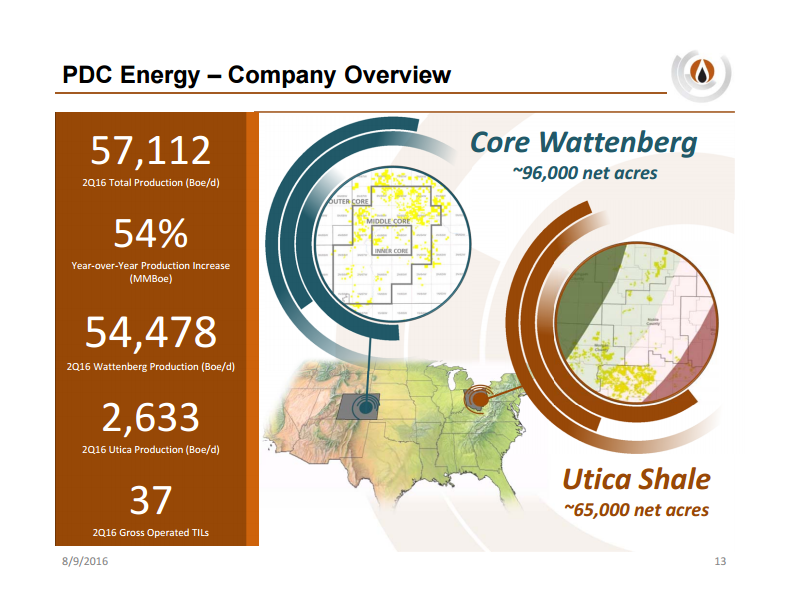

The majority of PDC’s assets are located in the Wattenberg Field in Colorado, where the company holds about 96,000 net acres. In combination with about 65,000 net acres of Utica Shale assets, the company reported 57.1 MBOEPD of production for the second quarter, up 14% from Q1, and LOE costs of $2.63 per barrel, down 29% year-over-year, according to PDC Energy’s press release.

With such a strong presence in Colorado’s oil and gas industry, it was not surprising that several analysts asked PDC about the validation process of the signatures collected for the ballot initiatives. PDC Energy’s management reiterated that they remain focused on stopping the initiatives, even as the validation process continues.

“We will continue to try and educate our voters about the importance of oil and gas in the State of Colorado,” management said. “PDC and the industry is treating this as though they have submitted the signatures; our campaign continues, [and] you can expect us to be full force until we get final verification from the Secretary of State’s office that they do not have sufficient signatures.”

The ballot initiatives could have a serious impact on PDC’s future drilling on its 54,000 Wattenberg acres in the oil-rich Niobrara/Codell shale of the DJ basin. During the company’s conference call, management said that it didn’t think its existing permits would be grandfathered in if the ballot does achieve enough signatures to get on the November ballot and then the voters approved it.

“At this point, we have enough [drilling] permits probably to get us through next year or close to the end of next year,” PDC said on the call. “But the way we read that, and the way [the initiatives are] written is – it would not allow us to grandfather those permits.”

Fighting back on ballot initiatives

During its Q2 conference Call, PDC said that it was also hopeful that ballot No. 96, which industry and pro-business groups have put forth to change the way signatures are collected for ballot initiatives, would, in fact, make it in front of voters. The initiative would change the requirement to say that signatures of at least 2% of the registered electors who reside in each state senate district are required for a proposed amendment to be placed on the ballot, and also require 55% voter approval to pass.

PDC hopes that this initiative to toughen the initiated amendment rule would help to mitigate the ongoing political risk oil and gas operators face in Colorado every election cycle. “We believe that is a much more stringent and fair way to give consideration to amending the constitution of Colorado.

“We have submitted the signatures on that effective last Friday,” management said during the call. “I can assure you based on the number we know, which I don’t think I’m at liberty to reveal, there are sufficient signatures to put that on the ballot.”

For all petitions submitted for all initiatives in this election cycle, the Colorado Secretary of State will now conduct a 5-percent random sample of submitted signatures to determine whether the proposal meets the threshold to make the ballot. To get on the ballot under existing rules, proponents need to submit 98,492 valid voter signatures — 5 percent of the total votes cast for all candidates for Colorado Secretary of State in the last general election, according to the Secretary of State.

After petitions were turned in yesterday, Wells Fargo issued the following commentary:

“Signatures submitted for proposed ballot initiatives #75 (local control) and #78 (setback) to Colorado Secretary of State’s office. We counted about 125 boxes in total between #75 and #78, with a roughly even split, and anecdotally heard from a Greenpeace associated individual that each initiative had gathered north of 100,000 signatures, versus a requirement of 98,492. Our initial read is that there is enough to move forward with the signature verification process. To be clear, submitting signatures doesn’t mean they’re on the November ballot. What it does mean is that the process moves forward. Could be as soon as a week or two, or could be a month before we get a final decision on whether they’ll be placed on the November ballot. We see this as a negative for DJ-exposed names including PDCE, BBG, SYRG, WLL, and to a lesser extent APC and CRZO.”

Estimates by other analysts and political issue experts have said ballot issues generally will need from 140,000- 160,000 signatures to achieve certification of 98,293 signatures.

Wells Fargo issued an update later:

“E&P: Update On Earlier Colorado Regulatory Note. Since we published our note earlier this afternoon (8/8) we’ve heard that an organizer for #75/78 had relayed to the Colorado Secretary of State’s office that they believe they turned in 110,000 signatures for each Initiative (consistent with commentary in our earlier note that they had ”over 100,000 signatures”). Clearly, some of the 125 boxes they turned in — which we wrote about earlier and quoted signature box math which assumed boxes were full — were likely far from full and we think this further supports the kind of dis-organized campaign we’ve seen from the Yes on #78/75 in general, and supports the possibility that even the 110,000 number could be questionable. To be clear, and apparently something that didn’t come through in our prior note, if 110,000 signatures is the correct number it means a lower likelihood of either initiative making the November ballot. We base this on both historical signature verification rates as well as a likely challenge for those against the proposed initiative. However, with regard to the share prices of Colorado exposed companies, we do still believe that some tail risk remains, and this uncertainty means the overhang remains. And could remain until will get some finality from the Secretary of State’s office, which could be as soon as a week or two, or longer if the process dictates.”

Ballot Risk Weighing on Stocks with DJ Exposure

In its research note on the topic Stifel said the following:

“Stocks with DJ Basin exposure have under-performed our peer group this year, largely due to Colorado’s political risk. For example, pure plays such as SYRG (Buy, $6.31, TP: $10.00) and PDCE (Buy, $55.54, TP: $70.00) are down 37% and 7% YTD vs our group average of +18%. NBL (Buy, $33.48, TP: $45.00) and APC (Hold, $53.05), larger companies with significant DJ Basin exposure, have also lagged (+2% and +9%). This risk is likely to remain an overhang until the November 8 vote for these 4 stocks along with WLL (Hold, $7.93), BCEI (Sell, $0.86, TP: $2.00 – Under Review), and BBG (uncovered, $5.44).

While investor skepticism in pre-vote polls should be high following this summer’s British referendum, our sources indicate that the vast majority of Coloradan’s support the state’s oil and gas industry. As such, we would remain buyers of NBL, PDCE, and SYRG in front of the November 8th vote. All three have strong balance sheets and their DJ Basin wellhead returns rank among the best in the industry (Figure 1).”

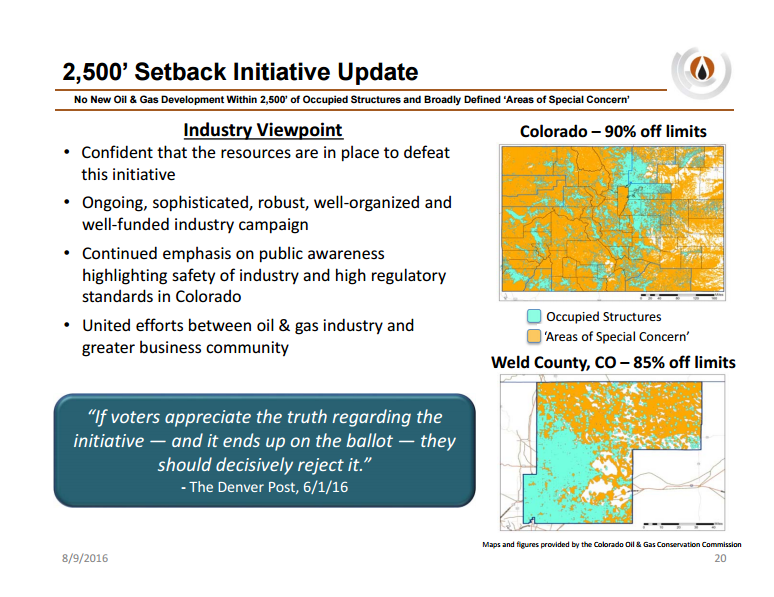

The Colorado Oil and Gas Conservation Commission had issued a report in May that laid out a bleak scenario showing, according to their measurement, that 90% of Colorado’s surface area would be banned from drilling by a new required 2,500-foot setback.

COGCC’s key findings: the Impact on Oil & Gas Development in Colorado

Here are the state’s key findings as to the impact the amendment proposed by initiative 78 would have on oil and gas drilling in Colorado if it is on the November ballot and if it is passed by voters:

- ~90% of surface acreage in Colorado would be unavailable for future oil and gas development or hydraulic fracturing under the proposed mandatory setback requirement.

- 85% of surface acreage in Weld County, the state’s largest oil and gas producing county, would be unavailable for new oil and gas development facilities or hydraulic fracturing operations.

- In the state’s top five producing oil and gas counties (Weld, Garfield, La Plata, Rio Blanco, and Las Animas), 95% of the total surface area would be unavailable for new oil and gas development facilities or hydraulic fracturing operations.

The COGCC report states: “Of the two defined feature categories in the proposed initiative, the setback from an “Area of Special Concern” (which includes lakes, rivers, perennial or intermittent streams, creeks, irrigation canals, and riparian areas) would have a larger impact on surface acreage available for oil and gas facility development statewide. A 2500’ setback from “Area(s) of Special Concern” will result in 89% of the surface land being unavailable for new oil and gas facilities; whereas for “Occupied Structure(s)” the calculated estimate is 22% of the state surface acreage being unavailable. In Weld County, the proposed setback requirement from an “Occupied Structure” will potentially make more than 40% of the land unavailable.”

PDC Energy is a presenting company at the EnerCom Conference next week. The company is presenting Monday, August 15th at 1:30 p.m. MDT. Conference registration is available here.