PDC Energy 2017 capital budget and growth both exceed analyst expectations

Denver-based PDC Energy (ticker: PDCE) announced its capital budget and production plans for 2017 on Monday exceeding analyst expectations. According to the company’s press release, PDC plans to grow production more than 40% year-over-year with a capital budget of $725 million to $775 million. The budget is about 7% higher than analysts’ consensus leading to 6% higher production growth than consensus as well, according to a note from Wells Fargo.

Production guidance for 2017 will be 30-33 MMBOE in total, or 82.2-90.4 MBOEPD, more than 40% higher than anticipated 2016 production at its midpoint. The anticipated commodity mix is approximately 43% oil, 21% NGLs and 36% natural gas.

PDC said it plans to outspend cash flow in the first half of next year, assuming an internal weighted-average NYMEX pricing of approximately $51 per barrel of oil, $3.30 per Mcf of natural gas and NGL realizations of approximately 25% of NYMEX oil, the company said.

PDCE plans to be cash flow neutral in the second-half of next year, however.

PDC projects to exit 2017 with a debt to EBITDAX ratio of approximately 1.8x. Total year-end liquidity is projected to be approximately $900 million, assuming its current $700 million borrowing base and an anticipated $200 million of cash on hand.

Based on the mid-point of production guidance, nearly 50 percent of 2017 expected crude oil volumes are hedged at approximately $48 per barrel and approximately 52 percent of anticipated gas volumes are hedged at nearly $3.50 per Mcf, including CIG basis swaps.

Continued focus on the Wattenberg

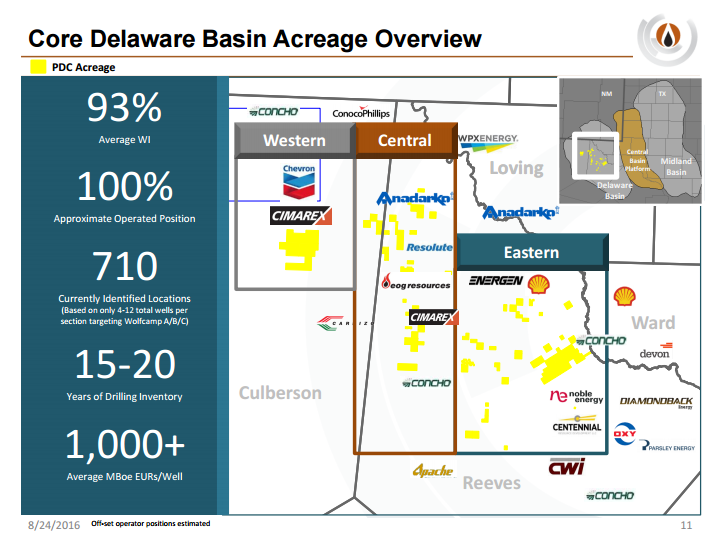

Despite a $1.5 billion entry into the Permian’s Delaware Basin in August, the primary focus of PDC’s 2017 budget will continue to be the Wattenberg, according to the company.

The company plans to operate a three to four rig program and spend approximately $490 million (65% of the capital budget, at its midpoint) in the Wattenberg Field. Approximately $460 million is allocated for operated activity with approximately $20 million anticipated to be spent on non-operated activity and the remaining $10 million on miscellaneous workover and capital projects.

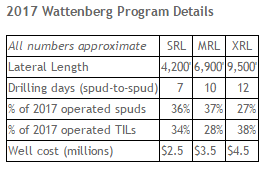

The company plans to drill standard reach lateral (SRL), mid-reach lateral (MRL) and extended reach lateral (XRL) wells in 2017 with an average lateral length of approximately 7,300 feet. Turn in Lines (TILs) for the field are expected to be approximately 150, an increase in terms of one mile-equivalent wells of more than 20% compared to 2016.

Delaware program

About 31% of the company’s 2017 capital budget will go toward its newly acquired Delaware Basin assets, the company said Monday. PDC anticipates operating a two rig program for the majority of the year with the addition of a third rig in the fourth quarter. Total capital spend is expected to be approximately $235 million (approximately 31% of total capex budget), of which approximately $185 million is allocated to spud and turn-in-line an estimated 28 and 19 wells, respectively.

The company plans to drill 12 wells in its Eastern acreage block, 14 wells in the Central acreage block and two wells in its Western acreage block, with the majority of wells targeting the Wolfcamp A zone. Thirteen of the 19 planned TILs are expected to have laterals of approximately 10,000 feet with 72 completion stages. Similarly spaced completions are anticipated for the remaining six turn-in-lines. Estimated well costs for SRL, MRL and XRL wells are approximately $6.5, $8.0 and $9.5 million, respectively.

PDC plans to spend approximately $35 million for leasing, seismic and technical studies with an additional $15 million for midstream related projects including gas connections, salt water disposal wells and surface location infrastructure.