JRCO: “One of the Best Multiple/Growth Propositions in Energy”

Roughly one month after its 2015 Analyst Day, PDC Energy (ticker: PDCE) released its first quarter results for the fiscal year in a press release on May 7, 2015. The Denver-based E&P reported net income of $17.1 million, or $0.46 per share, compared to a net loss of ($2.1 million) in Q1’14. Revenues increased by about 18% to $144.6 million in the same time frame, even though the average sales price, excluding net settlements on derivatives, decreased by 56%.

PDC’s production volumes, sourced exclusively from its position in the Utica and Wattenberg plays, reached 32,162 BOEPD in the latest quarter – 15% higher than Q4’14 and 41% higher than Q1’14. Crude oil accounted for 45% of the mix. PDC management credited the increase to an additional rig in the Wattenberg, along with “successful horizontal development” in both core areas.

Positive Reviews from Analysts

Positive Reviews from Analysts

PDC’s popularity among analysts was evident in its Analyst Day; 23 of 26 firms covering the small-cap company issued a BUY rating. That ratio was unchanged with the most recent quarterly release.

Johnson Rice & Company labeled PDC “One of the best multiple/growth propositions in energy” in a note covering the Q1’15 release. “The company remains priced cheaply (6.3x EV/EBITDA vs group’s 9.0x) despite having top decile CFPS growth (+25% y/y vs group’s -41%).” OAG360 notes that PDC’s stock has climbed 35% in fiscal 2015.

Capital One Securities and Wunderlich Securities both expect production to hit the higher end of guidance due to better than expected volumes and better performance of the capital program.

[PDC is] still among our favorite names on the possibility for well performance improvements in the Wattenberg,” added Capital One. “The company’s pristine balance sheet and hedges that cover the vast majority of production for this year and next are also rare traits among our E&P universe.”

BMO Capital Markets had a similar view: “PDC’s defensive hedge book continues to support its differentiated growth profile among SMID-cap E&Ps. Leverage remains minimal and liquidity abundant providing the flexibility and potential to further accelerate activity with any rebound in commodity prices. An option not shared by all, in our view.”

Why the Upside?

Production Growth: PDC’s sequential volume growth is expected to continue; the company spent $140.3 million, or about 30%, of its 2015 capital guidance in Q1’15 and will place a four-well Utica pad online in May. A similar four-well pad, turned in line in Q4’14, is tracking 15% higher than its 680 MBOE type curve after 90 days of production. Both Utica pads are located in the condensate window. PDC management anticipates drilling additional Utica wells once oil returns to the “mid to high $60s” in order to compete with its Wattenberg locations.

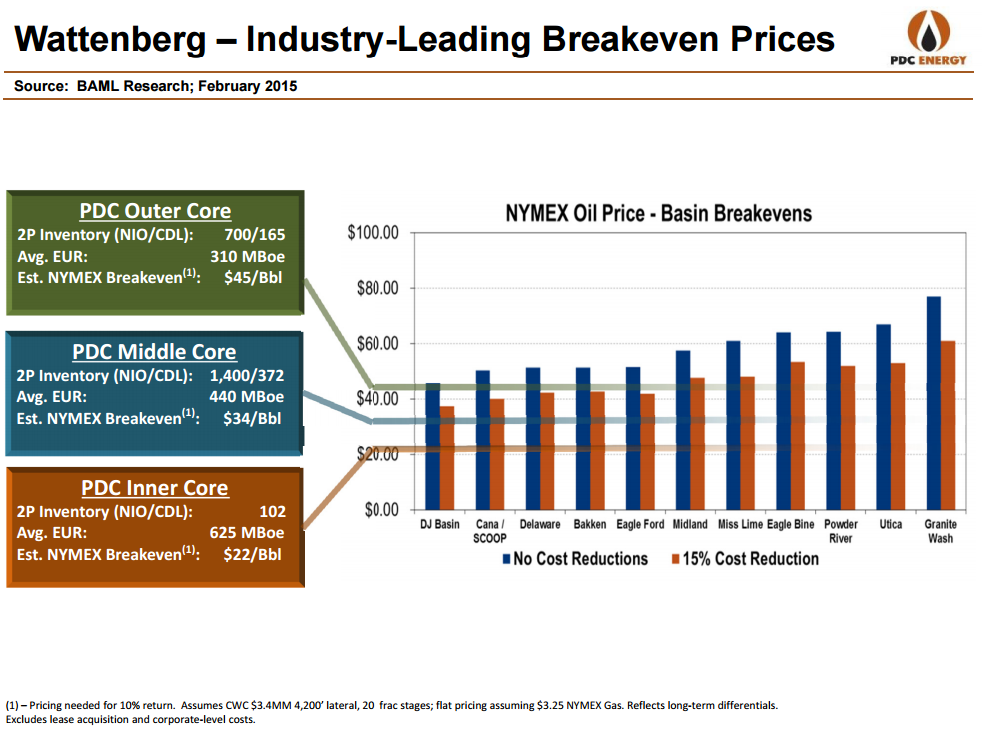

Meanwhile, the performance in the Wattenberg continues to climb and costs continue to fall. A lower cost structure utilizing tighter spacing and enhanced designs are expected to drop costs to a midpoint of $3.9 million per well – a 20% reduction from 2014. PDC’s plug-n-perf completion method is outperforming sliding sleeve completions by as much as 35%, and 30 such wells are scheduled for completion this year. Bart Brookman, President and Chief Executive Officer of PDC, summed it up in the conference call, saying “Our drilling group is just killing it.” Management is also expecting midstream capacity to increase by as much as 40%, with the first increment beginning in June with the completion of the Lucerne plant.

The company turned 20 gross wells to sales in the latest quarter. As many as 50 additional gross wells will be turned in line in Q2’15. Its planned growth track is significant; midpoint 2015 guidance of 38.4 MBOEPD is 50% higher than 2014’s total. At the Analyst Day, Lance Lauck, Senior Vice President of Corporate Development, said, “We’re growing the production at a very robust three-year compounded annual growth rate of 31% to 36% over this time period to a 2017 midpoint rate of approximately 60 MBOEPD.”

Cash Management: As previously mentioned by the analyst reviews, PDC’s strong financials are a rarity among companies of its size. PDC has $756 million in available liquidity with its $700 million borrowing base, which was reaffirmed earlier this month. The company has an elected commitment of $450 million but expects to exit 2015 with an undrawn revolver. The company solidified its balance sheet with an equity offering that resulted in net proceeds of approximately $203 million.

PDC has $610 million in long-term debt, with $110 million of 3.25% senior convertible notes due 2016 and $500 million of 7.75% senior notes due 2022. Its debt to EBITDAX level at year end is expected to be 1.5x.

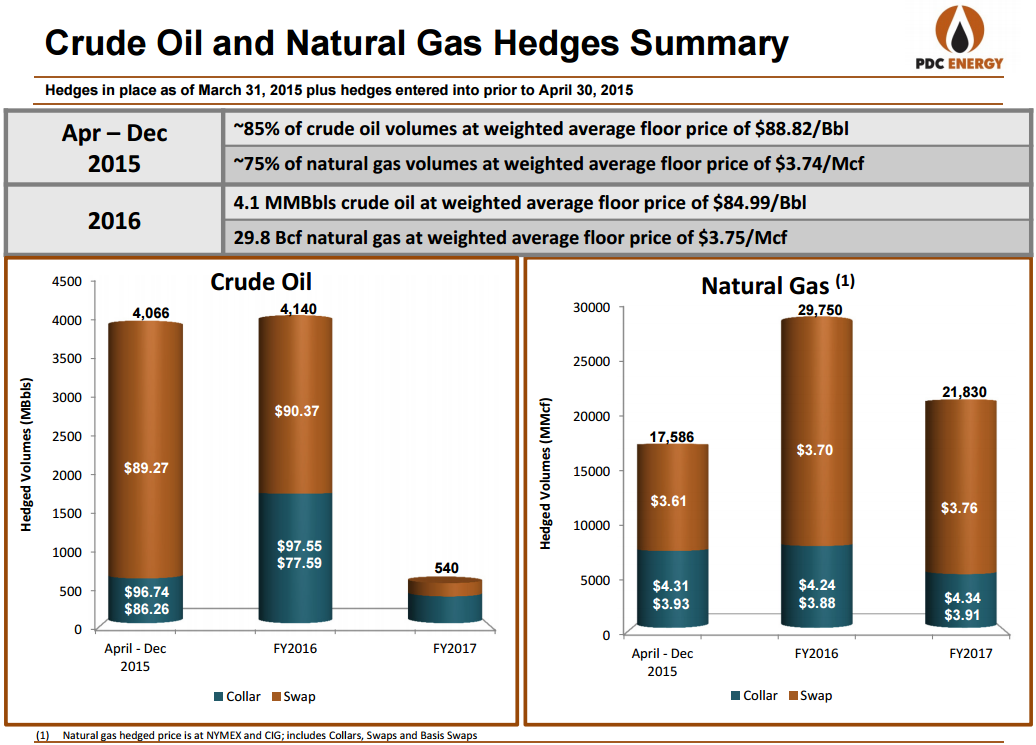

Strong Hedges: The commodity downturn has affected everybody in the energy sphere, but PDC’s impressive hedges offer a reliable flow of income. About 85% of its 2015 oil volumes are hedged at $88.82/barrel, while about 75% of expected gas volumes are hedged at $3.74/MMBtu.

Gysle Shellum, Chief Financial Officer, explained more in-depth in the call: “For 2016, 4.1 million barrels are hedged. That’s about 80% of our total hedge volumes we had for 2015 at a weighted average floor of $84.99 per barrel. About 30% more of our gas volumes are hedged in 2016 than we had this year at a weighted average price of $3.75 per MMBtu. We also have good hedge volumes on natural gas for 2017 and have been considering adding more in the $3.40 range for both 2016 and 2017. A small slice on hedged oil in 2017 is in the low $60s. Very recently, we’ve seen opportunity to add some 2017 oil costless collars with ceilings in the mid $70s and we think that could be an attractive trade for a small tranche of 2017 production. We’re still bearish to get on gas through 2017 and we’re gaining confidence on the bullish side for oil.”

Future Drivers

PDC is also bolstered with an extensive inventory of future drilling locations. PDC management believes its Wattenberg position alone holds 2,600 proved and probable drilling locations prospective for the Niobrara and Codell formations, and an estimated 1,000 of those locations can deliver drilling returns greater than 50%. An estimated 70% of PDC’s properties are classified as proved undeveloped in EnerCom’s Weekly Benchmarking Report – the fourth-highest percentage among 88 companies on the report.

The amount of capital required to maintain operations, relatively speaking, is minimal. PDC’s asset intensity, defined as the percentage of every EBITDA dollar required to maintain flat production, is 43%. That means $0.57 of every dollar can be reinvested into escalating projects, addressing the balance sheet or saving for potential acquisitions. The percentage is well below the industry median of 64% and ranks as the second lowest percentage among 23 small cap peers.

PDC management expressed encouragement on the recent “recovery” of oil prices and may revisit its drilling program if prices continue to improve. Of its 250 MMBOE of reserves, 91% are still economical at $50/barrel, according to its most recent presentation.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.