On March 7, 2016, PDC Energy, Inc. (ticker: PDCE) announced the company would offer 5,922,500 shares, including the expected purchase of overallotments, in common equity to the market. The offering is expected to bring in gross proceeds of $262.7 million dollars. The net proceeds from this offering will be used to repay the principal amounts owed upon the maturity of the company’s 3.25% convertible senior notes due in May 2016 and for general corporate purposes, which may include repaying amounts borrowed under the company’s revolving credit facility. The offering is expected to close on or around March 11, 2016.

Prior to the announcement, PDC Energy had 40.2 million shares outstanding, the offering would represent a 14.7% dilution of shares outstanding. PDC Energy shares closed the March 7, 2016 trading session at $52.11 per share prior to the announcement, and closed the March 8, 2016, trading session at $51.81 per share, a fall of $0.30, or a 0.6% drop, 14.1% less than share dilution.

Assuming the proceeds from the offering are all used to pay down various forms of debt, PDC’s net debt to EBITDA ratio would fall from 1.5 times to 0.87 times.

2016 Equity Offerings

The market has seen a flurry of activity in regards to equity offerings in 2016. Of the companies tracked in EnerCom’s database, fifteen of them have come to market with a total of 582.16 million shares for total proceeds of $9,412.7 million.

| Announced Date | Issuer Name | Offer Proceeds ($MM) | Shares Issued

(MM) |

Offer Price |

| 01/05/2016 | Pioneer Natural Resources | 1614.6 | 13.80 | $117.00 |

| 01/13/2016 | Diamondback Energy Inc | 254.5 | 4.00 | $63.63 |

| 01/21/2016 | Synergy Resources Corp | 89.3 | 80.50 | $0.00 |

| 01/28/2016 | Oasis Petroleum Inc | 185.3 | 39.10 | $4.74 |

| 02/04/2016 | Hess Corp | 1121.3 | 28.75 | $39.00 |

| 02/17/2016 | Devon Energy Corp | 1487.8 | 79.35 | $18.75 |

| 02/17/2016 | Energen Corp | 384.3 | 18.17 | $21.15 |

| 02/19/2016 | EQT Corp | 380.3 | 6.50 | $58.50 |

| 02/22/2016 | Cabot Oil & Gas Corp | 1012.0 | 50.60 | $20.00 |

| 02/25/2016 | Newfield Exploration Co | 697.5 | 30.00 | $23.25 |

| 02/29/2016 | Marathon Oil Corp | 1275.6 | 166.75 | $7.65 |

| 02/29/2016 | QEP Resources Inc | 379.5 | 37.95 | $10.00 |

| 03/03/2016 | Callon Petroleum Co | 86.2 | 13.27 | $6.50 |

| 03/07/2016 | PDC Energy Inc | 302.1 | 5.92 | $51.00 |

| 03/07/2016 | Matador Resources Co | 142.4 | 7.50 | $19.00 |

| Total | 9412.70 | 582.16 |

Offerings by Region

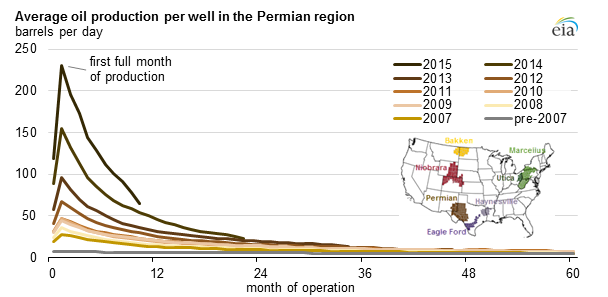

According to a February 2016 drilling productivity report from EIA, tight oil production in the United States accounted for more than half of total U.S. oil production in 2015. Tight oil growth has been driven by increasing initial production rates from tight wells in regions analyzed. As drilling techniques and technology improve, producers are able to extract more oil during the initial months of production from new wells.

The Permian Basin has seen one of the largest jumps in initial production due to increased efficiency of hydraulic fracturing. Increased improvements in completion techniques and the ability to drill longer laterals have increased the overall efficiency of the region.

Looking at the equity offerings by region companies operating primarily in the Permian account for $2.3 billion worth of capital raised. These companies include PXD, FANG, EGN, and CPE.

The cross state rival to the Permian has gobbled up $2.9 billion in capital as companies with a focus on the Eagle Ford have looked to capitalize on increased efficiencies in that region. Companies in this region include DVN, MRO, MTDR.

Companies operating in the Niobrara have raised a total of $391 million. PDCE and SYRG have a primary focus in this region.

Bakken focused companies have raised a total of $1.7 billion for operations. Companies in this region include HES, QEP, and OAS

Other regions obtaining capital from offerings in 2016 are the Marcellus/Utica region which has harnessed $1.4 billion in capital and the SCOOP play which has brought in $697.5 million in capital.

The majority of companies that have raised equity have cited the need to pay down debt or fund 2016 capital expenditure programs as the primary allocation of capital. The fall in oil prices in 2015 and 2016 have left companies focused on high-producing areas as the rig count has continued to fall. Production levels have not fallen as far or as fast as rig counts and the increased focus on core areas and increased efficiency is largely to credit for this.

The never resting decline curve will undoubtedly catch up to the production numbers and new wells will need to be brought online. However, the recent rise in oil price may make a number of those new wells more economical and more wells will be drilled, completed, and begin production with newly acquired capital.